More on Municipal Bonds

By breaking out the impact of the Facebook IPO, California was able to generate an enormous amount of media coverage. The Facebook story also became a California story. Without spending a dime, the state was able to put forth the idea that California was a great place for starting a business. After all, the greatest start-up of the decade had grown up (although it was not started there) in California. However, Facebook has struggled lately, with its stock falling upper $30 range in May, to the low $20s in early August. This has implications for California as its projected budget windfall was based on a share price of $35. As California is struggling to deal with a huge budget gap, the theme of the story is now about Facebook contributing to the budget problems, rather than helping.

On August 6th 2012, Moody’s Credit Outlook contained a report titled, “California Risks Losing Hundreds of Millions of Dollars from Facebook’s Plunging Share Price”. Following this report, many publications including The Wall Street Journal and the Sacramento Bee have published articles about the connection between the price of Facebook shares and California’s budget problems.

Want to Earn 5 to 9% Interest? Learn More.

However, I would like to highlight one important fact:

The budget for California’s general fund is estimated to be $91.5 billion dollars. Assuming that Facebook related income taxes bring in half as much as originally estimated, the one-time impact on the budget will be less than 1 percent of the budget. While I won’t say this a non-story, its not a major one.

What market prices should investors in municipal bonds be watching?

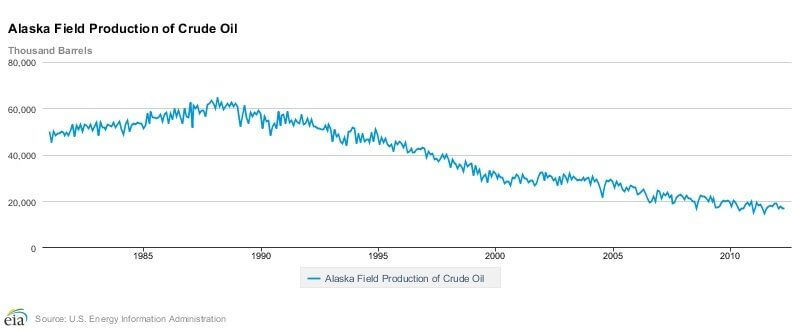

FB is not going to make or break California’s budget. However, I wondered if there were any states where the market price of a particular stock or commodity might be very important in terms of a state’s economic health. The first answer that came to mind was the price of oil to Alaska. However, as you can see from the chart below, I discovered that oil production in Alaska has been in decline for many years.

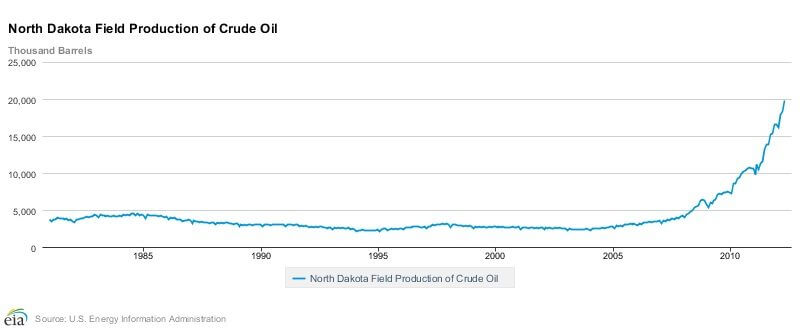

On the other hand, North Dakota has been rapidly increasing oil production. In fact, it recently surpassed Alaska as the number 2 (behind Texas) oil producing state.

As a result of oil production, North Dakota had the highest growth state GDP (GSP) in 2011 at 7.6%. On the back of oil production, the state economy is doing well. However, a major change in the price of oil (which has been trading in $75 – $95 per barrel (WTI)) would have a much larger impact on North Dakota than the gyrations of Facebook shares on California. On the hand, the state of North Dakota has less than $10 billion or so of debt compared to hundreds of billions for California.

Learn More About Municipal Bonds

- Should California’s $16 Billion Deficit Cause Municipal Bondholders to Run?

- BlackRock: Are the Recent CA city bankruptcies cause for alarm?

- 5 Tips for Municipal Bond Investors

- Obama proposes cap on municipal bond tax deduction

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account