Exxon (NYSE: XOM) stock price dropped sharply in the past couple of months amid volatility in gas and oil markets. Lower commodity prices have also impacted XOM financial numbers. This is evident from a significant year over year decline in third-quarter revenue and earnings.

XOM shares plunged almost 12% year to date. Exxon stock price is currently trading around $70, down from a 52-weeks high of $83 a share. The decline in XOM shares is presenting a buying opportunity for new investors, according to market pundits. They believe the dividend king is well set to offer steady growth in share price and dividends.

Production Remains Strong Despite Lower Financial Numbers

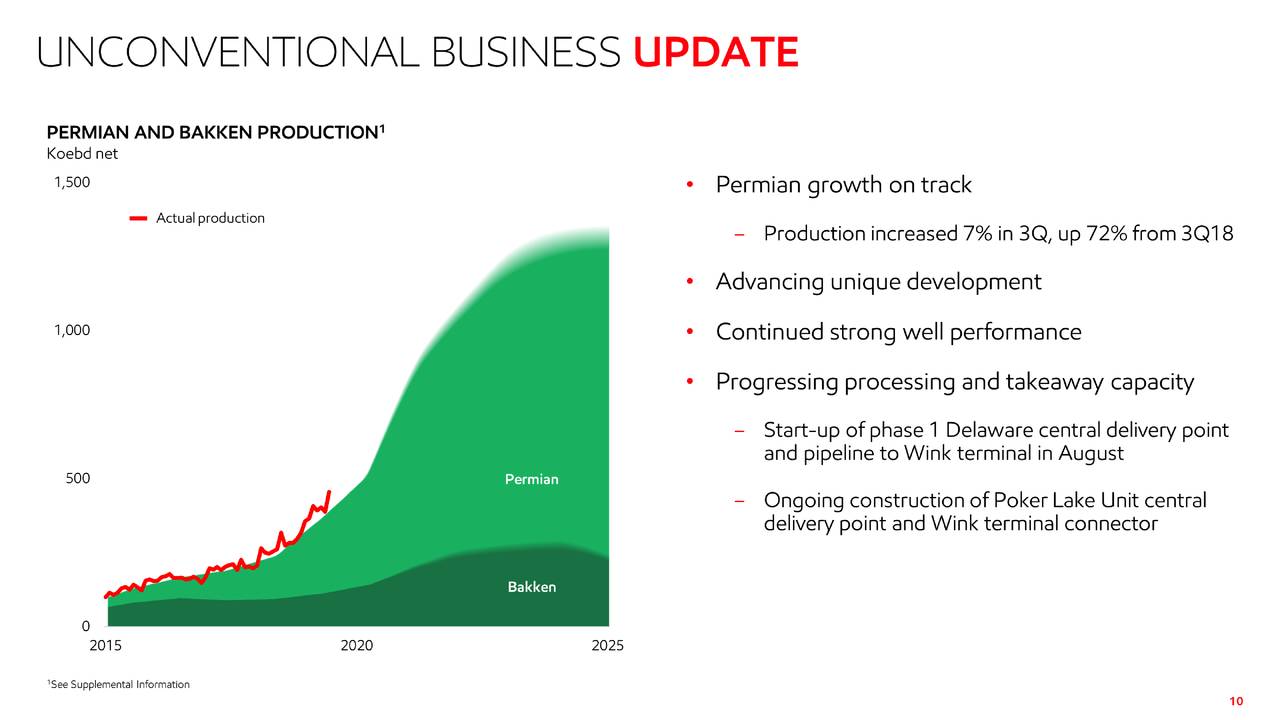

Although the company reported a huge year over year drop in third-quarter revenue and earnings, its production remains strong. Its focus on U.S. oil plays is helping in generating strong production growth.

Its Q3 production grew 3% from the past year period to 3.9M boe/day. Production growth is driven by the Permian Basin. Its Permian production rose 7% from the previous quarter and it is up 70% compared to the year-ago period.

“We are making excellent progress on our long-term growth strategy,” said Darren W. Woods, chairman, and chief executive officer. “Growth in the Permian continues to drive increased liquids production and we are ahead of schedule for first oil in Guyana. “

Despite higher production, its revenue declined 15% year over year. In addition, earnings plummeted almost by half when compared to the previous quarter.

Buy Exxon Stock Price on Dip As Cash Returns are Safe

The company has recently increased its quarterly dividend by 6% to $0.87 per share. This was the 37th consecutive dividend increase. Despite lower earnings, its cash returns appear safe. The company has been receiving cash from asset disposals along with cash from free cash flows.

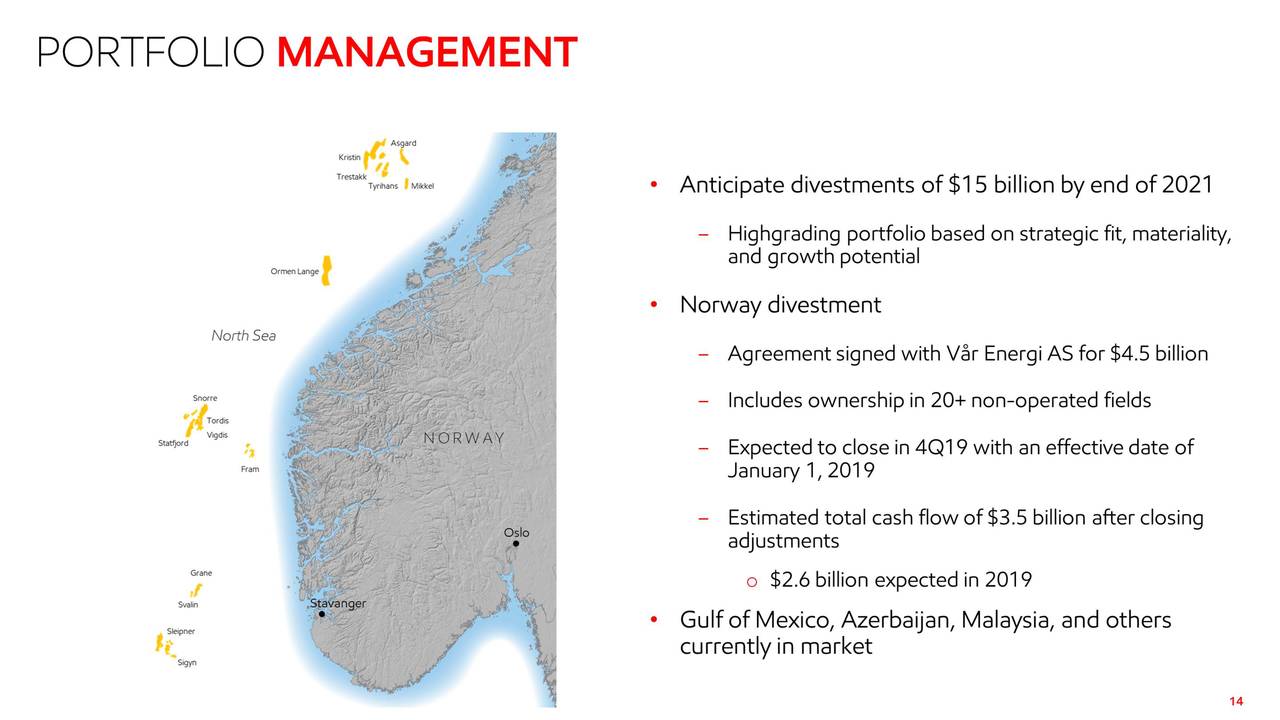

The company plans to sell $15 billion of assets by the end of 2021. On the other hand, it has generated an operating cash flow of $9.1 billion in the latest quarter. Overall, the dip in Exxon stock price appears like a good buying opportunity for dividend investors.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account