Ford (NYSE: F) stock price continues to trade in a single-digit range over the last twelve months. Trader’s concerns over negative revenue growth and increasing market competition have been impacting the share price performance.

Ford stock price currently trades around $9, down slightly from 52-weeks high of $10.5 a share. Analysts believe lower than expected results for the third quarter and light guidance could impact its share price performance.

Soft Q3 Results Could Impacts Ford Stock Price

Ford’s third-quarter revenue of $33.93 billion declined more than 2% from the previous year period. Indeed, Ford experienced a notable decline across all segments. It’s market share dropped from 6.3% in the year-ago period to 6% in Q3 of FY2019.

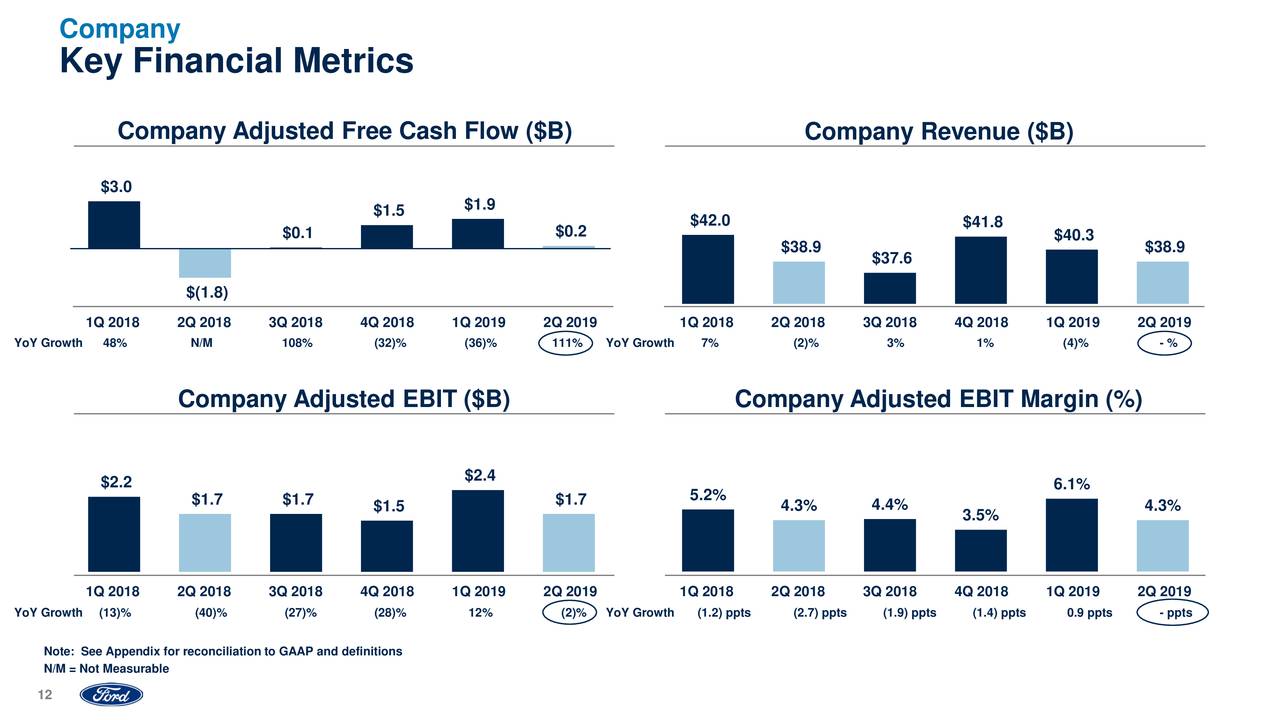

The company’s earnings, cash flows, and full-year guidance reflects a significant drop from the past year.

Its third-quarter earnings per share of $0.11 plunged more than 50% from the year-ago period. The huge earnings drop is driven by charges for special items. The company, on the other hand, claims that its transformation strategy is setting footprints for long-term success.

“Our Global Redesign is about making choices to transform our organization, to become the world’s most trusted company and a clear leader in an era of rapid change,” said Jim Hackett, Ford president, and chief executive officer. “We are getting stronger today and we have more work to do.”

Light Guidance Limits the Upside Potential

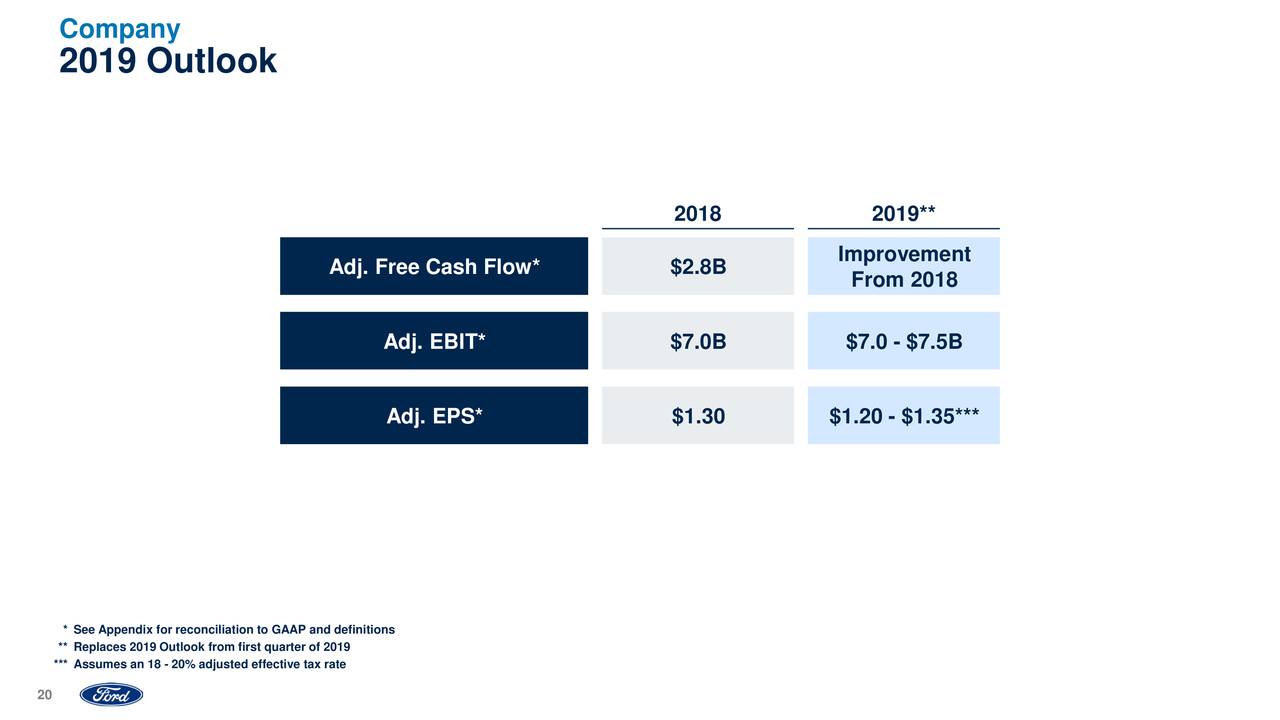

Although Ford expects full-year structural costs to decline in its automotive business, the company has dropped its guidance for the full year. It now expects full-year EBIT in the range of $6.5B to $7.0B. This is down considerably from previous guidance of $7.0B to $7.5B prior.

The full-year earnings per share guidance came in at $1.20 to $1.32 compared to the consensus estimate for a $1.27. On the positive side, the company still anticipates full-year growth in adjusted free cash flow. Overall, analysts expect pressure on Ford stock price in the coming days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account