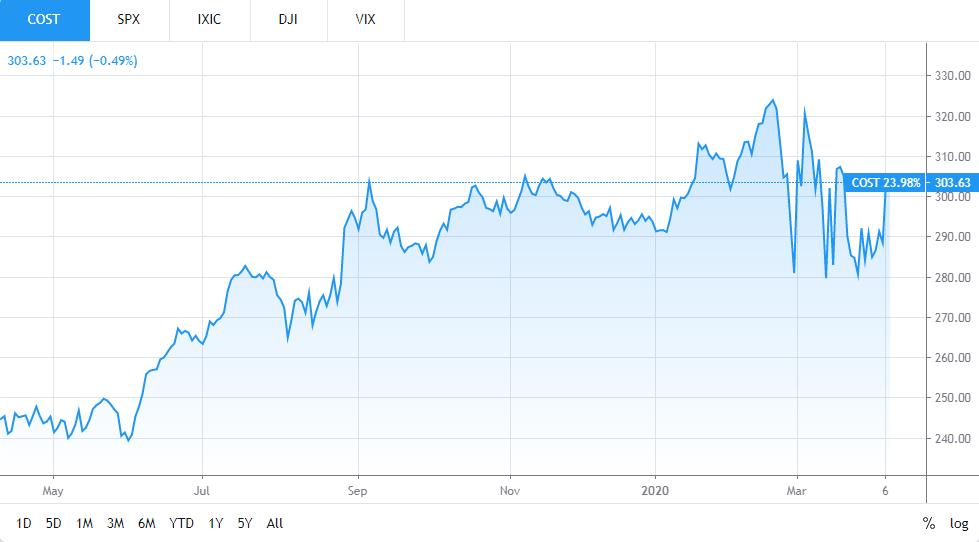

Investors are turning their interest towards Costco (NASDAQ:COST) stock as America tries to cope with the impact of the novel coronavirus. The chain saw its traded shares go up 5% in 2020, while the S&P 500 has fallen more than 16%. Retailers such as Costco, Walmart, and Kroger stores are seeing a spike in customers stocking up on essentials, while department stores like Macy’s have temporarily shut down their stores

Investors are bullish on both Costco and Walmart with Costco coming off as the top pick. Based on a bullish view on US large-cap growth, Costco’s stock has been marked as a “buy” since April of 2018, outperforming through the sell-off. With the focus remaining on long-term recovery, Costco has been able to outperform during market rallies in recent years as well.

The Washington-based group’s membership model works well to enhance customer loyalty, which is crucial during a time of crisis. Other factors, such as earnings and revenue growth contribute to a favourable picture for Costco.

The firm’s consistent gains since late 2018 have pushed its valuation to 33 times forward earnings. The company’ has been implementing modest growth strategies alongside better price management. Coupled with strong membership trends and increasing penetration of e-commerce business – these factors have helped the company sustain an impressive comparable sales run. The company witnessed same-store sale growth of 12.1% during the month of February. Its performance also benefited from an uptick in sales due to coronavirus-led demand spike. This boosted the monthly same-store by roughly 3%.

Costco has made various steps to cements its status as one of the dominant warehouse retailers by selling products at heavily discounted prices, launching a new CostcoGrocery service to deliver non-perishable items to buyer’s home, and expanding same-day grocery delivery service in collaboration with grocery delivery firm Instacart. A differentiated product range also helped the company diversify into the upscale shopping market.

All of this has contributed to Costo’s stock trending upward and future outlook for the chain looks promising. Costco has a Zacks Rank #2 (Buy) as analysts expect an above-average return from the stock in the coming months.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account