The Boeing Company (BA) is scheduled to release its results for the first three months of the year on Wednesday, before the opening bell and its first revenue is expected to fall by more than a third, according to Wall Street.

The results come as Brazillian rival Embraer said on Monday said it had begun an arbitration process against the Seattle-based planemaker, after Boeing canceled a $4.2bn deal to buy it over the weekend that had been years in the making.

Meanwhile, Boeing chief executive Dave Calhoun told shareholders Monday that air travel demand won’t recover for two or three years, another challenge for the manufacturer that is still reeling from the grounding of its 737 Max that has suffered two fatal crashes even before the coronavirus pandemic.

The US planemaker is scrambling to cut costs to meet the weak demand for new airplanes, with Air travel in the US is about 5% of what it was a year ago.

Analysts expect the company’s first-quarter revenue to be down roughly $10bn billion from the approximately $28bn it reported in the same quarter last year

“When it does [recover], the commercial market will be smaller,” Calhoun said in a webcast of the company’s annual shareholder meeting.

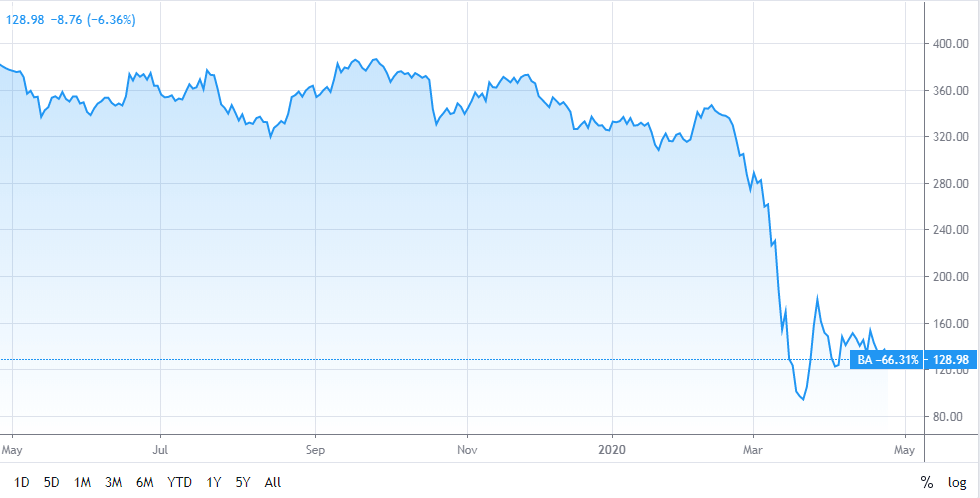

Several factors that have influenced Boeing’s performance in the first quarter, resulting in a massive 66.4% year-over-year drop in commercial shipments. The company’s defense deliveries are also estimated to have slumped by 35%.

The 737 Max, which was once considered a key growth catalyst for Boeing’s revenues, has been weighing heavily on the company’s overall performance since last March. At the beginning of the year, the company halted production of this jet model altogether. Boeing’s commercial business is expected to have performed dismally, as a result

You can uncover the best stocks to buy shares in before they’re reported when you browse our list of recommended stock brokers or look into the best suited trading platforms.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account