Burger King UK is the latest of several high street fast food chains to ask chancellor Rishi Sunak for a nine-month rent holiday during the coronavirus crisis.

Jose Cil, chief executive of Restaurant Brands International, the parent company which owns the Burger King, Tim Hortons and Popeyes brands, said on Moday: “Our business model has allowed us to maintain a strong balance sheet and we ended 2019 with about $1.5 billion in cash.”

Toronto-based Restaurant Brands is implementing a number of measures in an attempt to offset its giant losses during the coronavirus pandemic. Workers diagnosed with the virus or who need to isolate will receive 14 days of paid sick leave and restaurant owners will receive cash payments and rebates.

As part of a slew of drastic cost-saving measures in response to the pandemic, Burger King in the UK, which has more than 500 outlets, recently notified its landlords that it would not be able to pay monthly rent in full “for the foreseeable future” and asking for a temporary suspension on all its rent payments.

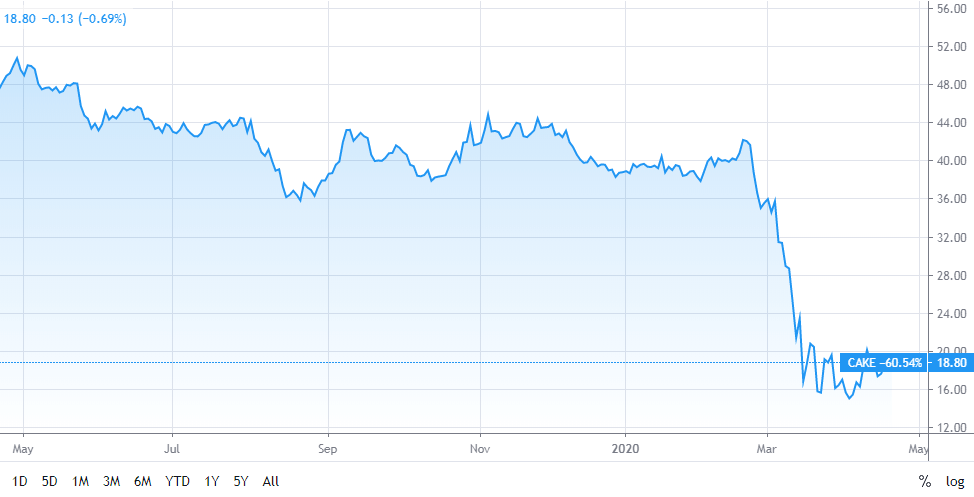

It has been a crushing few months for consumer-facing businesses with restaurants and chains such as Wahaca, Nando’s, D&D, Dishoom and Gordon Ramsay Group expected to back Burger King’s plea. In the US, The Cheesecake Factory informed landlords last month will not be sending in rent checks for the month of April, as its eateries remain closed off to the public to try to help halt the spread of coronavirus. Following the news, the eatery’s stocks took a 14% plunge to just over $17 per share in March.

Burger King’s has written a letter to the chancellor has been signed by 14 other restaurant bosses (included those named above) asking for a nine-month rent holiday during the coronavirus crisis, paying nothing until the first quarter of 2021. The move is supported by trade associations such as UK Hospitality, the Music Venue Trust, the Night Time Industries Association and UK Active.

The British Property Federation points out that food chains and restaurants pay landlords a rent bill of £2.5bn each quarter.

Restaurant Brands International reported revenue of $1.48 billion and income of $257 million, or 54 cents per share, down from $301 million, or 64 cents per share, a year earlier. The company’s shares have rebounded 44% in the last thirty days. But unfortunately, the stock is still down by 30% over a quarter.

While the coronavirus-driven lockdown has resulted in shares of some US chains plunging substantially in the past three months, analysts view this as a perfect opportunity for investors to buy shares with good price-earning ratios.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account