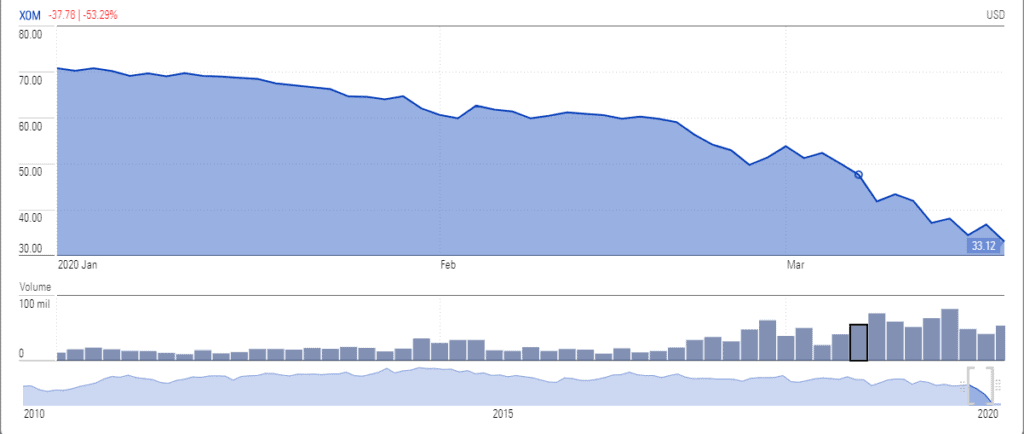

Exxon (NYSE: XOM) stock price is among the biggest losers of the oil price crisis that raised questions over the going concern of some of the industry’s largest companies.

Credit agencies have dropped Exxon’s ratings after the historic oil price selloff; the company paid a huge premium on $8.5bn of debt it raised yesterday to cope with pricing headwinds. S&P has dropped Exxon’s credit ratings to a AA from AA+. The agency has set a Negative outlook with expectations of another cut in the coming days. The agency said: “Cash flow and leverage measures for Exxon have fallen well below expectations, and expected to remain weak for the next couple of years.”

Analysts at RBC said Exxon’s strategy of cutting its spending plans is likely to hurt volume forecasts through 2025. The firm dropped Exxon’s cash flow forecast by 30% for 2020. Exxon stock price is currently trading around $33, its lowest level since 2002.

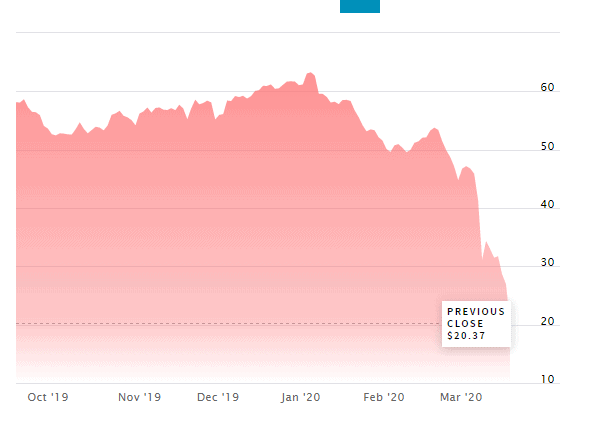

Oil price crashed to the $20 range in Wednesday trading as increased supplies from Saudi Arabia and its allies along with a substantial decline in demand due to the pandemic has toppled oil markets over the past month.

Although oil price staged a slight recovery after hitting the lowest level since 2002, market analysts anticipate prices will plunge below $20 if the global economy falls into a recession. The risk of bankruptcies from major oil producers across the world is likely in a scenario of $20 a barrel.

“Even if global production remains static over the near term, let alone factoring in Saudi Arabia increased supply, inventories will swell as gas and oil demand drops precipitously in the weeks ahead,” said Stephen Innes, chief market strategist at AxiCorp, in a note to clients. “In this situation, it’s unclear if a point of equilibrium even fits into this scenario. The markets could quickly fall to [US oil] WTI $15 or even further, which is now becoming the base case for some,” he said.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account