Exxon (NYSE: XOM) stock price dipped to the lowest level since 2010 following the huge oil price drop in the past couple of days. The threats of lower oil demand from China are among the biggest contributor to the XOM share price selloff. China has stopped manufacturing and industrial activities in several cities as the virus identified in Hubei late last year continued to spread into the other parts of China.

The threat of the virus is significantly impacting imports and exports of the second-largest economy. China is the largest importer of oil and other commodities. Consequently, the energy sector lost substantial value in the past few days. Oil prices plunged close to 6% this week alone. Exxon stock price lost almost 9% since the beginning of this year.

Future Fundamentals are Strong

The dip in Exxon stock price is presenting a buying opportunity for long-term investors. This is because the long-term fundamentals appear strong; the company’s dividend growth is also safe considering cash generation potential and asset disposal program.

Exxon has been moving its focus towards high margin U.S. assets while it is working on selling non-core international assets. The one of the largest oil & gas major is accelerating its biggest assets sale plan of $25B of oil and gas fields in Europe, Asia, and Africa over the next five years. The company is seeking to complete the sale of $15 billion of assets by 2021.

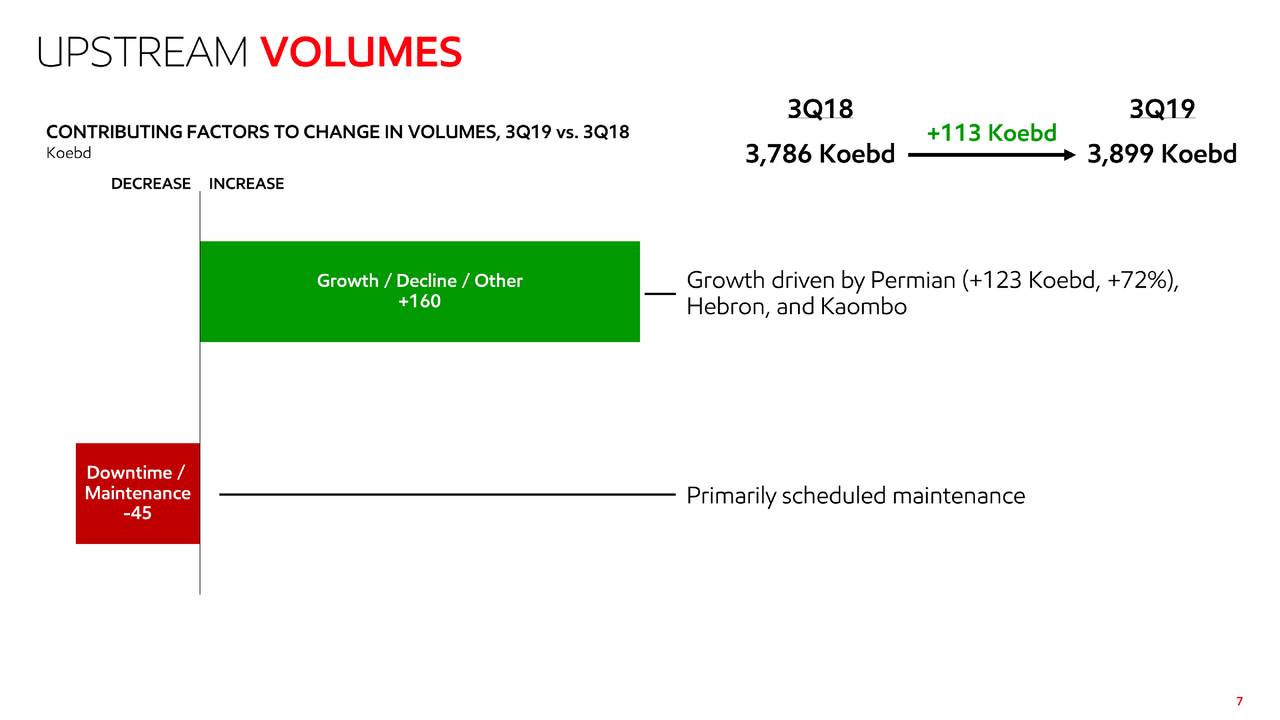

On the other hand, Exxon Mobil’s strategy of investing in U.S. asset plays is working. Its third-quarter oil production from the Permian basin increased 7% compared to the previous quarter and up almost 70% from the past year period.

Exxon Stock Price Is Presenting a Buying Opportunity

XOM share price selloff is only supported by external factors such as oil price volatility and problems in China. Traders are showing concerns over low demand due to the threat of Coronavirus. Fortunately, market analysts are seeing short-term headwinds as a buying opportunity for long-term investors.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account