Dell (NYSE: DELL) stock price tumbled following lower than expected results for the third quarter. In addition, a lower outlook for the full year is likely to create a negative impact on investor’s sentiments.

Its shares are down more than 19% from 52-weeks high that it had hit five months ago. The stock price is currently trading around $53, up slightly from a 52-weeks low of $45 a share.

The market analysts are blaming Dell’s management for not transforming their business model according to market trends. However, the management is now seeking to make big changes in their entire product portfolio.

Q3 Performance Limits Dell stock Price Upside

Its third-quarter revenue of $22.93 billion missed the consensus estimate by $100 million. Moreover, its revenue grew by 2% from the previous year period.

Its Infrastructure Solutions Group revenue of $8.39B remains light from the consensus of $8.63B. The Client Solutions Group revenue of $11.41B also missed the consensus estimate while VMware revenue topped the consensus of $2.41 billion.

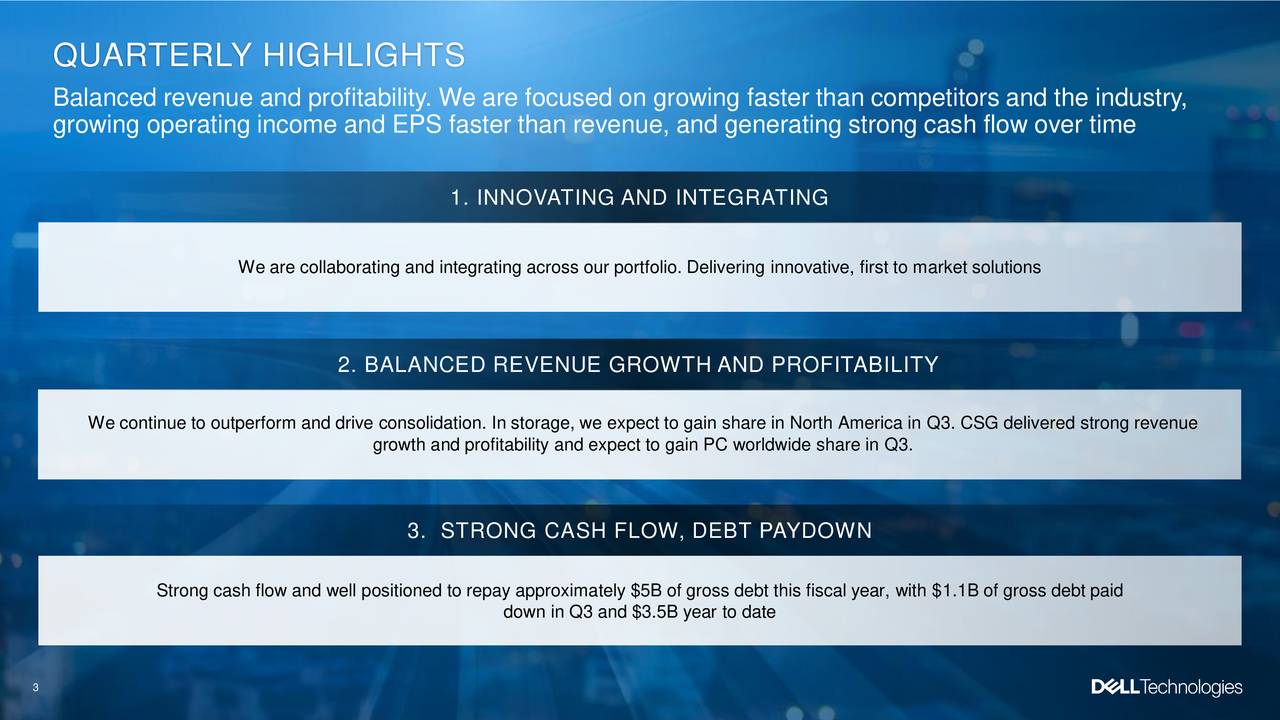

“Dell Technologies is innovating and integrating solutions across our entire portfolio to create the technology infrastructure of the future for our customers,” said Jeff Clarke, vice chairman, Dell Technologies.

On the positive side, Dell’s third-quarter earnings remain robust. Its Q3 non-GAAP operating income grew 18% year over year to $2.4 billion.

The cash flow generation was strong enough to cover capital investments and dividends. It generated $1.8 billion in third-quarter operating cash flows. It returned almost $2 million to investors through share buybacks.

Bleak Outlook Could Keep Shares Under Pressure

The company has lowered its revenue and earnings outlook for the full year. It now expects fiscal 2020 revenue in the range of $91.8B-$92.5B, short significantly from the consensus for $93.5B.

The adjusted EPS is likely to stand around $7.25-7.40. Slower revenue growth along with big restructuring actions could create pressure on its financial numbers in the short-term. Therefore, Dell’s stock price is also likely to remain under pressure.

Click here to learn more about stock brokers and stock trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account