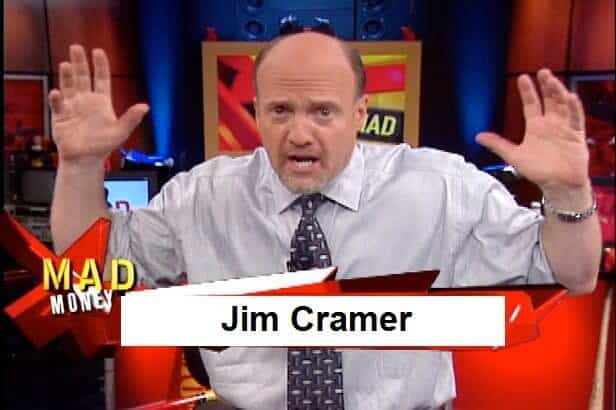

Facebook Inc shares are up strongly on Friday morning. There have been no new reports on the firm, nor was any new info trotted out. Instead traders seem to be seeing a pattern in what Jim Cramer calls the FANG, and Facebook is thought to be the next big runner off of the trend.

Back in 2013 Jim Cramer took four firms as “totally dominant in their markets” and told traders to put money behind them. Those four firms were the FANG group, Facebook, Amazon.com Inc. Netflix Inc. , and Google Inc Anybody who has been watching this earnings season can see a trend in their numbers, and only Facebook has yet to deliver.

Facebook is next

After Netflix released its numbers for the three months through June, the firm’s shares jumped by 15 percent. After Google released its numbers shares jumped by 20 percent. Amazon is about to open up 20 percent higher on Friday after its blowout earnings were released on Thursday afternoon.

In Friday’s pre-market shares in Facebook were trading up by more than 2 percent, apparently part of a belief that the FANG group success would carry through into Menlo Park’s results. Shares in Facebook have done very well since the start of the year, gaining more than 20 percent since January 1.

Facebook will release its numbers for the three months through June on July 29. If Netflix grew on better than expected user numbers, Google jumped on a cost cutting measures, and Amazon exploded after a revenue beat and AWS success, what could lead to a similar hike in shares at Facebook?

Looking for upside at Facebook

Facebook Inc will be watched closely this time around after the performance of the rest of the FANG group. The mot vital parts of the firm this time around will likely be its mobile ad costs, its progress with getting ads onto Instagram, and its progress with getting money out of its other two major apps, Messenger and WhatsApp.

After the massive rise in the firms stock in the weeks leading up to the release of the earnings numbers, it’s hard to see where the firm could surprise and bring a stock surge similar to the rest of Cramer’s FANGs. Analysts are looking for 47 cents per share and $4 billion in revenue.

The real surprise could come from the apps that Facebook runs on mobile. Those are going to be the next great leg of growth at the firm. Instagram, on which the firm has started to ramp up ads, is going to be the highlight.

If monetization is quicker than thought on the service, that means that Facebook will likely be able to get ads onto the other apps in golden circle quicker, and capture the sales opportunity sooner than Wall Street is modelling. Likewise video ad numbers could spur a stock spike if they’re much better than thought.

Watch Instagram and Video this time around. It’s likely those numbers that will make Facebook join the rest of Mr. Cramer’s FANG group in a stock surge. There is no promise that will happen, however. High growth web firms are volatile, and the waves don’t always break your way.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account