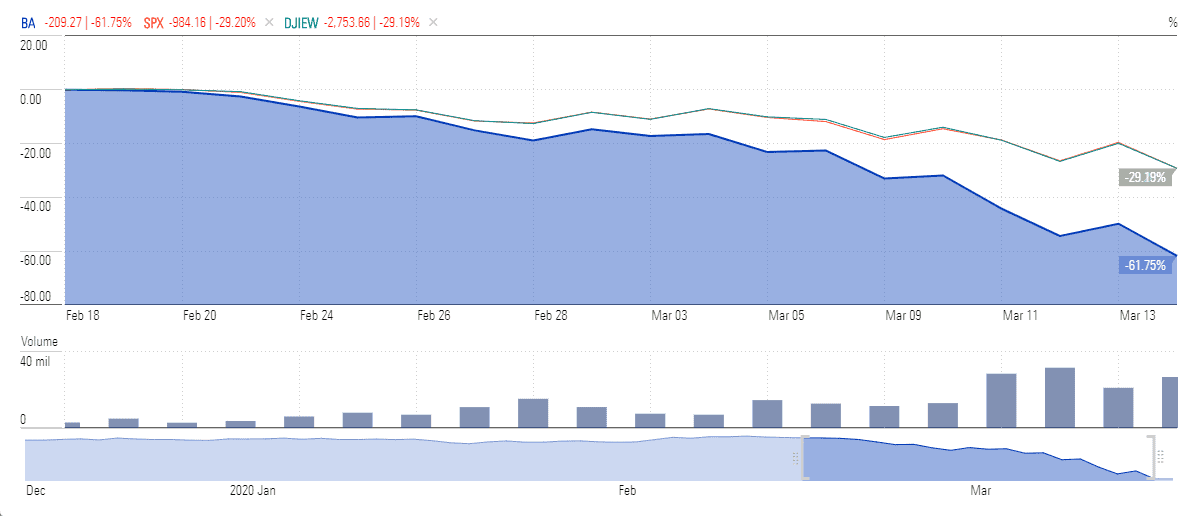

Boeing (NYSE: BA) stock price lost more than 60% of its value over the last month as coronavirus rips through the airline industry. Boeing, which is already struggling with the 737 MAX crisis, is in talks with the Trump administration about a potential aid package.

The airline industry, which Boeing supplies, has slashed flights, frozen hiring and either laid off or asked employees to take unpaid leave as passenger numbers plummet as a result of the outbreak.

The crisis comes as Boeing, led by chief executive David Calhoun (pictured), deals with the fallout of two fatal crashes of its 737 Max, its best-selling plane.

“Global airline business models will be stressed, airlines will cut capex, growth plans will be slashed and there will be airline bankruptcies,” says BofA analyst Ron Epstein. “The 737 MAX program could be especially hard hit due to its own idiosyncratic circumstances.”

Boeing’s stock price slide of 60% in a month makes it the biggest loser of Dow Jones Industrial Average – the index that is composed of 30 largest companies plunged 29% in the last month.

Boeing’s debt ratings slashed to BBB from A- by S&P. The rating agency claims that Boeing will generate much weaker cash flows in the following two years due to the 737 MAX grounding and reduction in global air travel.

Fitch has also placed the Boeing on “credit watch – negative,” saying “These [coronavirus] concurrent risks could influence the pace of 737 MAX delivery to ramp up after the [737 MAX] grounding is lifted, which could slow the rate of debt reduction from peak debt levels… which will be higher than Fitch previously expected.”

Boeing’s total debt stands around $27.9bn and the company expects to generate negative cash flows in 2020. The company had recently generated the first annual loss in more than two decades. Boeing is currently looking towards the US government for support for itself and suppliers and airlines.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account