Cisco (NASDAQ: CSCO) stock price underperformed in fiscal 2019 compared to the broader market index. Its share price remained under pressure throughout the second half of the last year amid macroeconomic headwinds.

The sluggish revenue growth and bleak outlook have also impacted its share price performance. CSCO share price grew only 17% in fiscal 2019, down from the S&P 500 rally of 29%.

Cisco stock price could remain under pressure in the coming days, according to market analysts. CSCO share price is currently trading below $50, down from the 52-weeks high of $58 a share. The company could also experience pressure on its dividend growth potential due to poor financial numbers.

Macroeconomic Headwinds are Likely to Impact Cisco Stock in 2020

Piper Jaffray expects CSCO share price to remain range-bound in the coming days. This is because of macroeconomic trends. The firm has slashed the price target to $51 from $54.

Its analyst James Fish said, “There’s a slowing macro environment across Enterprise and Service Provider, and it will take product orders time to recover after peaking three quarters ago. But the downside to the stock is fairly limited for now.”

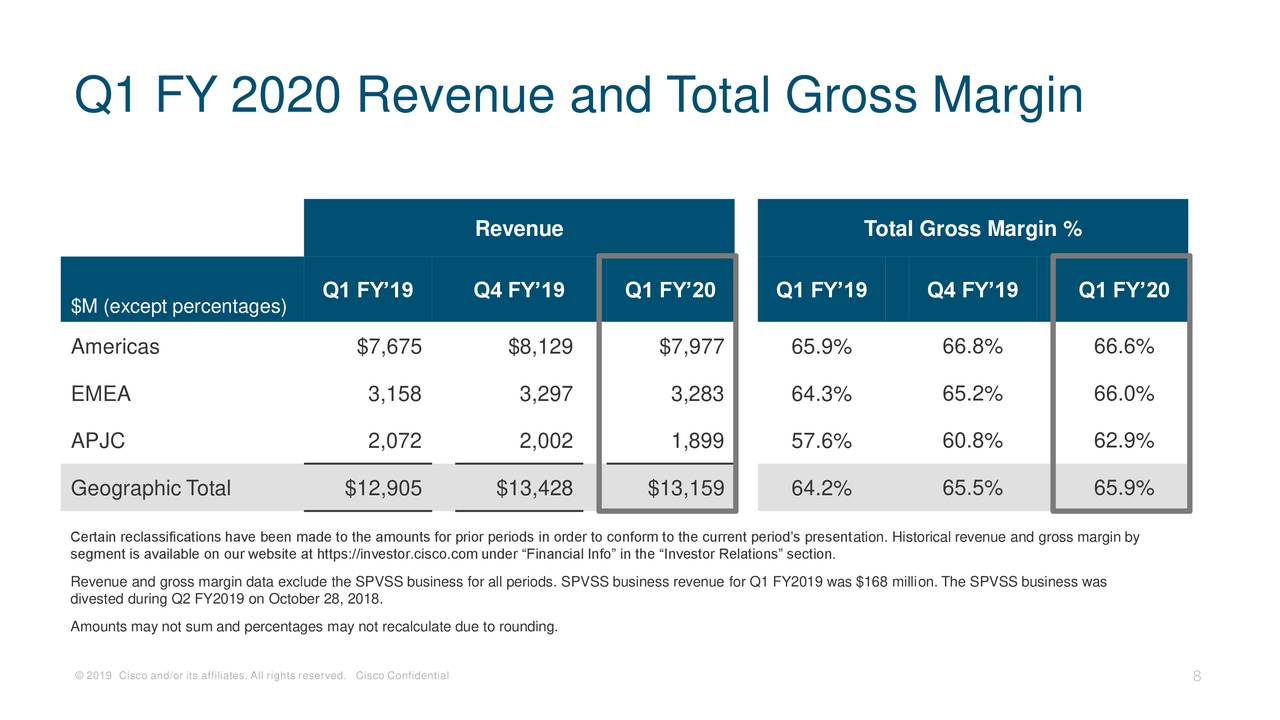

The company had generated only 2% year over year revenue growth in the latest quarter. In addition, its margins also declined compared to the earlier periods. Its net income in the first quarter of 2020 dropped 18% from the year-ago period.

Moreover, the company has presented a bleak outlook for the second quarter. It expects Q2 revenue to decline 3 to 5% from the past year period. The GAAP EPS is likely to stand around $0.61 to $0.67 in the second quarter of fiscal 2020.

Dividend Growth is at Risk

The company had raised the quarterly dividend by 6% last year. However, negative financial growth could force the company to trim its dividend growth in the coming days. The company needs a lot of cash for investment activities in organic and inorganic growth opportunities to boost its revenue growth. Overall, though time is ahead for Cisco stock.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account