Caterpillar (NYSE: CAT) stock price plummeted sharply since the beginning of this year due to the trader’s concerns over slowing Chinese demand. The revenue and earnings miss for the fourth quarter added to the CAT share price selloff. The company has also presented poor sales and earnings outlook for fiscal 2020.

Caterpillar stock plunged close to 12 per cent in the last month. CAT share price is currently trading around $130, up from the 52-weeks low of $115 a share. The threat of coronavirus could create an additional dent on its financial numbers, according to market analysts. This is because China is one of the largest markets for CAT.

Fourth Quarter Results Enhanced Bearish Sentiments for Caterpillar Stock

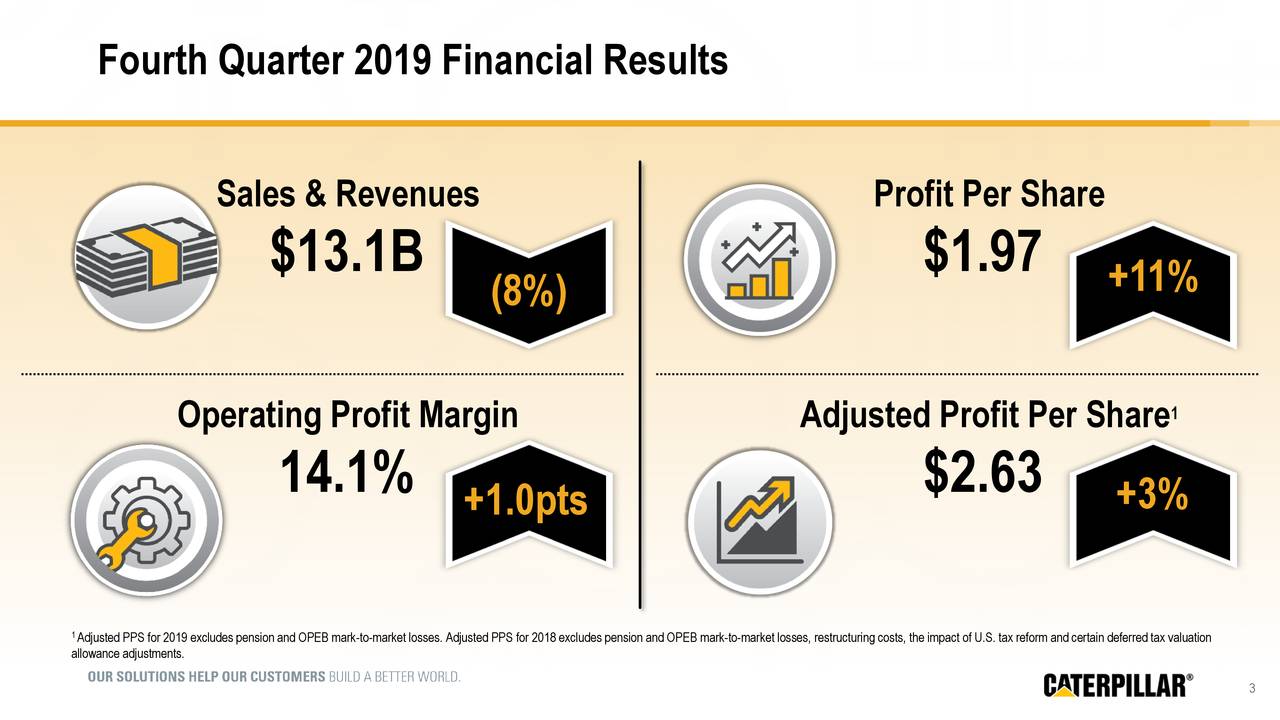

The company missed a fourth-quarter revenue estimate by $280 million and $0.40 per share, respectively. Its fourth-quarter revenue of $13bn declined by 8% from the year-ago period. Its full-year revenue of $54bn dropped modestly from last year’s revenue of $53bn.

On the positive side, CAT generated a strong margin and earnings performance considering a huge decline in revenues. Its fourth-quarter earnings per share of $1.97 increased from last year’s earnings of $1.78 per share. The earnings growth is attributed to cost cuttings, share buybacks and investments in high margin areas.

“While sales declined modestly in 2019, we delivered an operating margin and free cash flow consistent with our long-term targets and continued to invest in services and expanded offerings,” said Umpleby.

Outlook is Pessimistic

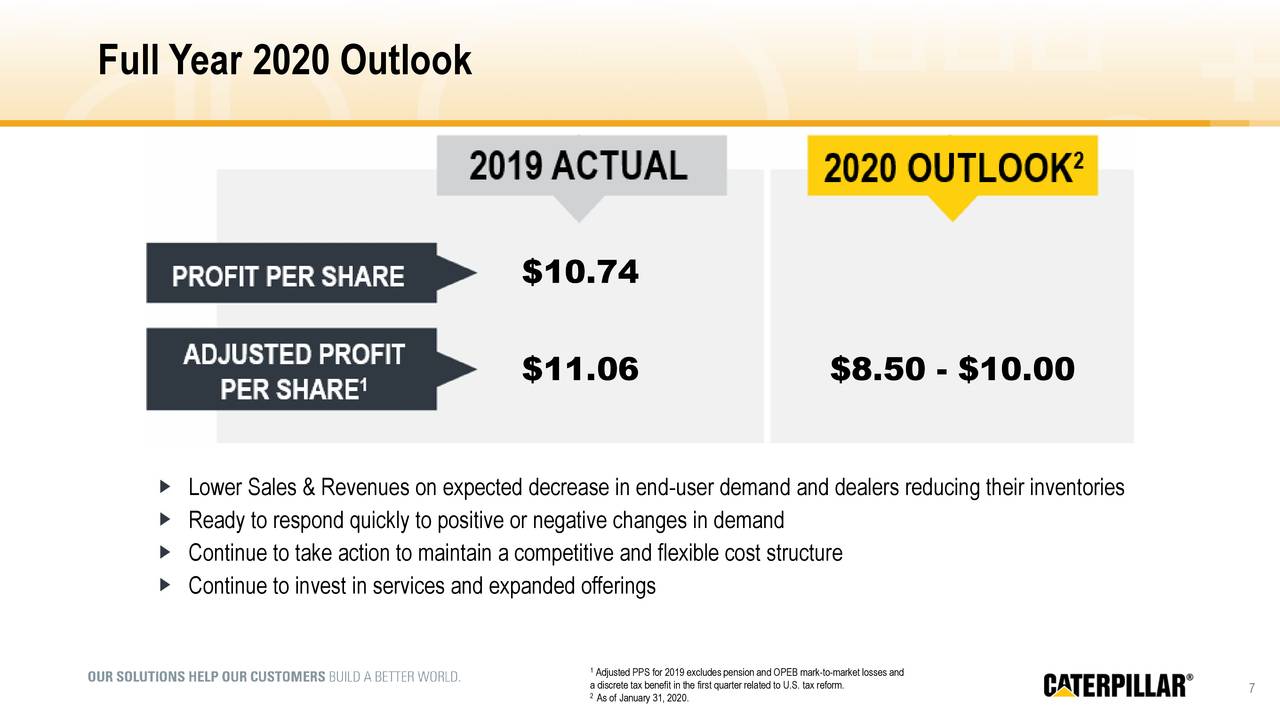

The company expects its 2020 revenue and earnings to decline from fiscal 2019. It anticipates 2020 profit in a range of $8.50 to $10.00 per share. The company had generated earnings per share of $10.74 in 2019. CAT’s cash returns are safe considering the cash generation potential. It recently raised the quarterly dividend by 20%. The cash flows are offering a complete cover to dividend payments. “We expect continued global economic uncertainty to pressure sales to users in 2020 and cause dealers to further reduce inventories,” said Umpleby.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account