Chevron (NYSE: CVX) stock price lost some value in the past couple of months amid oil price volatility. The oil price instability has impacted its third-quarter results. Fortunately, the company is seeking to cope with low oil prices by improving its profitability and margins. CVX is seeking to do this through cost cuttings and investment in high margin oil plays.

Chevron stock price is up 7% year to date despite a huge decline in oil prices. The market analysts are expecting oil producers to set their footprints for low oil prices. Analysts are forecasting oil prices to stay below $60/bbl for a longer time. WTI crude oil is currently trading around $57.24/bbl.

Chevron CEO Announced Major Cost Cutting Initiative

Chevron is planning to generate big profits despite depressed oil prices. Its CEO Michael Wirth announced to make major cost cuttings to improve their profitability. The company is looking to expand its position in U.S. high margin plays while selling non-core assets in other parts of the world.

The company plans to cut its global upstream group into individual units; it is moving focus on shale along with the deepwater businesses and liquefied natural gas. This strategy could help in reducing operating expenses over the long-term.

The company also announced to sell North Sea assets for $2B to Israel’s Delek Group. On the other hand, its strategy of strengthening U.S. footprints is working.

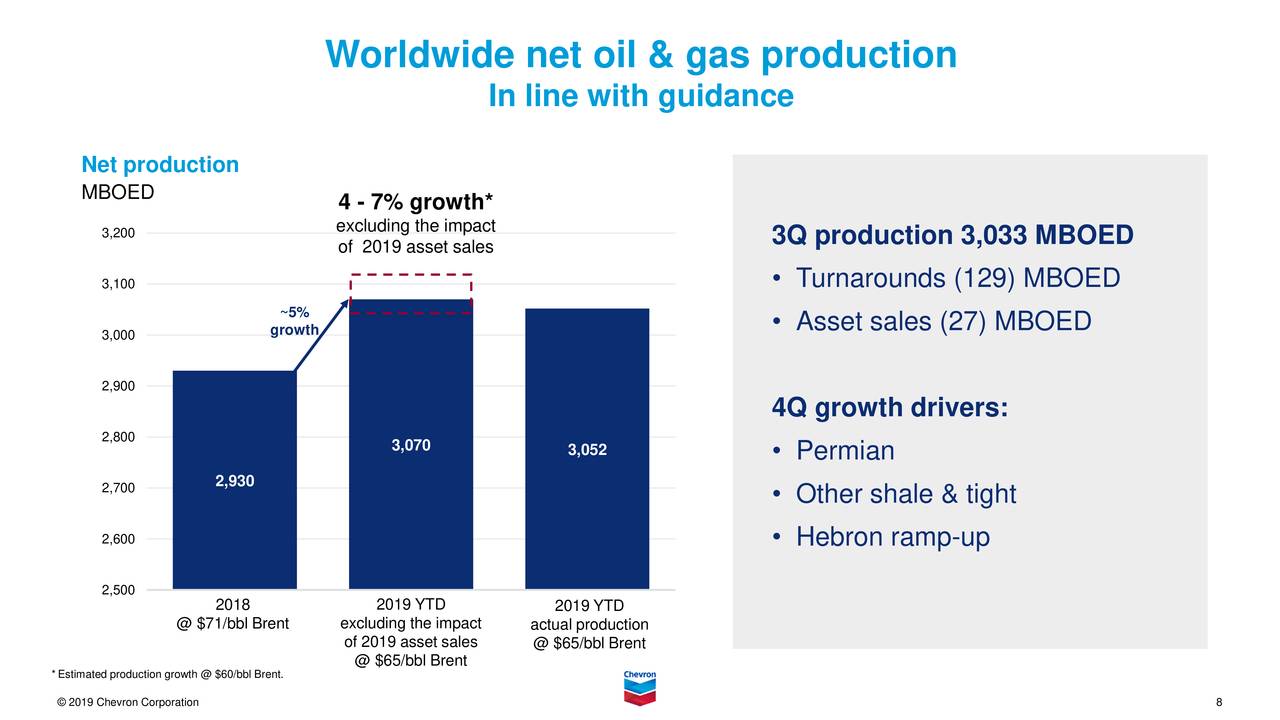

Its production from Permian Basin rose 35% Y/Y to 455K boe/day. The total Q3 total production increased by 2.6% year over year to 3.03M boe/day, driven by a 2.5% increase in liquids production.

Profitability Drive Supports Dividends and Chevron Stock Price

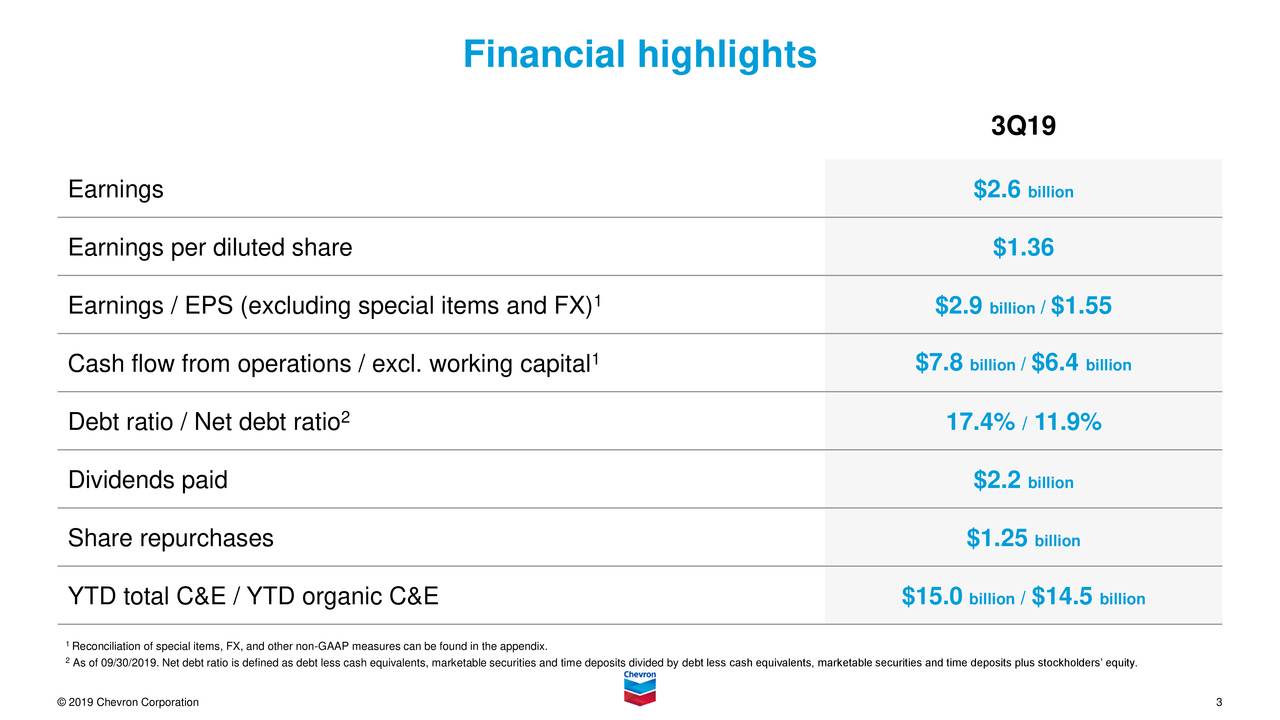

Chevron is among the big names when it comes to dividend investing. It has increased dividends in the past eighteen consecutive years.

The company currently offers a quarterly dividend of $1.19 per share, yielding around 4%. The company is also returning cash in the form of share buybacks. Overall, its strategy of boosting margins and profitability is likely to enhance its dividends and share price.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account