Cisco (NASDAQ: CSCO) stock price plunged significantly since it announced first-quarter results along with a lower than expected outlook for the second quarter. The company’s shares dropped almost 20% in the past three months.

The share price is currently trading slightly above the 52-weeks low of $40. The market analysts have also been showing concerns over macroeconomic headwinds.

Fortunately, some investors are seeing the dip in Cisco stock price as a buying opportunity for the long term investors. Its strong dividend yield along with the extensive history of returning significant cash to investors makes it a perfect stock for a dividend portfolio.

Buy Cisco Stock Price on the Dip

Wise investors always like to buy stocks when they trade well below fair value. In the case of Cisco, its shares are down substantially from a 52-weeks high of $58. The shares are also trading at attractive valuations considering the price to earnings ratio of 13. In addition, the company offers a dividend yield of 3.19%.

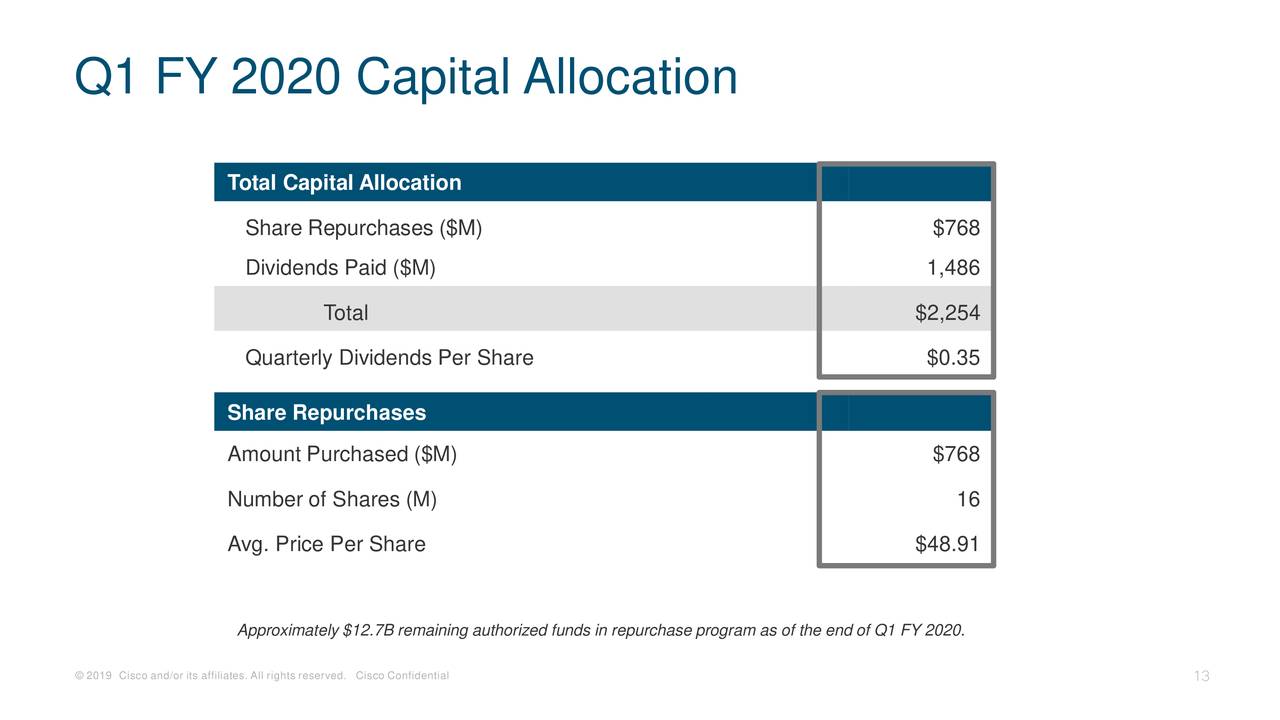

It has raised dividends in the past eight successive years. The company currently offers a quarterly dividend of $0.35 per share. Moreover, the company is likely to make a dividend increase at the beginning of next year despite pressure on financial numbers.

Its cash generation potential is more than enough to cover dividend payments. CSCO has generated an operating cash flow of $3.6 billion in the latest quarter, which is more than enough to cover dividend payments of $1.5 billion. Indeed, the gap in cash flows and dividend payments would allow it to make a dividend increase in the coming days.

Acquisitions and Investments in Growth Opportunities Could Reaccelerate Growth

The company had made several acquisitions in the previous quarters to support revenue growth. It has also recently announced Acacia Communications acquisition. The company says they are seeking to complete several small acquisitions in the following quarters to capitalize on changing market trends. Overall, Cisco appears like a good play for dividend investors.

Click here to learn more about stock brokers and stock trading.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account