According to a recent report released by Binance Research, when central banks adopt an easy monetary policy, the price of Bitcoin (BTC) tends to go up. However, when central banks tighten their monetary policy, Bitcoin tends to drop.

Bitcoin Could Increase Its Relationship With Risk Assets

The report suggests that during periods of sluggish economic performance, BTC could receive an impulse from investors.

During the last months, several central banks decided to reduce their interest rates in order to help the economy.

The eurozone is currently experiencing low growth rates and some of the most important countries in the group, including Italy and Germany, are experiencing a heavy slowdown on their economies.

This is why the European Central Bank (ECB) decided to reduce interest rates, which are already in negative territory.

The United States through the Federal Reserve (FED) has also been reducing interest rates during the last months in order to avoid entering a recession in the near future.

A Sluggish Start for Bakkt

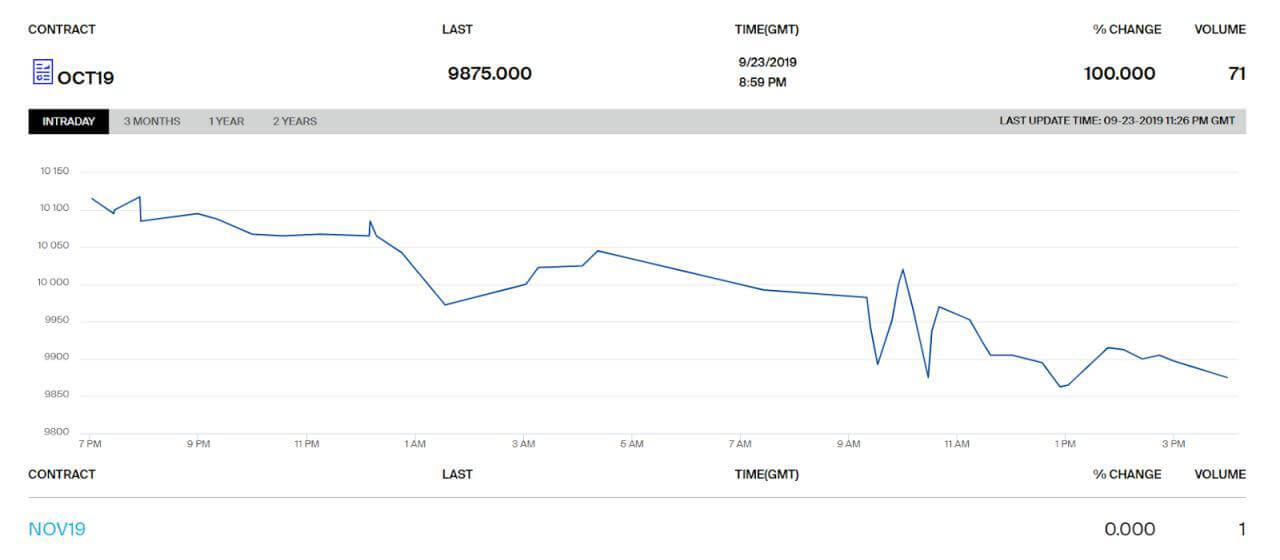

It is worth mentioning that in the last hours, BTC fell close to $9,600 after Bakkt launched its physically-backed Bitcoin futures contracts.

According to the Intercontinental Exchange (ICE), during the first 24 hours operating, Bakkt handled 71 Bitcoin Futures Contracts.

Although this was a sluggish start for the over-hyped Bakkt, it is now possible for larger investors to have exposure to Bitcoin, the largest digital asset in the world.

Bitcoin is considered to be an uncorrelated asset, taking into account it has never traded in a specific direction when comparing it to macro events.

Despite that, Binance Research considers that as more institutional capital flows into the crypto market, there could be a growing relation between BTC and traditional risk assets.

This is something that could have an unwanted effect on the most popular digital currency. Indeed, several enthusiasts and experts promoted it as a store of value during periods of economic uncertainty.

Thus, with a larger number of platforms offering services to institutional investors considering Bitcoin another risk asset, there could be a growing relationship between a global sluggish economy and the price of this virtual currency.

During financial crises, risk assets are negatively affected. Why invest in Bitcoin rather than in safe-haven assets during economic crises? Investors prefer to place their funds in safer investment options.

If Bitcoin is not able to leave its position as a risk asset for investors, it may be affected during an economic crisis. Bitcoin would also have to prove it is more like digital gold rather than a high-risk asset.

Click here to know more about Crypto Trading & Bitcoin Trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account