Catena Media (STO: CTM) stock price plunged sharply following lower than expected results for the second quarter and first half of 2019. The company blamed regulatory restrictions in the U.K., France and Swedish markets for revenue and earnings miss. The lack of supporting events during the last three months contributed to the year over year decline.

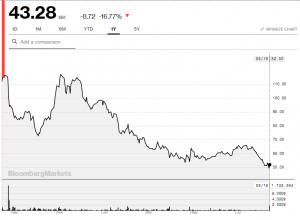

Catena Media stock price plunged close 16% after reporting second-quarter results. Its stock is currently trading close to 43 SEK, the lowest level since March 2016.

Besides from the latest selloff, its stock has been following the declining trend over the past twelve months; Catena Media shares plunged from 120 SEK in August 2018 to 43 SEK a share at present.

Its revenue of €23.7m in the second quarter dropped 9% from the year-ago period. It’s fiscal 2019 first-half revenue dropped 0.4% year over year to €49.8m. Catena Media fails to sustain earnings growth. Its second-quarter EBITDA dipped 22% year over year to €9.4 million. The company blames lower revenue growth along with the NDC slowdown and high player pay-offs for the significant decline EBITDA.

Catena Media CEO Per Hellberg said, “It’s a seasonal pattern that’s already part of our forecasting. However, this year was negatively affected by regulatory changes in the United Kingdom and France but we haven’t been biding our time – instead, we have pulled out all the stops to gear up for a strong second half.”

The company is seeking to expand its footprints in U.S. markets to reduce the impact of strict regulations in European markets. Catena plans for the new US media property launch in H2 ahead of the NFL season. Moreover, Catena plans to launch a fully translated Spanish, Japanese and Portuguese version of AskGamblers.com this quarter.

Catena Media stock price has already lost significant value in the past twelve months due to concerns related regulatory restrictions and declining revenue. However, the strategy of entering new markets and restructuring an existing business model could help Catena Media share price in regaining momentum in the coming days.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account