Facebook (NASDAQ: FB) stock price regained momentum in fiscal 2019 after experiencing a steep downtrend during the second half of 2018. Its shares are currently trading around $186 with the 52 weeks trading range of $123 to $208. Market pundits believe the Facebook stock price has further upside potential in the days to come.

MKM, for instance, has set a price target of $245 with a Buy rating. RBC, on the other hand, set the target of $250 for FB shares. RBC analyst Mark Mahaney believes FB could be in a “sustained re-rating period,” as the worst fears “appears not to have been realized.” The analyst claims that intrinsically attractive” valuations along with strong fundamentals are supporting stock price and financial performance.

It’s true that Facebook has been regaining customer’s confidence after experiencing slower growth and privacy-related issues last year. This is evident from robust growth in users and ad revenue in the latest quarter.

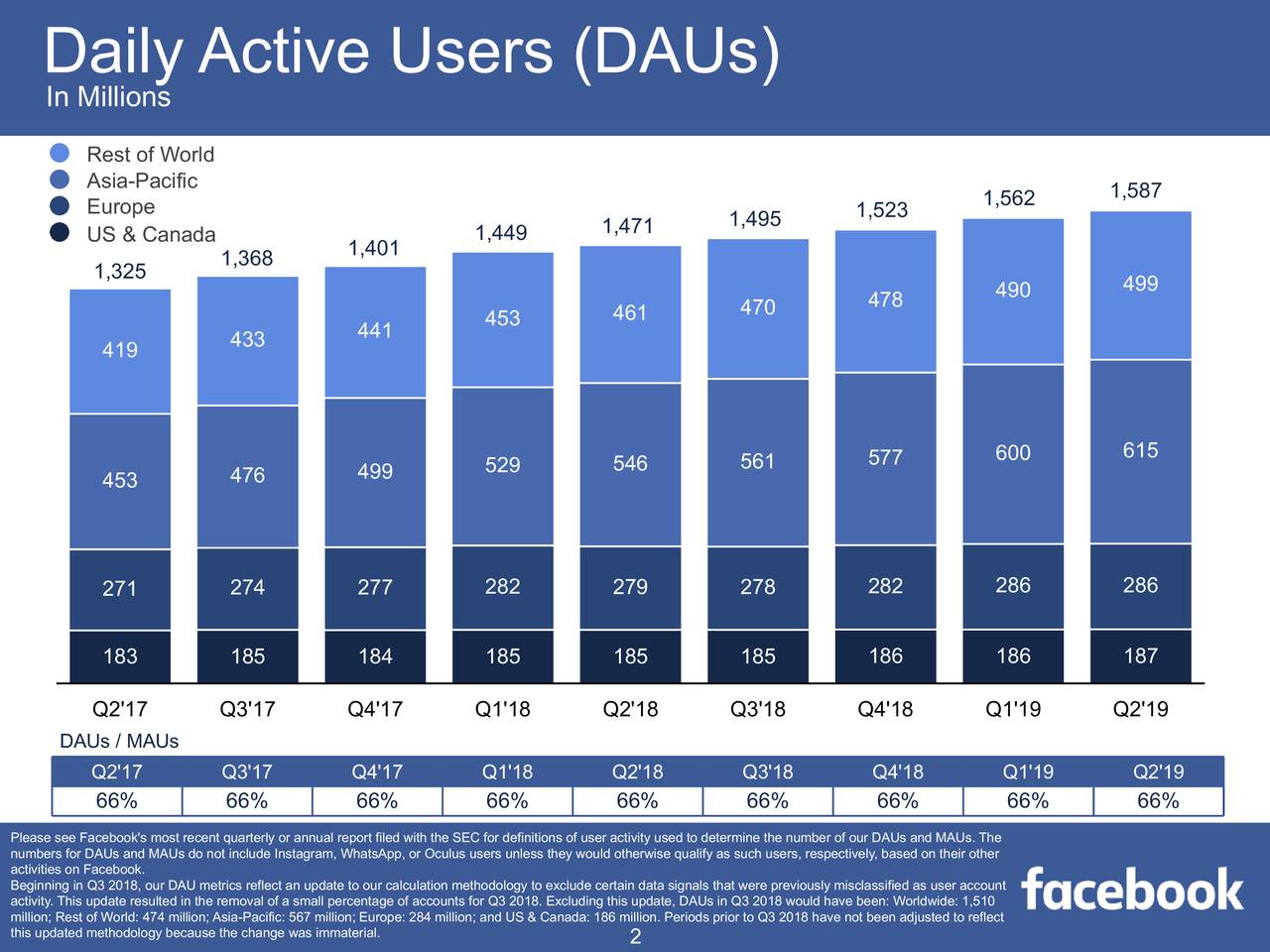

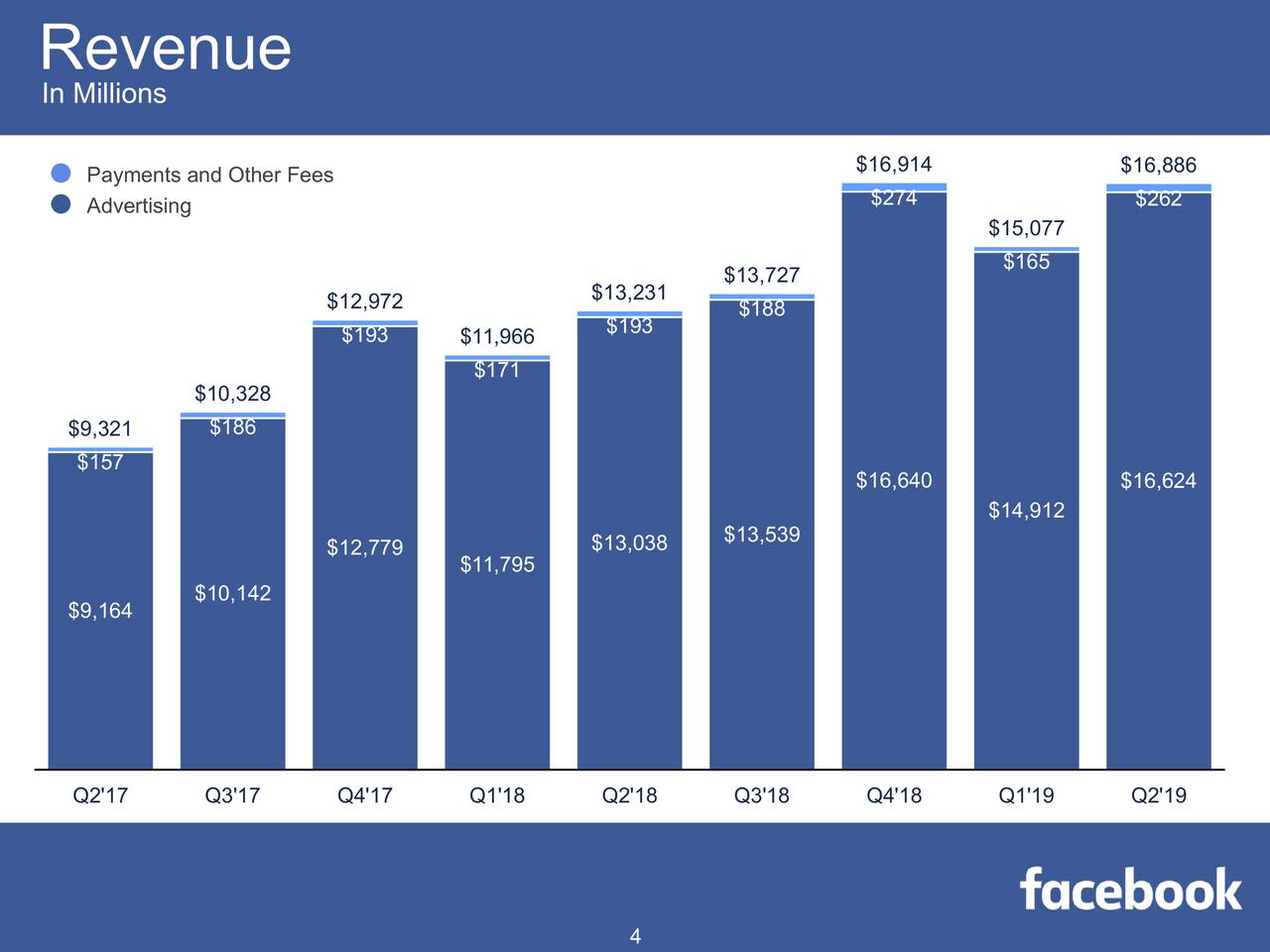

Its daily active users grew to 1.59 billion in the second quarter of 2019, up 8% year-over-year. Monthly active users were standing around 2.41 billion, representing a growth of 8% year-over-year. On the other hand, its mobile advertising revenue grew to 94% of total advertising revenue compared to 91% of advertising revenue in the same period last year.

With the growth in daily users and advertising revenue, its consolidated revenue jumped 28% Y/Y in the second quarter. The company’s adjusted earnings per share rose to $1.99 per share from $1.74 per share in the year-ago period.

“We had a strong quarter and our business and community continue to grow,” said Mark Zuckerberg, Facebook founder, and CEO. “We are investing in building stronger privacy protections for everyone and on delivering new experiences for the people who use our services.”

Despite robust Facebook stock price growth, the valuations are receiving support from significant growth in financial numbers. Its stock is trading around 22 times to earnings, in line with the industry average. The company expects similar growth in the following two quarters of this year – which could help in extending the share price momentum.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account