Billionaire investor Howard Marks says that the chaos thrown up by the coronavirus pandemic is a good time to step into the stock market.

The co-founder investment firm Oaktree Capital said: “I never believe that I know when’s the bottom, but I know things have gotten a lot cheaper and it’s reasonable to do some buying, If it goes lower, do more buying.”

“I personally think that securities are low enough to buy a little,” he told CNBC in an interview on Wednesday. “Somebody said to me, ‘is this the time to buy?’ I say no, ‘this is a time to buy.’”

After the February coronavirus sell-off swiped trillions of dollars from the stock market, stock prices are now trading at significant lower valuation ratios compared to previous months, which could attract investors who are seeking to buy shares in companies that are being undervalued as a result of increased volatility.

The S&P 500 seems to be currently valued at nearly 19 times the earnings per share of its components, compared to its price-to-earnings ratio of 25 back in January 2020, which indicates that stocks are more conservatively valued after the sell-off, even though this valuation may still be high if corporate earnings take a hit during the following quarters.

Marks did warn investors about taking “a moderate approach” towards buying in markets that are still extremely volatile.

He added: “There’s no argument for spending all your money now, but there’s also no argument for not spending any of your money now. I would do something moderate, in between.”.

The investment manager has been buying high-yield bonds in the U.S., with yields jumping from 3.5% a couple months ago to around 10%, according to CNBC.

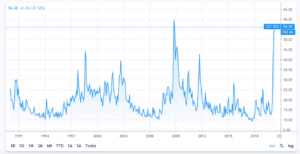

Meanwhile, the CBOE Volatility Index, also known as the VIX, which measures the market’s expectation of short-term volatility in the S&P 500, has reached historical levels that can only be compared to the 2007-2008 financial crisis, as the index is currently trading at 56.13 compared to its October 2008 peak of 59.89.

Marks has an estimated net worth of $2.2bn. Born and raised in Queens, New York, he graduated from the prestigious Wharton School of Business to later on pursue a career in finance, specializing in distressed debt during his time working for the California-based asset management firm TCW Group.

Howard, along with four other partners, founded his own asset management firm Oaktree Capital in 1995, which currently manages more than $100bn in assets, specializing in alternative investments such as distressed debt and private equity.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account