US stock indices have lost more than 10 per cent of value in the last six days after hitting the highest level in history only two weeks ago. The Dow Jones Industrial Average slumped 1,190.95 points in Thursday trading—its largest-ever one-day fall.

The Dow Jones Industrial Average is pointing to further decline in trading at the end of the week. Around the world, coronavirus panic sent world share markets crashing again on Friday morning, adding to their worst week since the 2008 global financial crisis and bringing the wipeout in value terms to $5trn.

In Britain, Bank of England governor Mark Carney warned this week that the coronavirus outbreak could lead to a downgrade of the UK’s economic growth prospects.

In the US, investors’ concerns about the spread of the coronavirus are the biggest driver of the latest selloff as many of the companies that make up the Dow Jones Industrial Average are planning to lower their revenue and earnings outlook for this year.

US investment bank Goldman Sachs warned this week that it now thinks the coronavirus will wipe out any growth in US company profits this year. Goldman’s chief US equity strategist David Kostin said: “US companies will generate no earnings growth in 2020. We have updated our earnings model to incorporate the likelihood that the virus becomes widespread.”

He added: “Our reduced profit forecasts reflect the severe decline in Chinese economic activity in the first quarter, lower end-demand for US exporters, disruption to the supply chain for many US firms, a slowdown in US economic activity, and elevated business uncertainty.”

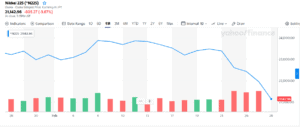

The S&P 500 and Nasdaq set record highs on February 19, but now trade well below its peak. The Dow sits more than 12% below its all-time high.

The US companies have started working on precautionary measures to deal with the potential impact of slowing business activities due to coronavirus impact.

Apple (NASDAQ: AAPL), the world’s largest tech company, recently announced it might not be able to reach March quarter targets as sluggish business activities are impacting its supply and demand.

Cisco Systems (NYSE: CSCO) shares plunged amid broader market volatility, but the company said it is experiencing expanded user base for Webex division, the developer and seller of online meeting and video conferencing applications.

Coca-Cola (NYSE: KO) believes coronavirus will drop its unit case volume by two- to three-points while earnings are likely to decline a one- to two-penny in the first quarter.

Microsoft Corp. (NASDAQ: MSFT) warned that it will miss its financial target for the third quarter of 2020 due to virus breakout.

In Asia, MSCI’s regional index excluding Japan shed 2.7%. Japan’s Nikkei slumped 4.3% on rising fears the Olympics planned in July-August may be called off due to the coronavirus.

Over the past 24 hours, around 10 countries have reported their first virus cases, including Nigeria, the biggest economy in Africa.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account