Eventbrite (NYSE: EB), the ticketing and event management company, missed first-quarter consensus estimates amid the cancellation of live shows because of the coronavirus pandemic. Its net losses ballooned to $146.47m in the first quarter from a loss of $9.9m in the year-ago period as revenue of $49.1m slumped 40% year over year, missing analysts’ expectations by $22m.

The company says in earnings call on Monday that ticket sale have started to improve from the March low, due to small gatherings and online events, which it has trurned to as lockdown restrictions bar large gatherings in most parts of the world as s a result of the health crisis.

The San Francesco-based company claims that almost 20,000 online events are now carried out on a daily basis all over the world, a growth of 2000% from the year-ago.

“While this devastating public health crisis brought on by COVID-19 has ground the live experiences economy to a halt, we’re encouraged by the increase in demand for online experiences as it shows our timeless need for human connection remains as strong as ever,” says chief executive Julia Hartz.

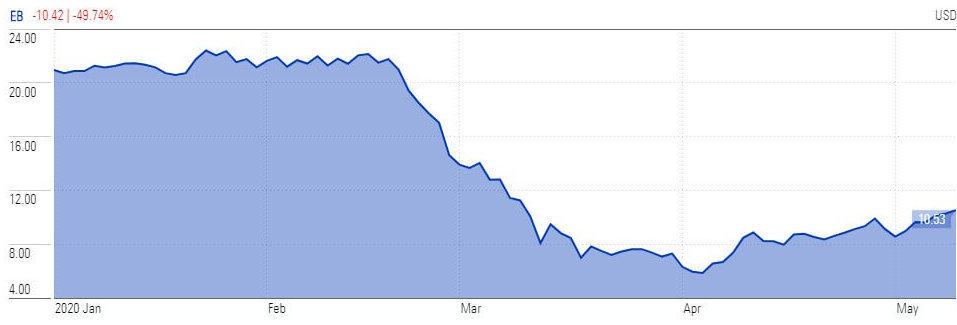

The business plans to slash its global workforce by 45% along with lowering operational and management expenses. Eventbrite stock trading price plunged close to 50% since the beginning of this year to around $8.75 in Tuesday morning dealing.

The company has cancelled all of its concerts and shows that include the Canalside Live summer concert series, Beak & Skiff, and June Mountain Stage Events, among several others due to the virus outspread.

Since the start of March, event creators on the Eventbrite platform have refunded more than $150m to ticket buyers, while refunds and chargebacks funded by Eventbrite totaled less than $3m over the same period.

The group also said on Monday it has secured a financing deal with private equity group Francisco Partners for up to $225m in term loans, to strengthen its balance sheet until the return of live events.

Founded by entrepreneurs Kevin and Julia Hartz in 2006 and went public in 2018. It said last year the firm sold over 300 million tickets on its platform to more than 4 million events ranging from food fayres, music festivals, professional webinars to weekly yoga workshops.

If you plan to invest in stocks, you can review our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account