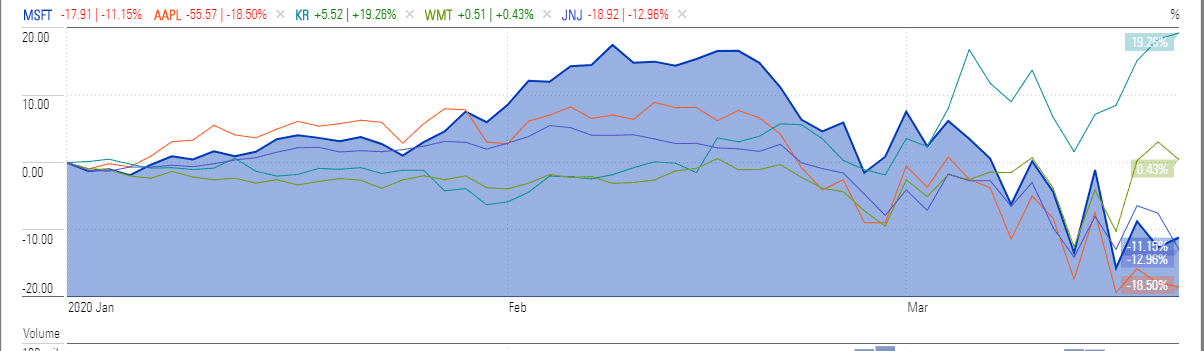

Dividend stocks that have outperformed broader markets over the years present attractive buying opportunities as the panic selling amid coronavirus outbreak across the world has pared US markets to a three-year low. But the trick is to find the bottom of a selloff to maximize returns because analysts do not know how markets will behave over the next couple of weeks.

The latest selloff has substantially damaged the liquidity of several top-rated companies that were considered among the best dividend stocks. For instance, coronavirus related uncertainty has massively dented fundamental outlook of oil companies, airline stocks, travel and hotel industry. Consequently, the market analysts are suggesting investors pick the stocks with strong cash-generating potential. Below are the best dividend stocks that are trading at cheap prices following the market crash.

Microsoft (NASDAQ: MSFT)

Microsoft stock price experienced a huge share price decline of 25% during the latest selloff. It is among the best dividend stocks to buy because of its strong business model. Although the company plans to make a small change in its 2020 earnings forecast, its products are not directly exposed to the slowing production growth.

Deutsche Bank maintains a Buy rating for Microsoft stock, citing no material impact on third-quarter results, but it’s too early to tell. Microsoft’s cash generation potential is also strong enough to face headwinds. The company had generated operating cash flow of almost $14bn in the latest quarter compared to dividend payments of only $3.8bn.

Apple (NASDAQ: AAPL)

Although the tech giant has a short dividend history, the company is well set to rebound once coronavirus impact fades. Its future fundamentals are strong despite facing short-term headwinds due to lockdowns across the world. The Bloomberg report suggests that Apple is still in position for its 5G iPhone fall launch as mass production is likely to begin in May and factories in China have resumed operations.

“The fundamental impact for the March quarter adds to what is already bracing for doomsday-like results as we continue to focus on a more normalized full-year 2021 number as the right way to value Apple at current levels,” Wedbush analyst Dan Ives said.

The Kroger Co (NYSE: KR)

Kroger stock price has been outperforming the bearish market trends by generating growth of 18% since the beginning of this year. Indeed, the company started experiencing more demand as people are rushing towards grocery stores to hoard everyday items, such as toilet rolls and hand sanitizers, due to the health emergency. The company said recently it would hire 2000 extra workers to meet the demand.

Kroger offers a quarterly dividend of 16 cents, yielding around 2%. Kroger’s has increased the quarterly dividend at a double-digit compound annual growth rate since 2006.

Walmart (NYSE: WMT)

Walmart (shopper, pictured) stock price rallied in the past few days and hit a 52-week high amid increasing traffic at its grocery stores. According to Gordon Haskett, Walmart is far and away the most popular choice among new online grocery shoppers. Morgan Stanley’s Simeon Gutman says Walmart is likely to generate a 3% rise in same-store sales this year. Walmart has raised dividends over the past 47 successive years. It currently offers a quarterly dividend of $0.54 per share, yielding around 2%.

Johnson & Johnson (NYSE: JNJ)

Johnson & Johnson is considered a dividend king because it has increased dividends over the past 57 consecutive years. It currently offers a quarterly dividend of $0.95 per share, yielding around 3%. Its revenue growth could decline slightly in the coming quarters due to lockdowns across the world. However, its long-term fundamentals are strong and its share price is likely to rebound once the stock markets stabilize.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account