Ford Motor (NYSE: F) stock price plunged below double-digit figure after lower than expected results for the second quarter. It’s stock price lost 9% of value in the last month; the stock is still up 11% since the start of this year.

Market pundits strongly believe in the future fundamentals of Ford Motors. Morgan Stanley, for instance, increased Ford stock price target to $12 with an Overweight rating.

The MS analyst team said, “We view the reset of FY19 expectations following 2Q results and a 3-month low in the shares as a buying opportunity.”

The analysts are showing confidence in Ford’s restructuring efforts along with strategic actions such as EV commitment and the Volkswagen partnership.

Deutsche Bank’s analyst Emmanual Rose says Fords restructuring actions could start generating results in the coming years. However, traders and investors have been aggressively looking for the visible impact of restructuring actions on earnings and cash flow, before giving the stock credit for it.

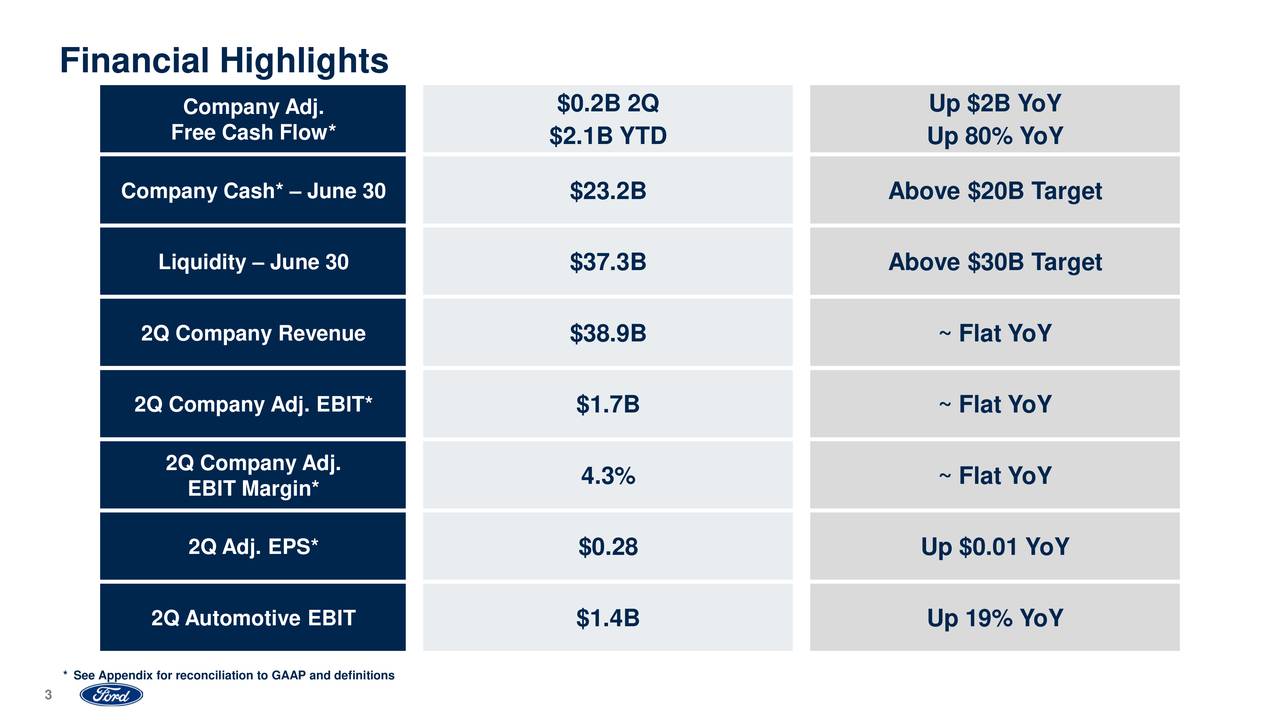

Ford Motors has generated EBIT of $1.7B in North America in the second quarter, down from last year figure of $1.8 billion.

The company said they are working on improving their operational performance and product line to enhance profitability. They are particularly focusing on automotive business. The automotive business has generated EBIT of $1.4 billion in the latest quarter, up 19% year over year.

“We are building a compelling product portfolio for our customers, executing against our global redesign and fitness initiatives, and investing in mobility opportunities to enhance our trajectory for growth, free cash flow, profitability and returns on capital,” said Tim Stone, the company’s chief financial officer.

The company expects to generate full-year EBIT in the range of $7.07 to $7.5B compared to analysts estimate for $7.08B. The guidance for full-year EPS stands around $1.20 to $1.35. Ford stock price is likely to receive support from improving financial numbers and restructuring actions. The upside momentum is also correlated to investors sentiments regarding the industry environment.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account