Deutsche Bank (NYSE: DB) stock price jumped to the highest level in the past sixteen months amid strong fourth-quarter performance, restructuring actions and Capital Group’s stake of 3.1 per cent. The share price of the largest German bank rose 32 per cent since the beginning of fiscal 2020. Despite the recent run, its shares are down 60 per cent in the past five years.

The positive outcomes of the restructuring plan that the chief executive Christian Sewing announced in July added to investor’s sentiments. Sewing had announced to cut 18000 jobs in an effort to trim the investment banking division; the company also plans to move the business from serving asset managers and hedge funds to selling financial products to corporate clients.

The Bank Reported €3bn of Transformation Charges

The German bank incurred more than €3bn in transformation charges. The charges include goodwill impairments, restructuring and severance expenses. The massive amount of restructuring expense expanded its fiscal 2019 loss to €5.3bn. The bank’s fourth-quarter pretax loss surged to €1.3bn because of €1.1bn in transformation charges, restructuring and severance expenses. The net loss for the fourth quarter stood around €1.5ml.

Its common equity tier capital ratio surged to 13.6%, slightly beating the guidance for 13%. The leverage ratio grew to 4.3%; the bank plans to increase the leverage ratio to 4.5% by the end of 2020.

Capital Group’s Stake Strengthened Investors Sentiments in Deutsche Bank Stock

The massive 3.1% stake in the troubled German lender from Capital Group boosted investor’s sentiments. Deutsche Bank share price jumped 14 per cent after Capital Group announced the stake last week. The bank’s management, on the other hand, is showing confidence in the new business plan.

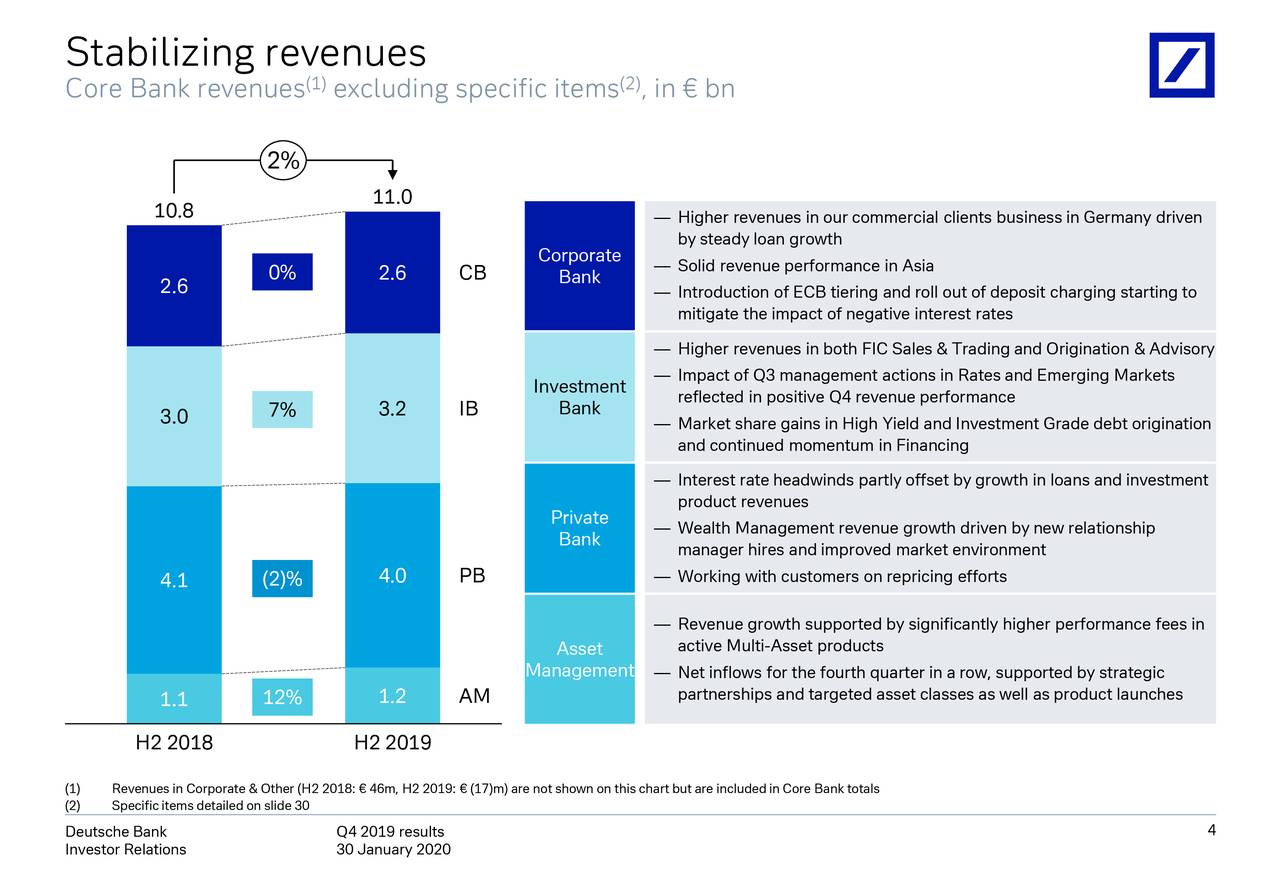

“Our new strategy is gaining traction. Stabilizing revenues in the second half of 2019 and our consistent cost discipline both contributed to better operating performance than in 2018. Our client business is developing well, right across the bank,” said Deutsche’s Sewing.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account