Exxon Mobil (NYSE: XOM) is set to announce a sales slide at its first-quarter earnings results next Friday which reflects an extraordinary three months of price wars and health emergencies that led to a 65% slump in crude prices.

Oil majors will be under pressure to cut dividends to preserve cash when many of them report their results next week.

The Texas-based Exxon is expected to see its revenue tumble by 16% to $53bn for the first quarter, compared to a year ago, following the oil price war between Russia and Suadi Arabia amid the slowdown in world economic activity during the coronavirus crisis.

The firm, led by chief executive Darren Woods (pictured) is expected to produce a full-year loss per share of $0.63 compared to earnings of $3.36 per share last year, according to a consensus of five analysts.

Low oil prices are likely to last for months, putting pressure on the balance sheets of oil firms as few can make money at the current oil price of $20 a barrel. Most big firms budget at a price of $40 a barrel.

The five biggest US and European firms — Exxon, BP, Chevron, Royal Dutch Shell and Total — have announced spending cuts averaging 23% in a rapid response to the dramatic fall in oil.

“We haven’t seen anything like what we’re experiencing today,” Exxon’s Woods said in a conference call earlier this month.

Oil Major boards have traditionally maintained dividends during previous crises, resorting to measures such as borrowing cash or offering discounted shares instead of cash.

But Norweigan firm Equinor surprised the market on Thursday by becoming the first big oil company to cut its dividend, slashing its first-quarter payout by two thirds and suspending a $5bn share buyback programme.

Majors such as Exxon, BP, Chevron, Royal Dutch Shell and ConocoPhillips all report next week, and investors will watch to see if they move to cut dividends for the first time in decades in some cases.

Earlier this month, Exxon said it would cut planned capital spending by 30% this year and has already suspended share buybacks. However, it said nothing about its dividend. Exxon spent $14.8bn last year on shareholder payouts, and investors will hope Exxon’s Woods pledges to maintain them next week.

The eighteen analysts who cover Exxon have cut their earnings per share estimate twice in the last seven days, according to Yahoo finance data.

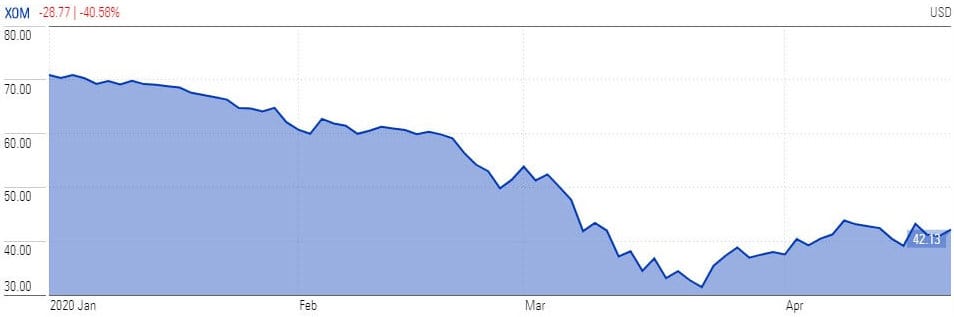

Exxon stock trading has also remained under pressure since the beginning of this year amid the volatility in oil prices.

If you are interested in buying commodities, our commodities trading guide could help you in understanding how to trade commodities.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account