Find more information about how to buy and trade stocks in our stock trading guide here.

Beyond Meat (NASDAQ: BYND) stock price has been on a roller coaster since it began trading on the New York stock exchange early last year. The vegetarian food producer’s aggressive sales growth remains the biggest driver of its share price performance over the past few months. Beyond Meat stock price bounced back early this year before plunging on broader market volatility over the past month. The shares are currently hovering around $90, down substantially from an all-time high of $240, set last July.

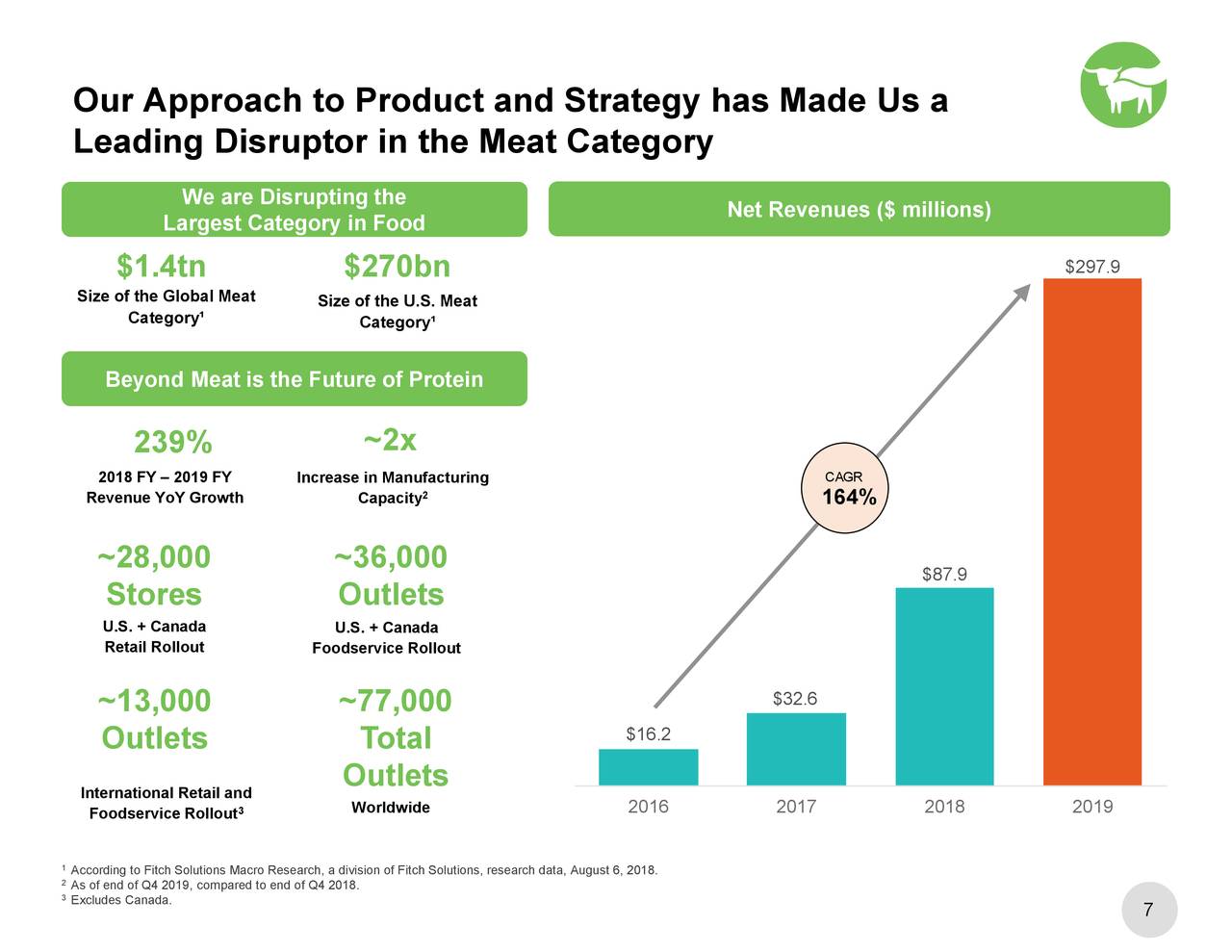

The company generated year-on-year revenue growth of 212 per cent in the final quarter of 2019, while full-year revenue jumped 239 per cent compared to the same period a year ago. Sales are driven by expanding into international markets along with growing its distribution outlets. Its gross margin improved sharply to 34 per cent in the fourth quarter from the past year period.

It expects fiscal 2020 revenue in the range of $490m to $510m, representing a growth of 64 to 71 per cent from 2019.

“In 2020, we seek to build on this foundation while continuing to prioritize aggressive growth by increasing our intensity with respect to our marketing and research and development initiatives, and accelerating our global expansion plans to capitalize on our strong positive momentum,” said chief financial officer and treasurer Mark Nelson.

Credit Suisse has also increased its 2020 sales estimates to $470m from an earlier estimate of $380m; the firm expects 2021 revenue to stand around $681m. The firm also anticipates growth in earnings over the coming years.

Credit Suisse anticipates Beyond Meat shares to bounce back sharply in the coming days, setting a price target of $125.

The market pundits are also not ruling out the possibility of its acquisition by large rivals such as Starbucks (NASDAQ: SBUX). This is because Starbucks recently said it is exploring more environment-friendly plant-based menu options as part of a multi-decade goal to become more environmentally friendly.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account