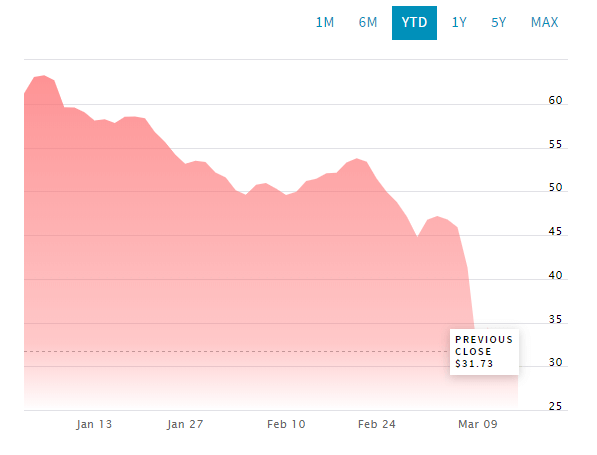

ConocoPhillips (NYSE: COP) stock halved in value in a month due to a crude oil price crash sparked initially on coronavirus fears, but then crystallised into a market share war between the industry’s largest producers.

US producers are feeling more pain of crude oil price fall than other producers around the world because of their higher breakeven level, and the narrowing trading prices between the US WTI oil and Europe’s Brent crude.

“The big loser will be US shale, where the Republican government will possibly face a bailout decision on a heavily indebted industry sooner rather than later,” said Jeffrey Halley, a senior market analyst at OANDA in Singapore.

Brent crude oil fell close to 7% to just below $33 a barrel while WTI declined 5% to $31 a barrel – crude oil prices are down almost 50% since the start of this year.

The latest oil price drop is supported by the second unscheduled Federal Reserve’s interest rate cut, along with US President Donald Trump’s pledge to fill the strategic oil reserves of the world’s largest oil consumer.

“Fear remains the crux of the problem here as market players remain unconvinced that monetary policy easing and liquidity injections will solve an essentially healthcare crisis,” OCBC Bank’s economist Selena Ling said.

ConocoPhillips, which claims to have the lowest breakeven level among US producers, is feeling the pressure of oil price drop. Its stock price dropped close to 50% in a month to the lowest level since the 2008 financial crisis. Moving averages and short-term price predictions are hinting more downside in the coming days.

ConocoPhillips recently said it has the potential to remain cash flow positive around $35 a barrel. However, in 2018 ConocoPhillips announced a ten-year plan of generating $30bn from free cash flows at an average price of $50 a barrel.

The company also announced to repurchase $25bn of common stock over the next decade along with investing in growth opportunities. The oil price crash will test ConocoPhillip’s cash generation potential. “We have laid out a powerful 10-year plan based on our formula for value creation and we look forward to successfully delivering that plan in the quarters and years ahead,” Ryan Lance, chairman, and the chief executive said during the fourth-quarter conference call last month.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account