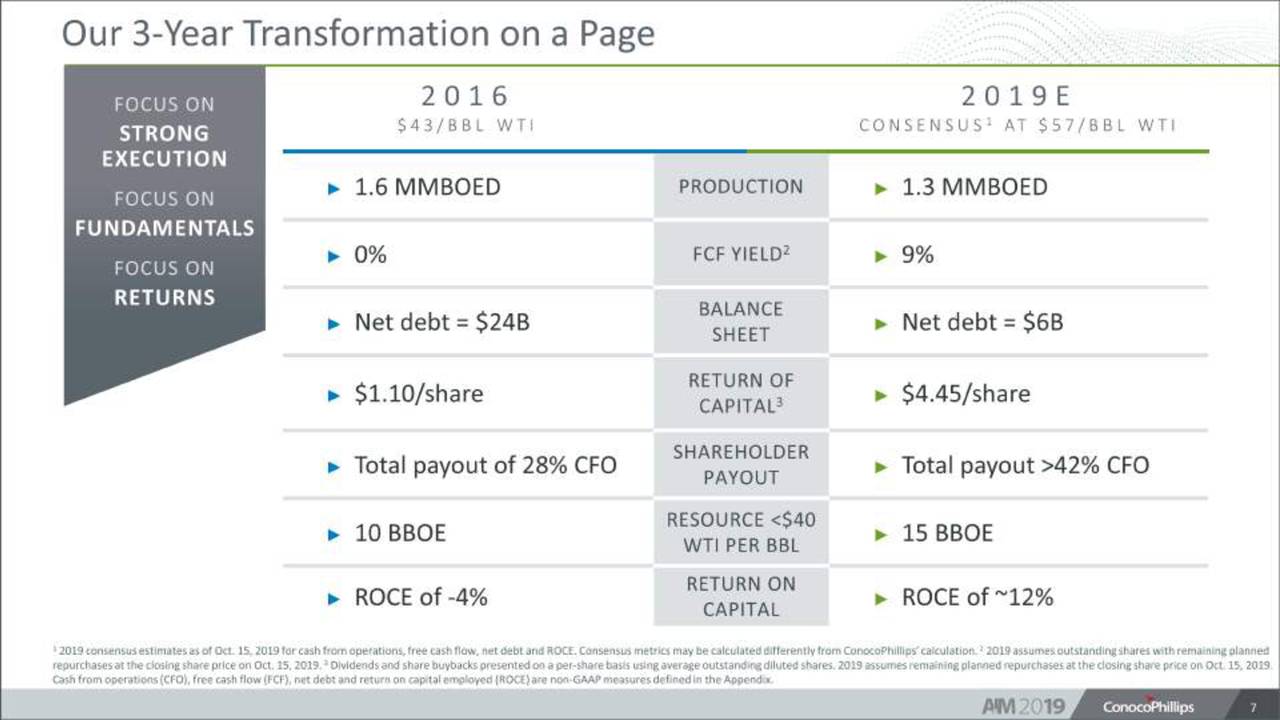

ConocoPhillips (NYSE: COP) stock performed in line with expectations in fiscal 2019. Fortunately, the largest U.S. oil & gas exploration and production company stunned investors with its operational and capital allocation strategies. The company had significantly declined its breakeven point along with giving a substantial boost to free cash flows in 2019.

Consequently, the company appears in a strong position to boost cash returns for investors in 2020. The E&P company currently offers a dividend yield of more than 3%.

It recently raised the quarterly dividend by 37.7% to $0.42 per share. In addition, COP announced to repurchase $3 billion of common stock to give a further boost to earnings and cash generation.

Market Fundamentals are Strong for ConocoPhillips Stock Price

The market fundamentals turned bullish for the oil & gas industry after the latest U.S. airstrikes in Iraq and Iran. The threats of war escalation could push oil prices higher in 2020. This is because Iran and Iraq are among the largest oil producers in the world.

Oil prices are currently trading around the highest level in the last eight months. At present, Brent crude stands around $70 a barrel while U.S. West Texas Intermediate is at $63.05 per barrel.

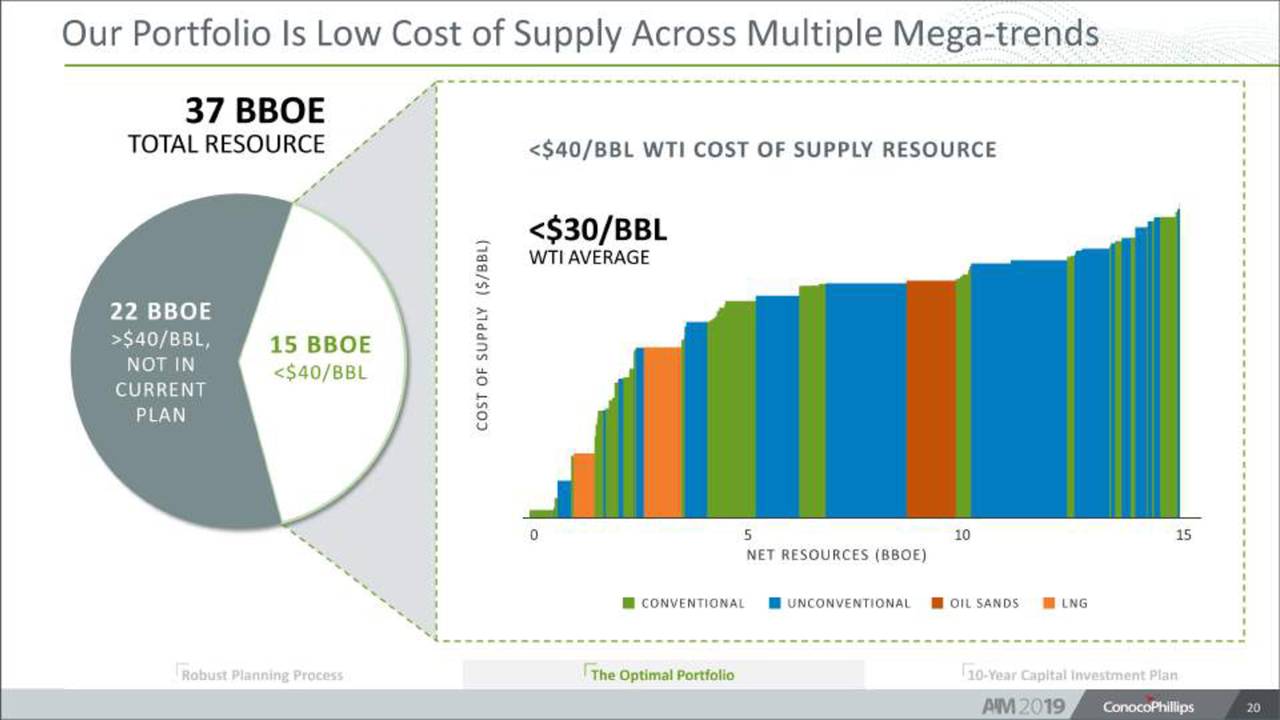

Meanwhile, ConocoPhillips has the potential to generate positive earnings and free cash flows at $40 per barrel. It has been aggressively working on declining its costs and boosting its earnings potential to cope with cyclical headwinds.

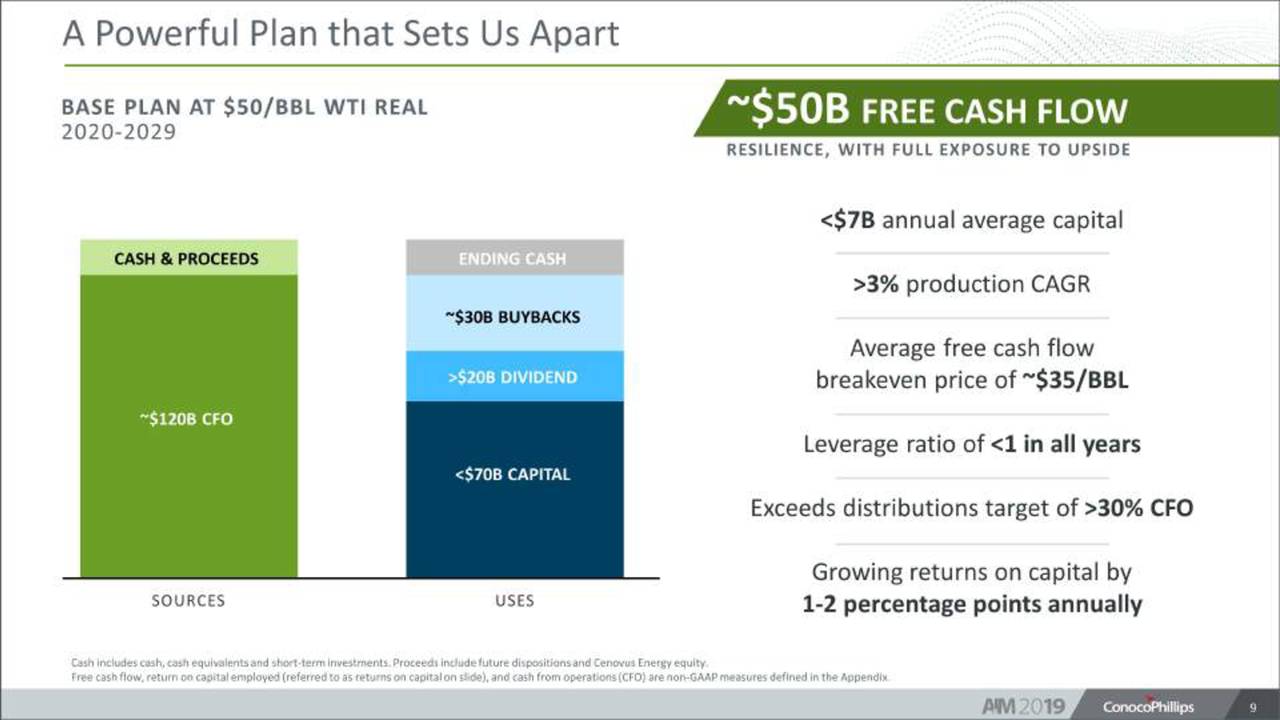

Ten Year Plan Exhibits Massive Returns and growth

The company’s 10-year business plan shows $50 billion in free cash flows along with the plan of returning $30 billion in share buybacks and $20 billion in cash dividends. It expects an annual production growth rate in the range of low mid-single digit.

The company anticipates the average capital investment of $7 billion in growth opportunities to sustain the growth trends. Overall, COP appears in a solid position to generate big returns for investors. ConocoPhillips’ stock price is also well set to increase the investor’s initial capital investments.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account