Telecom companies and chip makers have been working hard on building 5G wireless networks with plans to market products for this service later this year. Unfortunately, the outspread of coronavirus around the world has delayed any potential launch of 5G products, with research firms anticipating a huge decline in 5G smartphones shipments this year. Bank of America expects global 5G smartphone shipments to stand around 160 million this year from an earlier forecast of 200 million.

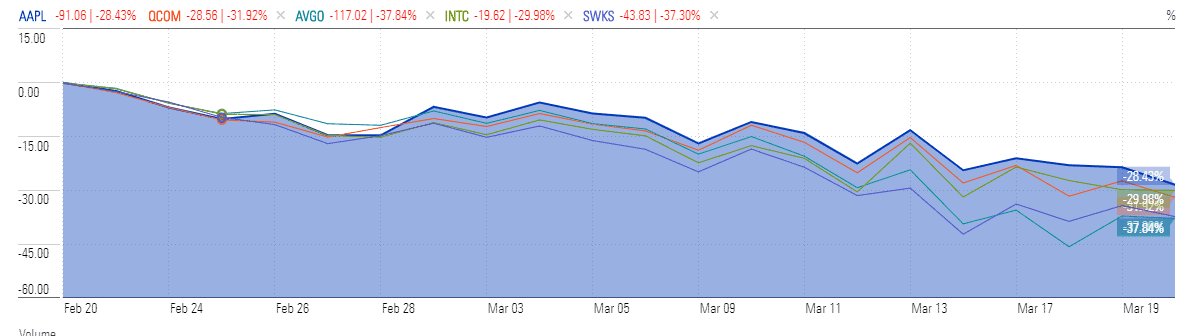

However, analysts do forecast a strong recovery for 5G products – which would also help to boost the sentiment of investors over 5G stocks. These stocks currently trade at a significant discount after panic selling over the last month. Below are the five best 5G stocks to buy that currently trade at discounts in comparison to their fundamentals.

Apple (NASDAQ: AAPL)

Apple stock price had experienced massive uptick during the final quarter of last year and in early 2020 amid prospects for the launch of 5G phone this fall. However, the September launch target looks gloomy in the view of some investors due to the broader market crash and slow operational progress.

Last week, Bloomberg reported that Apple is still in a position to launch 5G iPhones this fall as its mass production is scheduled to begin in May. Even if the company misses its September launch target, its outlook is significantly strong for 2021. “The fundamental impact for the March quarter adds to what is already bracing for doomsday-like results as we continue to focus on a more normalized full-year 2021 number as the right way to value Apple at current levels,” Wedbush analyst Dan Ives says.

Qualcomm (NASDAQ: QCOM)

Chipmaker Qualcomm stock price suffered massive losses over the last month due to the coronavirus market crash that has wiped off more than 30% of the value from the S&P 500. Qualcomm has a deal with Apple to provide 5G chips. Canaccord Genuity forecasts a strong impact of coronavirus on Qualcomm results in the short-term but also anticipates a strong recovery in long-term amid potential revenue growth from 5G.

Broadcom (NASDAQ: AVGO)

Although Broadcom has missed revenue and earnings estimate for the first quarter, the chipmaker expects a strong recovery in the second half of the year. Its first-quarter revenue came in at $5.86bn compared to the consensus estimate for $6bn. “Our confidence in that acceleration was driven by the anticipated launch of 5G phones late in the year and expected strong data center spending from enterprise and hyper cloud customers,” the chief executive officer said during the earnings call earlier this month.

Intel (NASDAQ: INTC)

Intel stock price lost close to 30% of value over the last month due to the broader market selloff. However, the company says it is on target to produce 90% of products on schedule, despite coronavirus related delays. Although the company sold its 5G modem business last year, Intel’s chief executive officer believes his company will still be a big 5G player. Intel has generated year-on-year revenue growth up 8% in the latest quarter, with the company expecting to generate full-year sales of around $75bn.

Skyworks Solutions (NASDAQ: SWKS)

Skyworks Solutions has developed an advanced Sky5 platform to expand its adoption of 5G among customers. The company claims that they power a range of things with 5G such as smartphones industrial robotics, wireless infrastructure, autonomous vehicles, virtual assistants and smart homes. The company recently announced that it boosted its Sky5 portfolio by adding Vivo, Oppo, and Xiaomi 5G mobile platforms.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account