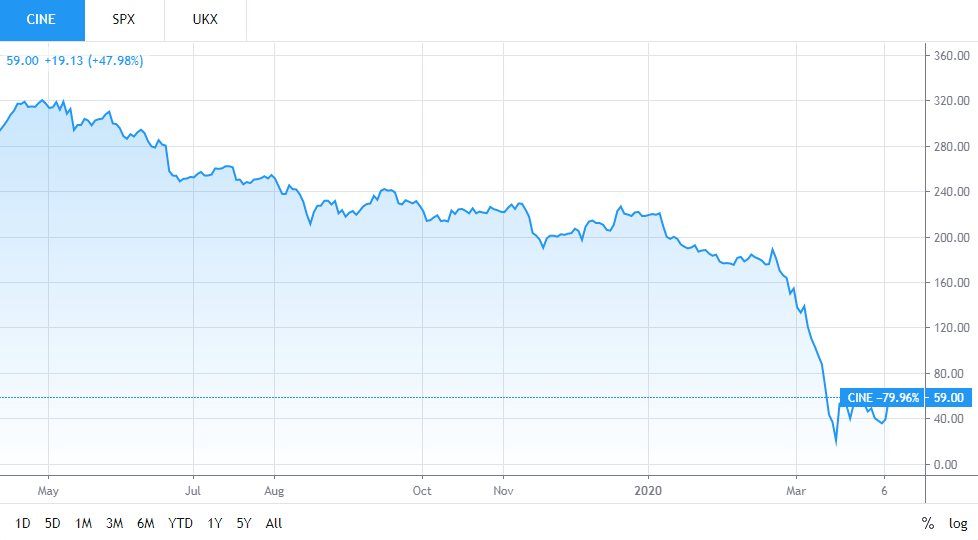

Cineworld revealed a survival plan which includes deferring executives’ annual salaries and bonuses for a year amid the looming coronavirus crisis, triggering a share price surge of more than 50%. The second-largest cinema chain in the world saw its shares jumped 20p to close at 59p on the London Stock Exchange on Tuesday, before giving back some of those gains to trade 2% down on Wednesday morning.

As the group’s entire estate of 787 cinemas across 10 countries remains closed due to the pandemic, the new measures will attempt to conserve cash and ensure the survival of the chain.

The group’s executive directors and non-executives have agreed to postpone salary payments and defer payment of their fees. Additionally, Cineworld will also scrap the payment of its 2019 fourth-quarter dividend, as well as all upcoming payouts.

News of Cineworld’s extreme measures to conserve cash follow years of heavy borrowings, built up to fund big acquisitions, which saw the company face a mountain of increasing debt prior to the outbreak of the pandemic.

Early March saw the company lay off hundreds of staff members and temporarily slash the pay of others by 60 per cent. Cineworld responded to a letter by a group called the ‘Cineworld Action Group’ of former employees by pledging to offer its hourly-paid workforce a lifeline under the ‘furloughed’ option. The UK government introduced the measure in an attempt to help workers and businesses amid the health crisis by covering 80% of staff salaries up to £2,500 per month.

Cineworld said: ‘We were very pleased when the government announced its Coronavirus Job Retention Scheme to support companies like ours. This scheme has allowed us to put all of our employees who are unable to work on furlough, which means they will be able to keep their jobs and still be paid during the closure.

“Every effort is being made to mitigate the effect of the closures, to assist our employees and to preserve cash,” Cineworld said in a statement.

“Under its efforts to stabilize its balance sheet, the cinema chain is in discussions with landlords, the film studios and major suppliers, as well as curtailing all currently unnecessary capital expenditure.

Russ Mould, investment director at AJ Bell, said: “Cineworld’s battle for survival involves bosses forgoing pay, capital expenditure being frozen and urgent discussions with lenders, landlords, film studios and suppliers. Coming out the other side will not be easy.

“A longer term question concerns the existential threat to the wider cinema industry. The upcoming release Trolls 2: World Tour – a sequel to the successful 2016 family film Trolls – will be the first major studio title with family appeal to go straight to streaming services when it drops on 10 April.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account