Bitcoin rallied past the $14,000 mark last night as results from the US presidential election started to come in but the cryptocurrency failed to hold that level as the uncertainty surrounding the political event keep market volatility at a high note.

This is the second time the price of the cryptocurrency has attempted to make a move above that psychological resistance in the past few days, with market players feeling particularly confident about Bitcoin’s future given the uncertain backdrop and the continuous fiat currency debasement resulting from monetary easing measures amid the pandemic.

For about an hour yesterday, BTC’s price approached the $14,100 level but quickly fell to $13,700, resulting in a loss of 2.5% so far in early cryptocurrency trading activity.

A potentially contested election outcome is taking a bite in the performance of the financial markets today, with the US dollar advancing 0.2% so far in the day while S&P 500 futures are up only 0.3% after surging nearly 2% last night.

Bitcoin’s reaction today looks similar to how gold is performing as well, as the yellow metal is also retreating 1.15% during the European commodity trading session at $1,887 per ounce.

Earlier this morning, President Trump tried to claim victory, despite millions of votes still being unaccounted for, saying that he was willing to go to the Supreme Court to challenge a potentially unfavorable outcome.

This would be a scenario that markets have long feared, as a contested election could result in significant volatility over the coming days – or even weeks – especially if the results are close enough to justify such stand.

Meanwhile, although Bitcoin (BTC) advocates have always supported the notion that the cryptocurrency should decouple itself from the performance of traditional financial assets in the context of a crisis, this has not been the case this year as the cryptocurrency’s value collapsed similarly to the overall market during the February – March crash.

What’s next for Bitcoin?

Bitcoin has delivered an outstanding 90% gain so far this year, outpacing all broad-market indexes as the cryptocurrency continues to attract the interest of a young generation that believes digital currencies are the future of the global economy.

Meanwhile, BTC has benefitted from a more favorable stand from central banks towards digital currencies, as a move in this direction is giving cryptos a credibility boost.

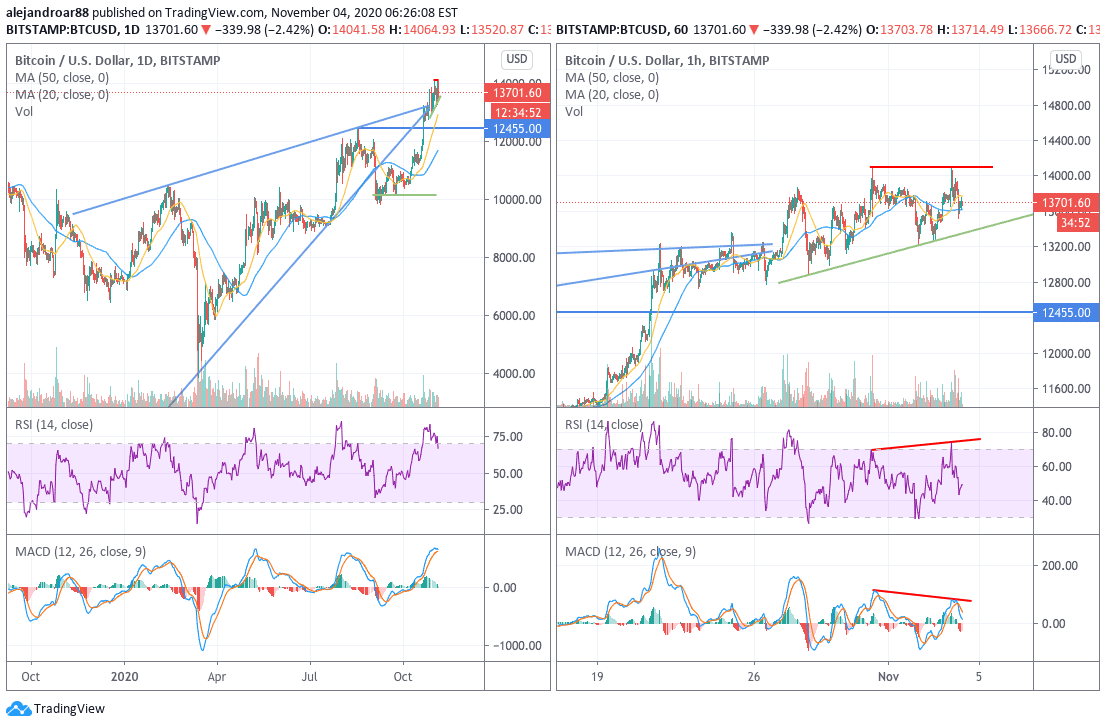

From a technical standpoint, the daily chart above shows how the price action has been forming a bearish rising wedge formation since the March lows, with the price slipping below the pattern in early September although finding support at the $10,000 level.

That strong support led to a sharp rebound for Bitcoin, as the price of the cryptoasset soared since then to its current 2020 highs of $14,100 – with the price action now sending mixed signals as bulls fail to push BTC above the $14,000 mark.

The hourly chart shows BTC has made a potential double top, which should result in a short-term pullback for the coin. This bearish outlook is supported by a bearish divergence in the MACD – although the RSI is not sending the same signal.

It is important to note that intraday oscillator readings tend to be less reliable than daily readings. With that in mind, a bearish thesis would find more credibility if the price slips below the lower trend line shown in the chart, with a potential entry price for short-sellers at around $13,200 per coin.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account