Different borrowers (bond issuers) are going to have different abilities to repay their debt.

Featured Bonds Broker 2020

- Minimum deposit and investment just $5

- Access to Bonds, as well as Stocks and Funds

- Very user friendly platform

The US government is considered to have a very low risk of not being able to re-pay debt, and therefor has a very good credit rating. To raise cash to re-pay debt, the US government has several tools at its disposal:

- Tax its constituents (both individuals and corporations)

- Issue more bonds

- Sell assets such as government buildings

- Print money

Corporations generally have a lower credit rating than the US government.

Corporations, for example the Ford Motor Company, have the following tools to re-pay debt:

- If profitable, they can generate cash to pay the debt

- Borrow funds from banks or issue more debt

- Sell assets. They do not have the power to tax or print money.

With this in mind, it stands to reason that people are going to feel more comfortable, and therefore demand a lower interest rate, when investing in US Treasuries than they are when investing in the Ford Motor company. This is where bond credit ratings come into play.

If a corporation or government has multiple bond issues, they will often have different credit ratings. In the case of bankruptcy there there is an order in which bonds get re-paid. Those bond issues that get paid first will have a higher credit rating.

Bond Credit Ratings Agencies

As there are literally millions of different types of bond issues out there, a standardized system is needed in order to know what the credit quality is of one bond vs. another. This is where the ratings agencies, or those companies that are tasked with classifying the credit worthiness via bond credit ratings come into play.

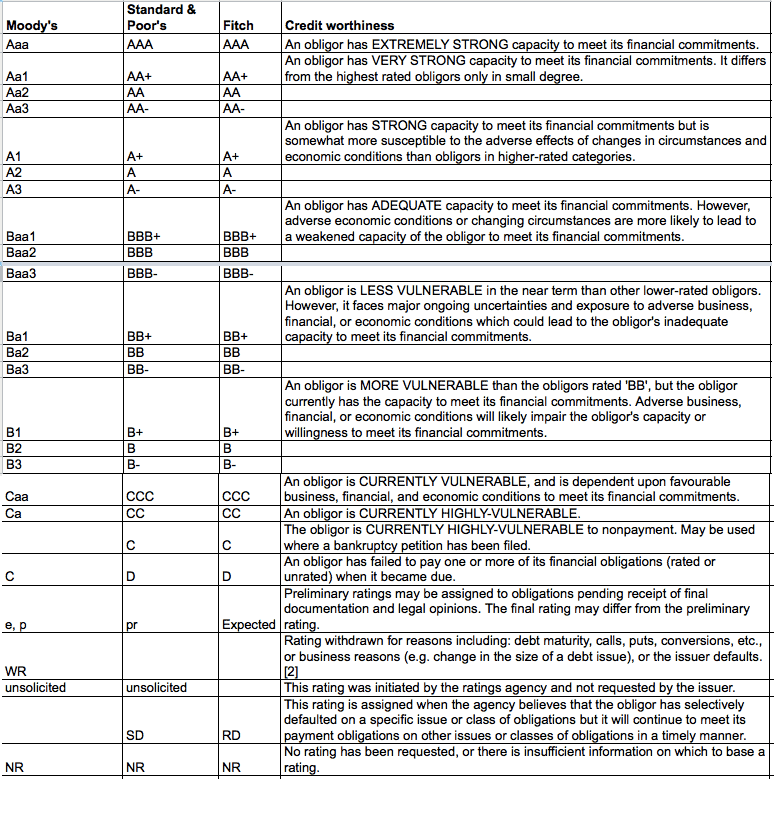

Currently there are 3 major credit rating agencies who investors look to when seeking standardized bond credit ratings.

- Moody’s

- Standard and Poor’s (S&P)

- Fitch

Based on the ratings for these companies, bond issues are put into two broad categories:

Investment Grade / High Grade Bond Credit Ratings

Bonds that have a high credit worthiness and a relatively low chance of defaulting on part or all of their debt.

Junk Bonds / Low-Grade / High Yield Bonds Bond Credit Ratings

These bonds are considered risky investments and tend to pay higher interest rates than Investment grade debt.

Lets move onto discussing the actual ratings issued by the Moody’s, S&P, and Fitch. Now I wish I could tell you that these fine institutions chose a simple and easy to understand rating system for telling a high quality bond from low quality bond, but unfortunately this is not the case. Not only are the bond credit ratings they put out complicated to understand, but they each have their own system.

To help simplify things for us, lets look at the below outlines from Wikipedia

This lesson is part of our Free Guide to the Basics of Investing in Bonds. Continue to the next lesson here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account