US fashion group Centric Brands has filed for Chapter 11 bankruptcy as part of a restructuring agreement that is likely to see it emerge as a private business.

The New York-based wholesaler said on Monday that it reached an agreement with largest lenders including Blackstone, Ares Management Corporation, and HPS Investment Partners.

The company struck a deal to secure $435m in the form of a debtor-in-possession business loan, a financial lifeline that seeks to support the company’s restructuring plan by allowing it to run as a going concern.

The firm, which distributes apparel for many brands including Calvin Klein (pictured), Tommy Hilfiger, and Nautica under licensing agreements, plans to become a private company while reducing $700m in debt to navigate the turmoil caused by the coronavirus health emergency, which has hit its profitability.

Centric Brands chief executive Jason Rabin said: “The pandemic disrupted many of our wholesale accounts’ ordering and constrained our cash flow. However, we are confident that with added flexibility in our capital structure, we will be well-positioned for long-term success during this period and beyond.”

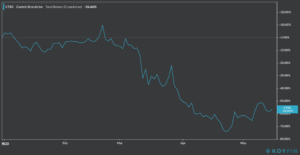

Shares of Centric Brands (CTRC) nosedived this morning, losing nearly 50% on pre-market trading. Meanwhile, the stock has lost 57% of its value so far this year, as the retail industry continues to feel the economic impact of store shutdowns.

The restructuring support agreement signed by Centric Brands and the three lenders also contemplates the transformation of Blackstone’s second lien debt into an equity stake in the firm. Moreover, Ares and HPS will maintain their senior loans as is while receiving additional equity in the company as part of the deal.

Centric has appointed consulting firms Alvarez & Marsal, Ropes & Gray, Dechert, PJT Partners, as advisors to assist with the proceeding. The company also appointed former L Brands executive Laura Ritchey as chief operating officer in early February.

According to its latest quarterly financial report filed in September 2019, the company had $19m in cash and equivalents and approximately $2.23bn in total liabilities. Total assets by the end of the quarter were $2.15bn.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account