Deutsche Bank’s (NYSE: DS) said it expects to make a first-quarter profit of €66m as the company sets aside €500m in provision for bad debts, a threefold increase on a year ago. It added its revenue for the period was €6.4bn.

Analysts had expected the bank to post a net loss in the quarter and revenue of 5.7bn. The figures indicate that Deutsche, like its large rivals in the US, got a revenue boost from a surge in trading as markets swung wildly in response to the coronavirus pandemic.

The Frankfurt-based bank released its numbers in an unscheduled statement late on Sunday, adding it would give full details of the results as planned on Wednesday.

The German bank also said that it might fail in reaching a loaded leverage ratio target of 4.5% this year, meaning that the bank will may face more financial health issues throughout this year.

Andreas Plaesier, an analyst with Warburg Research, said that the bank needs to make sure the ratio doesn’t fall toward 11%. “This could lead to renewed questions about capital strength and speculation about a capital increase,” he said.

The bank warned last month that the impact of the health emergency might affect its ability to meet its financial targets as the bank undergoes a major revamp after years of losses. The lender is cutting back its investment banking operations and is focusing on servicing big national and multinational corporate clients more directly.

“We are firmly committed to mobilising our balance sheet to support our clients, who need us now even more,” said chief executive Christian Sewing (pictured).

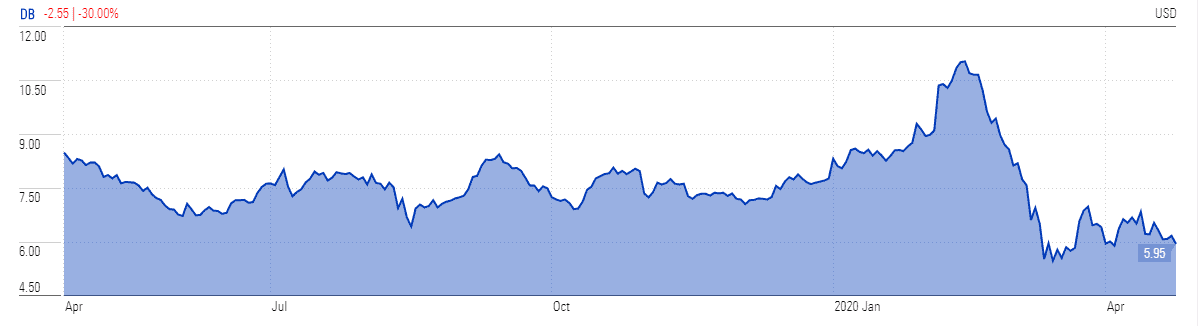

The German bank had reported only €104m in bad debts in the same period last year and ended 2019 with a net loss of €5.3bn euros. However, Deutsche Bank’s stock price rose more than 12% in Monday morning trading with investors praising its revenue performance for the first quarter. However, its stock price has fallen by almost a quarter over the last twelve months due to its ongoing restructuring.

Lower interest rate along with the threat that borrowers will fail in repaying loans is still weighing on Deutsche Bank stock trading. The shares are currently trading slightly up from the 52-weeks low of $5 that it had hit last month.

If you are interested in buying bank stocks, you can check out our featured brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account