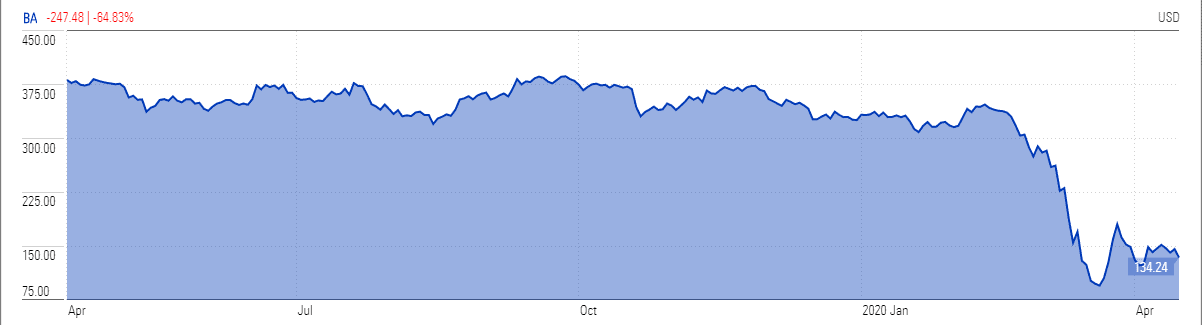

Boeing (NYSE: BA) stock price bounced back after it said it would restart production at its Washington state plants with close to 27,000 employees working on the 737, 747, 767 and 777. It plans to open other production facilities in a phased approach in the wake of the coronavirus.

The world’s largest aerospace and defense company also seeks to resume 737 Max production, which has been grounded since March last year after two deadly clashes that killed more than 300 people.

“Boeing’s work supporting the Department of Defense as a part of the defense industrial base is a matter of national security and has been deemed critical,” Boeing says. “Additionally, our commercial work supports critical global transportation.”

The $17bn bailout package from the Federal Reserve helped Boeing in resume production. While it has engaged Lazard and Evercore to explore the funding opportunities; market analysts believe the use of a debt facility could provide short-term support but it could also substantially increase the debt burden.

Also, the government relief package is attached with conditions like limits on capital returns, reducing executive pay and retaining most of the workforce.

The company’s debt could increase to $40bn by the end of this year from $18bn at year-end 2019, according to UBS analyst Myles Walton.

Boeing stock price recovered from seven years low of $90 on relief package. Meanwhile, Wall Street analysts see a limited upside for the planemaker’s share price. This is because of sluggish demand for new jets as airlines see eventually no travel demand in the near future.

Boeing has received order cancellations for 75 737 Max jetliner in March in addition to order cancelation of 75 jets from the Irish leasing company Avolon. Overall, Boeing has removed close to 300 jetliners order from books in March as airline companies are facing cash related problems as a result of the health emergency.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account