A challenging time for bond investors

By Kathy Jones

September 2012

Many people have spent a lifetime building up their savings only to discover that the current low- interest-rate environment doesn’t provide enough income to sustain their standard of living. Four years and counting into the current rate environment, investors are facing difficult choices: lower their expectations and/or take more risk. Is this the solution? Let’s consider strategies designed to help deal with the challenge of low interest rates.

Don’t give up; Strategize

Investors should consider laddering money they don’t need in the near future.

While the low-rate environment is challenging for bond investors who want to generate income, we still believe bonds can serve an important function in your portfolio: They can help preserve capital and provide diversification. These attributes have been important factors in helping stabilize portfolios over the past decade, while stock prices have been more volatile. Instead of giving up on the bond market, we believe investors should be prepared for interest rates to stay low for quite some time, but also leave some room to maneuver.

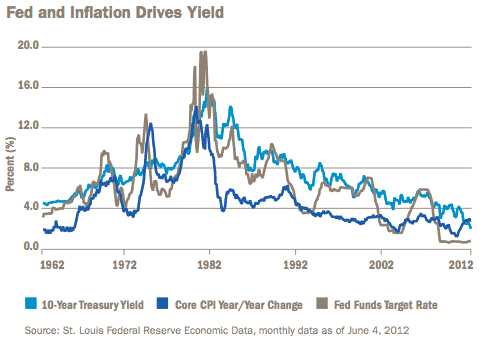

After all, low interest rates may remain for a while. The combination of the Federal Reserve’s zero-interest-rate policy 16.0 and the sluggish pace of economic growth in the wake of the financial crisis indicate to us that it could take some time before interest rates increase in a meaningful way. The work of Kenneth Rogoff and Carmen Reinhart, authors of “This Time Is Different,” indicates that economic expansions following financial crises tend to be weak. The current expansion appears to be following this historical pattern. GDP growth in the 11 quarters since the bottom of the downturn has averaged only 2.3% annually, compared to 4.4% for the past five expansions.

Despite our expectation for a slow-growth recovery, we don’t want to be complacent about the risk of rising interest rates down the road. There is a lot more room for rates to rise than to fall, and with current rates below the level of inflation, real returns may be negative. We generally suggest limiting duration to an intermediate-term range.

Investors may also want to reconsider strictly passive strategies. The major bond indexes have become less diversified in the past few years, with a higher concentration of longer-maturity government debt. We generally suggest supplementing core government bond holdings with high-quality investment-grade corporate bonds of intermediate duration to help diversify portfolios.

One strategy we favor is bond ladders. Ladders are designed to create a predictable income stream by spreading out bond maturities over time. If interest rates move higher, you can reinvest short-term bonds at higher rates. If rates stay low, you still have some bonds locked in for the longer term at higher yields. Ladders may not outperform portfolios with more narrowly targeted maturities, and bond prices will still decline if interest rates rise. But we see the benefits as outweighing the risks for many investors in a low-interest-rate environment.

The cost of waiting

Don’t try to time the market. Even in a low-rate environment, we think staying invested is more important than timing investments.

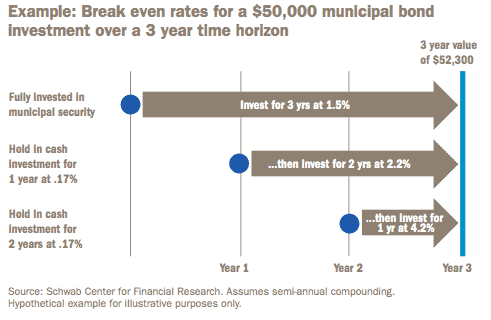

Unappealing interest rates and concerns about the potential for bond prices to decline if rates do rise have caused some investors to sit on the sidelines in low-yielding accounts or cash investments. However, there can be a cost to waiting for rates to rise before investing. Sidelined investors miss out on current income that could be reinvested and compounded. Moreover, by deferring an investment in higher-yielding securities, investors may be tempted to take more risk later on to catch up on missed income.

Hypothetically, let’s look at the difference in projected returns between a low-yielding cash investment, such as a money market fund, with a tax-exempt interest rate of 0.17% and compare it to a three-year AA municipal bond yielding 1.5%. Assuming an investment of $50,000, the municipal bond would be expected to earn $2,300 over a three-year period. If you waited in cash for one year, the bond’s coupon would need to rise to around 2.2% in order to generate the same amount of interest income. And if you held cash for two years, then a jump to 4% would be needed in the third year in order to make up for lost income.

While increases of this magnitude are not impossible, they’re certainly not common. The steepest rise in short-term rates in the past 20 years occurred in 1994–1995. The Federal Reserve raised short-term interest rates rapidly—doubling the rate from 3% to 6% in a year’s time. (The Fed subsequently changed course within six months of the last rate hike and reversed 75 basis points, or 0.75% of the increase.)

Trying to predict the direction of interest rates is very difficult, and there’s a cost to waiting on the sidelines for rates to increase before investing. At Schwab, we believe that you shouldn’t try to time the market. Even in a low-rate environment, we think staying invested is more important than timing investments.

The growing divide in muni bonds

We think the muni market remains relatively attractive overall; however, care should be exercised when buying individual muni bonds.

The municipal bond market continues to face dual headwinds caused by a weak economic recovery and rising public-service costs. States and municipalities face rising social-service needs and employment costs, while the political tide and weak economy are limiting revenue and taxing ability. This will be a challenge for the next decade or more, in our view.

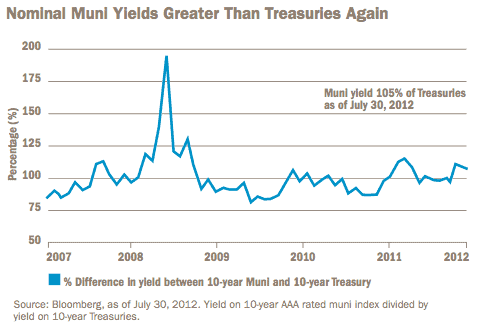

Even so, we believe municipal bond markets remain relatively attractive overall. Nominal muni yields are greater than yields on Treasuries of comparable maturities, as you can see in the chart below. And we believe that bankruptcies of municipal governments will remain relatively infrequent events. Many municipalities are taking the steps needed to address strained budgets by cutting spending and raising revenues. In our view, the revenue picture for state and, to a lesser degree, local, governments is generally stabilizing.

However, care should be exercised when buying individual muni bonds. While we expect defaults to remain low, we are seeing an increasing differentiation between higher-quality, more-stable issuers versus those not responding as actively or flexibly to credit challenges. We generally suggest that muni investors stick to issuers with local economies that are rebounding and management that shows signs of making cuts when necessary. We still prefer general obligation bonds, backed by a dedicated pledge of property taxes—often called an unlimited ad valorem tax pledge in a prospectus—along with essential-service water and sewer revenues bonds from stronger, more-stable systems as the core for most muni portfolios.

Many investors lack the time and interest to monitor individual credit conditions, which is particularly important when investing in longer-term bonds because some of the fiscal issues municipalities face may take years to play out. For these investors, bond mutual funds and managed accounts offer professional management of issuer-specific risk.

We’re living through challenging times, but we caution against overreacting to negative news that may have no impact on bonds you actually own. If you are truly concerned about widespread near-term defaults on munis, then reconsider your investment philosophy and risk profile. But if you do choose to avoid munis, you may be giving up some positives as well, including potential tax advantages, relative stability and the income stream.

Look beyond the index: Investors may need to look for more diversification

Benchmark indexes may not provide enough diversification or yield. But higher yield means higher risk.

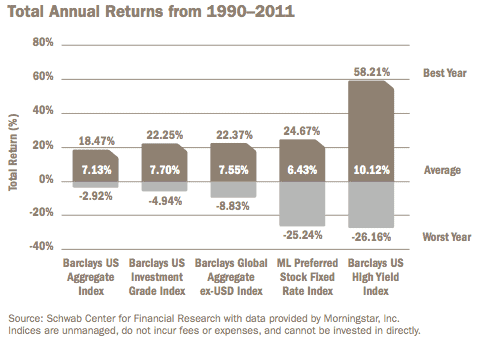

The benchmarks that index investors use are not as diversified as they used to be. They’re more highly concentrated in government-backed securities that have longer-duration bonds. We think investors have the potential to diversify more, increase yield and lower duration risk by looking into other sectors of the bond market such as high-yield bonds, international bonds, preferred securities and multi-sector bond funds. However, extra yield typically comes with added risk. We advise limiting the amount of these aggressive income investments to no more than 20% of your overall fixed income portfolio, to help reduce potential volatility and losses.

High-Yield Bonds: The average annual return in the high-yield bond market over the past two years has been 10% compared to an average of 6.5% for the broader aggregate bond index. In our opinion, the relatively strong returns for high-yield bonds have been driven by improving economic and financial-market conditions as well as increased investor appetite for yield.

But investors should do their research on these bonds: By definition, companies that issue high-yield bonds are less credit-worthy than investment-grade companies and more likely to default. In addition, the market for high-yield bonds is less liquid than for other types of bonds, which carries more risk. High-yield bonds also tend to be more correlated with the stock market than with Treasury bond prices, which can potentially change the overall diversification of your portfolio.

International: While international bonds have historically been a good source of diversification for investors, since the onset of the global debt crisis in 2008, they haven’t provided for the level of diversification seen in past economic cycles. Additionally, the rise of the US dollar as a perceived “safe haven”—immune from market turbulence—has reduced the benefits of exposure to other currencies. In the long term, we think the benefits of diversification will return, and that some allocation to the foreign bond markets is warranted. Additionally, emerging-market bonds can help add diversification for investors willing to take more risk. Generally, emerging-market countries currently carry less debt relative to the size of their economies than in developed-market countries, and their economies are growing at faster rates. However, these markets also tend to be more volatile and less liquid than the G-10 bond markets, so we suggest limiting exposure in a fixed income portfolio.

Preferred Securities: Preferred securities, also called “preferred stock” or “preferreds,” may be appealing to investors looking for higher yields in a low-interest-rate environment; however it’s important to know the details and risks of a particular security. Preferreds rank lower than bonds in a company’s capital structure and are considered “loss absorbing” securities. The dividends or interest payments from preferreds would be cut before interest on bonds in cases where the issuer is under stress. Many preferreds are callable, lack a maturity date and are sensitive to interest-rate risk. Most issuers of preferred securities are banks and financial companies, which can inadvertently lead to a concentrated position in the financial sector, and preferreds may be less liquid than other securities issued by the same firm. For each of these reasons, preferred securities may not be appropriate for all investors.

Multi-sector Bond Funds: Multi-sector bond funds generally have the broadest, least-defined allocation targets of funds classified by Morningstar, giving their managers the ability and discretion to look for opportunities across the range of global bond investments. This flexibility is increasingly important in the current rate environment, and professional management may make sense for investors seeking broader fixed income exposure. However, more flexibility and higher potential return come with higher risk. These “go anywhere” funds have tended to take on more credit risk rather than duration risk in their search for yield, including currency and high-yield credit exposure. As a result, multi-sector bond funds are often more volatile than less aggressively invested bond funds, especially during periods of market stress. Performance also depends on the talent of the fund manager.

No easy answers

Operation Twist—the program whereby the Federal Reserve has shifted its holdings from short- to long-term bonds—probably means interest rates will stay low well beyond 2012, in our view. The unintended consequence is to create a dilemma for investors looking to earn more from their fixed income portfolios without taking too much risk. Government-backed bonds, while considered the safest, offer very low yields and are susceptible to the risk of rising interest rates longer term. The alternatives entail taking more credit and interest rate risk at a time the economy appears to be losing momentum.

However, not investing means earning nothing. Waiting for interest rates to rise is costly in terms of lost income. And even at low interest rates, bonds can play an important role in a portfolio to help buffer volatility in other asset classes.

We favor taking a balanced approach when searching for yield in the current market. For most investors, we believe that means holding a core portfolio of high-quality bonds and adding a limited amount of riskier assets for more income, if the yields on those assets provide some compensation for the added risk.

#######

Brokerage Products: Not FDIC-Insured • No Bank Guarantee • May Lose Value

For funds, investors should carefully consider information contained in the prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by calling Schwab at 800-435-4000. Please read the prospectus carefully before investing.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Past performance is no guarantee of future results.

The material contained herein is proprietary to Schwab and for informational purposes only. None of the information constitutes a recommendation by Schwab or an offer to buy or sell any securities. This information is not intended to be a substitute for specific individual tax, legal or investment planning advice. Schwab does not provide tax advice. Clients should consult a professional tax advisor for their tax advice needs.

Fixed income securities are subject to increased loss of principal during periods of rising interest rates. Fixed income investments are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. International investments are subject to additional risks such as currency fluctuation, political instability, differences in financial accounting standards, foreign taxes and regulations and the potential for illiquid markets.

“High-yield” bonds are lower rated securities and are subject to greater credit risk, default risk, and liquidity risk.

Diversification strategies do not assure a profit and do not protect against losses in declining markets.

Municipal bond Income may be subject to the alternative minimum tax (AMT), and capital appreciation from discounted bonds may be subject to state or local taxes. Capital gains are not exempt from federal income tax. Individual municipal bonds may not be tax-advantaged, depending on the bond issuer and your state of residence. Bonds issued in U.S. states and territories are exempt from federal taxes, as well as state taxes for the residents of the state of issue.

©2012 Charles Schwab & Co. Inc. Member SIPC. All rights reserved.

IAN (0812-5185) MKT69224 (08/12)

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account