The billionaire investor and Baupost Group founder Seth Klarman (pictured) took big positions in tech stocks including Alphabet (NASDAQ: GOOG) and Facebook (NASDAQ: FB) during the first quarter of the year, according to the frim’s latest securities and exchange commission filings.

The man dubbed the next Warren Buffet, because of his similar value investing approach of adopting a long-term view about companies trading at discount but have strong business models, led Boston-based Baupost to generate a 20% compounded annual return since 1983.

“Value investors will not invest in businesses that they cannot readily understand or ones they find excessively risky. Because investing is as much an art as a science, investors need a margin of safety,” said Seth Klarman, who is sometimes called the Oracle of Boston.

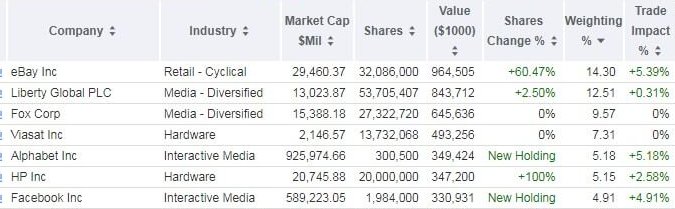

Klarman’s Baupost revealed in 13F filings that Alphabet is now its fifth-largest position after a new investment of $350m, accounting for over 5% of the overall portfolio.

The hedge fund has also initiated a new position in Facebook with the purchase of nearly two million shares valued at $330m and representing 4.91% of entire Baupost portfolio.

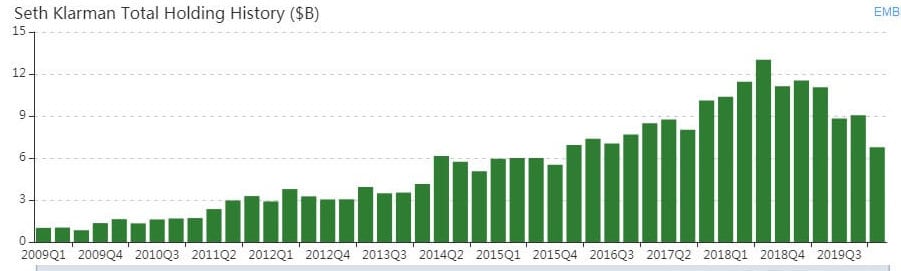

The hedge fund experienced a 26% year over year drop in overall stock portfolio value to $6.7bn in the first quarter, though the price of several stocks that Klarman’s Baupost owns increased significantly from March lows. Baupost owns 32 stocks at the end of the first quarter, according to 13F filing.

Baupost Group has also increased its stake by 60% in e-commerce stock eBay (NASDAQ: EBAY) to 32 million shares, making it the largest holding of $6.7bn stock portfolio.

However, the billionaire money manager exited its positions in hotel stock Eldorado Resorts (NYSE: ERI) because the fundamentals of this company significantly devastated by the virus impact. Baupost also sold the position in Bristol Myers Squibb (NYSE: BMY) and dropped its stake by half in PG&E (NYSE: PCG).

If you plan to invest in stocks like Seth Klarman, you can review our featured stock brokers here.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account