Thus far, 2014 has been a great one for investors who already owned bonds. Putting new money to work, however, has become more challenging. This is due to the fact that benchmark yields have fallen and corporate spreads have only widened slightly since the start of the year. Nevertheless, there are a few opportunities worth mentioning. One such opportunity is in the senior unsecured notes of Flextronics International Ltd.

Thus far, 2014 has been a great one for investors who already owned bonds. Putting new money to work, however, has become more challenging. This is due to the fact that benchmark yields have fallen and corporate spreads have only widened slightly since the start of the year. Nevertheless, there are a few opportunities worth mentioning. One such opportunity is in the senior unsecured notes of Flextronics International Ltd.

Flextronics provides global supply chain solutions, designing, building, shipping, and servicing electronic products for original equipment manufacturers (OEMs). Its network of manufacturing facilities spans four continents (North and South America, Europe, and Asia) with the majority of its manufacturing capacity located in low cost regions such as Brazil, China, India, and Mexico, among others. The company has four primary business groups, outlined below:

- High Velocity Solutions covers a variety of consumer electronics products including, but not limited to mobile phones, smartphones, wearable electronics, game consoles, PCs, notebook computers, tablets, set top boxes, and voice over internet protocol (VoIP) terminals. This group contributed 31.0% of 2013 revenues.

- Integrated Network Solutions provides telecommunications solutions, including optical networking, enterprise infrastructure, and servers and storage (includes cloud computing hardware). This group contributed 41.2% of 2013 revenues.

- Industrial & Emerging Industries (IEI) covers appliances, capital equipment, safety and security, and navigation and positioning. It also includes Flextronics’ Special Business Solutions (SBS), a manufacturing service provider that specializes in lower volume, highly diversified products for various industries. In 2013, 14.9% of revenues came from IEI.

- High Reliability Solutions provides, among other things, avionics, night vision systems, surveillance systems, automotive smart electronics, and medical diagnostic equipment. In 2013, this group contributed 12.9% of revenues.

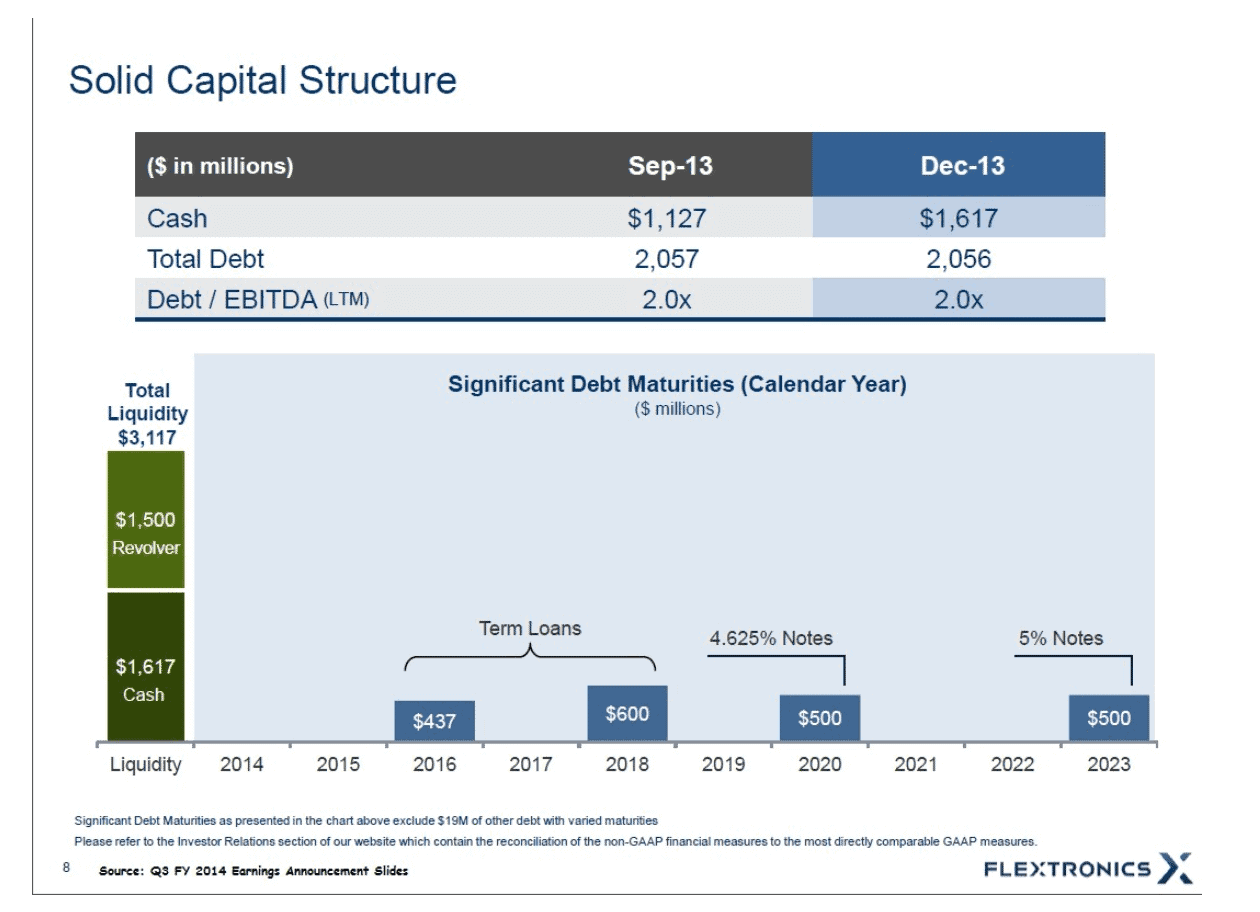

Also of interest, for the nine months ending December 2013, Flextronics generated $657 million of free cash flow. Furthermore, at the end of 2013, Flextronics had $1.617 billion in cash, $2.056 billion in debt, and debt-to-EBITDA of 2.0x. The following slide from the company’s recent earnings announcement provides an overview of its significant debt maturities:

In terms of the senior unsecured debt, both the 2020 and 2023 maturing notes currently offer enticing yields. The February 15, 2023 notes (CUSIP 33938EAS6), rated Ba1/BB+ by Moody’s and S&P respectively, have a 5.00% coupon, and were recently offered for 97.73 cents-on-the-dollar. That offer price translates into a 5.32% yield-to-worst. The February 15, 2020 maturing notes (CUSIP 33938EAQ0) are also rated Ba1/BB+ by Moody’s and S&P, carry a 4.625% coupon, and were recently offered for 99.25 cents-on-the-dollar. That offer price translates into a 4.77% yield-to-worst. Keep in mind that in recent days and weeks, both series of bonds have experienced notable price swings. Since the beginning of the year, I have even seen yields 30 or more basis points higher than today’s.

Should either of these notes be of interest, in addition to conducting your own due diligence on the company, it would also be wise to read the prospectus. The prospectus for both CUSIPs can be found here. In the prospectus, you will find numerous important details about the notes, including the following:

- Interest is paid semiannually.

- The notes include subsidiary guarantees, subject to certain conditions (outlined in the prospectus, linked above).

- There is a make whole call at the Treasury rate plus 50 basis points.

- Should a “change in tax law” occur, there is a conditional call at par that Flextronics could exercise at the company’s choosing. This optional redemption has to do with changes to the tax laws of Singapore. Additional details can be found in the prospectus.

- There is a “Change of Control Repurchase Event” at 101 cents-on-the-dollar.

If you are a buy-and-hold-to-maturity bond investor who finds the yield and credit risk attractive, there is no shame in buying either series of notes now, even if the price may drop in the future. With six and nine years still remaining until maturity, there could certainly be some volatility in the price of the notes. Whether the opportunity cost of waiting for a potentially higher yield is worth it, is something each of us must contemplate on our own. Only you can decide if the risk of owning an individual bond is right for you.

More from The Financial Lexicon:

The 5 Fundamentals of Building a Retirement Portfolio

Options Strategies Every Investor Should Know

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account