Foot Locker, Inc. stock had a solid 2015. But one bad quarter and shares are down 15 percent for the year. Jim Cramer reckons that regardless of the recent under performance, the stock should add value to any long term portfolio. Shares of Foot Locker closed Wednesday at $55.28, a big 25 percent below its all time high recorded in September of last year. Troubles began when the company posted below par quarterly results last month. The stock has been range bound since then.

“It is worth noting that even if some investors did not see these disappointing results coming, the stock market certainly did,” Cramer said on CNBC.

The first signs of a slowdown were visible as early as February, when despite delivering a strong top line and bottom line, shares fell over 4 percent amid reports of low-single digit growth in comparable-store sales.

The key area of concern was weakness in basketball. But Cramer insists that aside from tepid basketball sales, the company is actually doing well, as is evident from its strength in the lifestyle shoes segment.

Cramer also scoffs at analysts who say the company’s presence in shopping mall is dwindling. If that were to be true, traffic at its stores would be down. Instead, it’s up.

“One bad quarter does not make a downfall,” the “Mad Money” host added. “I am not saying that Foot Locker will bounce back the next time it reports…it might take a bit longer…but I do think the stock is insanely cheap.”

Charts Say Wait for a Reversal

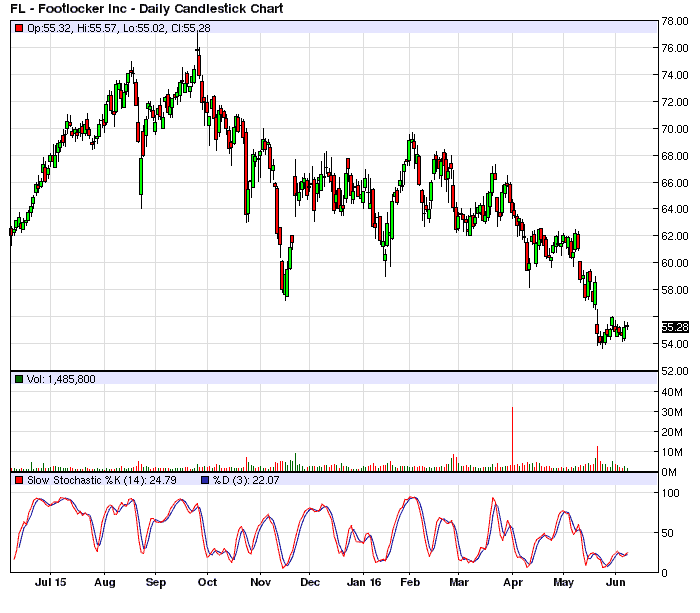

From a technical stand point, Foot Locker has been in a down trend since October 2015. The “Dow Theory” defines a down trend as a series of lower peaks and lower bottoms.

This trend will change from down to up only if shares manage to plot consecutive higher peaks and troughs. As long as that doesn’t materialize, buying the stock is not prudent.

A look at the daily price chart of FL shows the stock has been trying to form a bottom since the past one month. On the down side, $54 seems to be a strong support zone. The Stochastic is showing signs of positively diverging from price.

Investors looking to initiate a long trade should wait for a conclusive break out above the resistance around $56. If Foot Locker manages to do that, the intermediate trend would have also reversed from down to up.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account