ConocoPhillips (NYSE: COP) stock price extended the downside amid trader’s worries over the declining oil prices. Concerns over the slowing oil demand due to the spread of coronavirus in China have significantly impacted the performance of the energy sector in the last couple of days. Investors fear the latest virus attack could repeat the memories of the 2002-03 SARS epidemic, which led to a slump in travel.

Oil prices lost more than 6% of value in the last few days. Market analysts are seeing further downside if the crisis develops. On the other hand, ConocoPhillip’s stock price also lost significant value this month, driven by a huge drop in oil prices. The COP share price plunged 4.5% since the beginning of this year.

Buy ConocoPhillips Stock on Dip

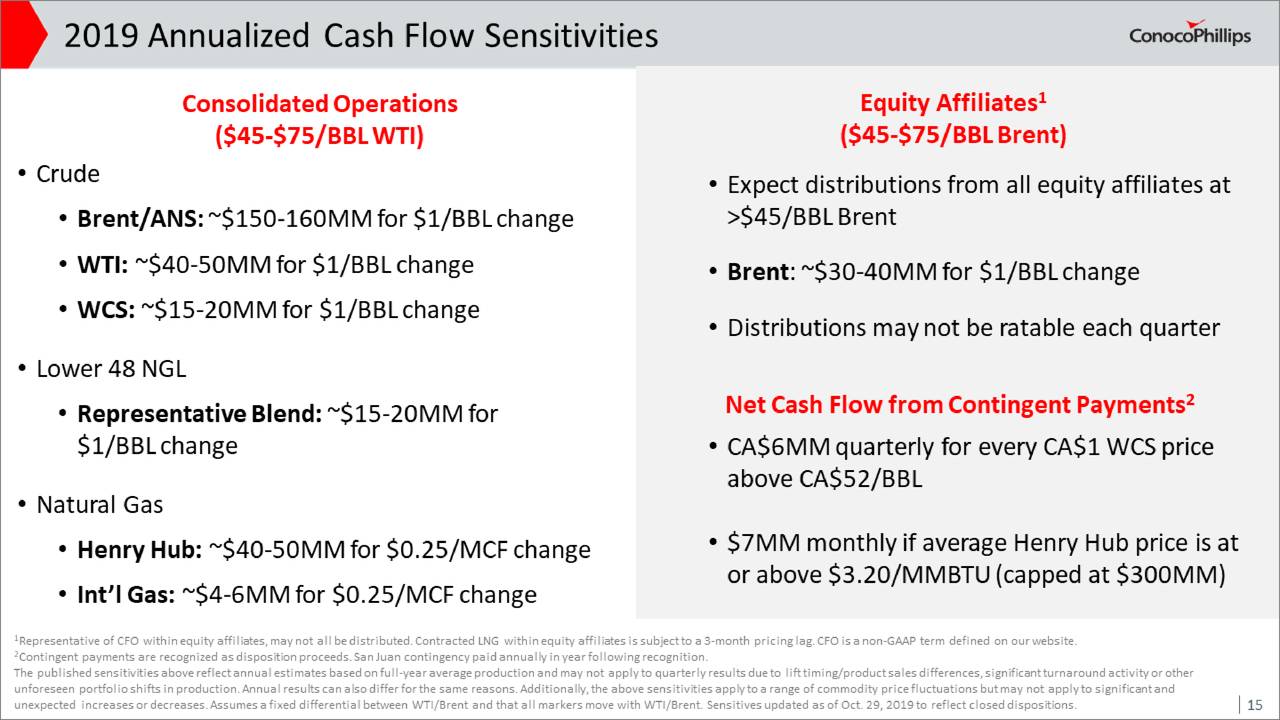

COP is among the top names in the energy sector. The company is famous for offering solid dividend growth. Therefore, the market pundits are seeing the share price selloff as a buying opportunity for new investors. This is because ConocoPhillips has strong future fundamentals. The largest U.S. exploration & production company has the potential to generate positive free cash flows around $40 a barrel.

“COP has a very strong plan going into the next decade where they’re going to attempt to generate $50B of free cash flow, they’re going to do a lot of asset sales and just essentially rationalize their operations all across the board,” BK Asset Management’s Schlossberg says.

Free Cash Flow Generation Potential Makes it a Good Play for Dividend Investors

The company appears in a strong position to generate cash returns for investors. This is because of its cash generation potential. ConocoPhillips has recently increased its quarterly dividend by 37% to $0.42 per share. In addition, the company plans to repurchase $3 billion of common stock in the following quarters. COP plans to generate $50 billion in free cash flows in the next ten years, which bodes well for its dividend growth strategy.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account