Billionaire hedge fund manager Steven Cohen (pictured) warned his staff to remain cautious over stock market rallies following the coronavirus driven sell-off. He said stock markets never regain the losses in a straight line and that’s why he told staff at his Stamford-based Point72 Asset Management to be disciplined when trading stocks.

“After an earthquake there are tremors. We need to continue to be disciplined. We are seeing plenty of opportunities to generate returns, but I don’t want us taking undue risks,” he wrote in an internal note.

Cohen’s Point72 is best known for stock market investments and other securities, where the firm follows a macro style, which involves global bets on lots of asset classes at once based on macroeconomic trends. The hedge fund manager has a net worth of $9.2bn and Forbes ranks him as one of the highest-earning hedge fund managers in the US.

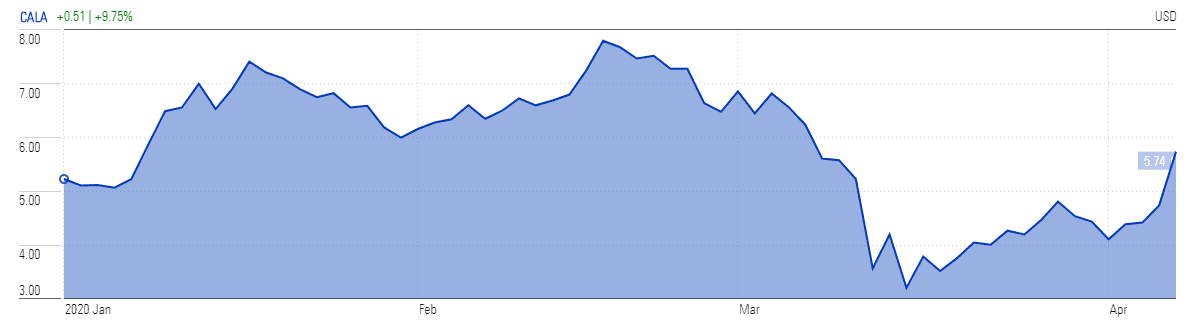

Point72 Asset Management recently disclosed that they have added 3,240,046 shares of Calithera Bio (NASDAQ: CALA), bringing its total stake to 5% in the healthcare company. Calithera Bio stock price soared by almost 50% over the last two weeks to $5.87 on Wednesday afternoon, but the stock is down from a 52-week high of $8 a share.

A clinical-stage biotechnology company focused on discovering and developing novel small molecule drugs for the treatment of cancer and other life-threatening diseases.

Also, Cohen’shedge fund recently announced a 5.1% stake in Syros Pharmaceuticals (NASDAQ: SYRS), which is engaged in the development of small molecule therapies that disrupt cellular metabolic pathways to block tumor growth. The firm claims that its gene control platform fuels a strong preclinical and discovery pipeline in monogenic and oncology diseases. Syros net loss stood around $0.46 per share while its cash, cash equivalents, and marketable securities came in at $91.4m. The company says they have enough cash to fund its operation this year and beyond.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account