Bulls are taking over Bitcoin this morning, as the price of the cryptocurrency has risen above its $12,000 psychological resistance on the back of increased support from the US central bank to the potential introduction of a digital currency. Many of these Bitcoin investors, also known as traders, are looking forward to trade with software like Bitcoin Supreme.

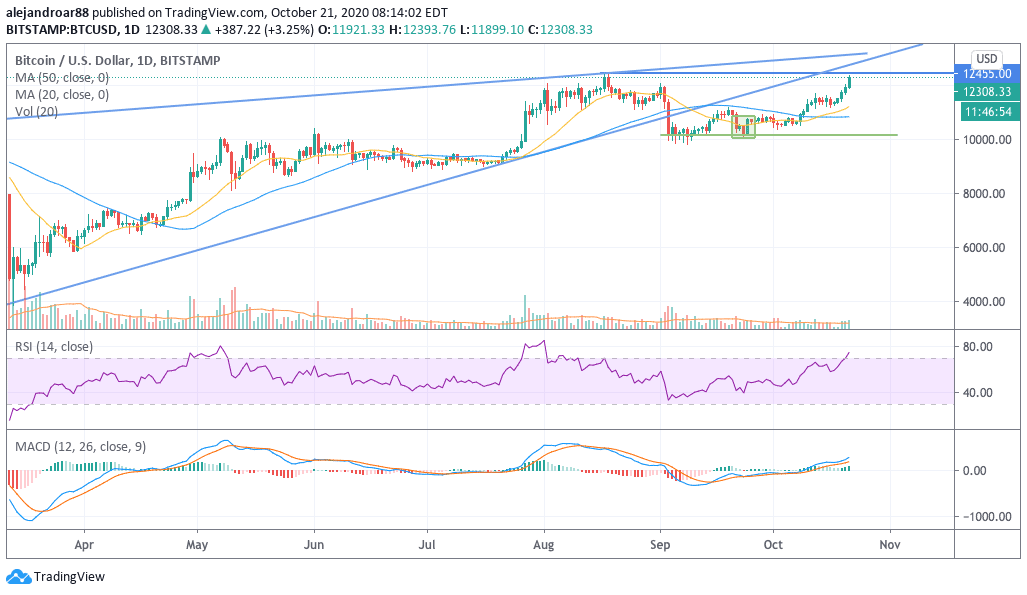

The price of Bitcoin has been lifted 3.6% so far during today’s early cryptocurrency trading activity, currently sitting at $12,346 on above-average volume.

Remarks from the Chairman of the Federal Reserve, Jerome Powell, during a conference with the International Monetary Fund (IMF) on Monday helped lift the price of the cryptocurrency in this past few days, as the head of the US central bank acknowledged the benefits that a central bank digital currency – also known as a CBDS – would have for the economy.

That said, Chairman Powell also clarified that the Fed is still not ready to make a decision on the matter as the institution still has to weigh both the risks and the benefits of introducing this type of currency to the financial system.

“It’s more important for the United States to get it right than to be the first. Getting it right means we not only look at the potential benefits of CBDCs, but also the potential risks, and also recognize the important tradeoffs that have to be thought through carefully”, said Powell.

Bulls have pushed the price of Bitcoin (BTC) higher for 12 out of the last 15 sessions, with the cryptocurrency now approaching a key resistance level at $12,455 – the coin’s 17 August highs.

What’s next for Bitcoin?

Bitcoin bulls have managed to hold the coin’s $10,000 level in the past few weeks after the sharp downward move that followed the cryptocurrency’s 2020 highs.

That kind of support has translated into a double bottom pattern that has helped lift the price of the crypto-asset higher since 24 September, a day in which a big bullish engulfing took place, with the price moving almost $500 higher in a single session.

Meanwhile, Powell comments have added more fuel to the rally as the market was already expecting positive remarks towards digital currencies, while some other news including a report showing that China has conducted a CBDS test with a small group of consumers and a $50 million purchase of Bitcoin from digital payments platform Square have also helped in pushing the price of cryptocurrencies higher.

Moving forward, Bitcoin bulls have to hold their ground this time if the price moves higher than the $12,455 level as it is highly likely that big players will reap their recent profits in the following sessions, which could end up plunging the price of BTC below that threshold.

In this regard, Simon Peters, an analyst for trading platform eToro, said: “Before investors look to the next bull run, we need to see the price remain above $12,000 for an extended period of time”.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account