Automatic Data Processing (NASDAQ: ADP) stock was among the best performers in fiscal 2019. The company also offers a healthy dividend yield to investors with a history of increasing dividends at a strong pace. ADP’s strategy of investing in its products, distribution, and services has been driving sustainable financial growth over the years.

ADP share price grew almost 30% in the past twelve months, extending the five-year rally to 100%. Automatic Data Processing stock is currently trading around an all-time high of $176. ADP share price is fairly priced considering a price to earnings ratio of 28, which is in line with the industry average. The sustainable growth in financial numbers is offering support to valuations despite a sharp share price gains in the past few years.

Financial Numbers are Supporting Automatic Data Processing Stock

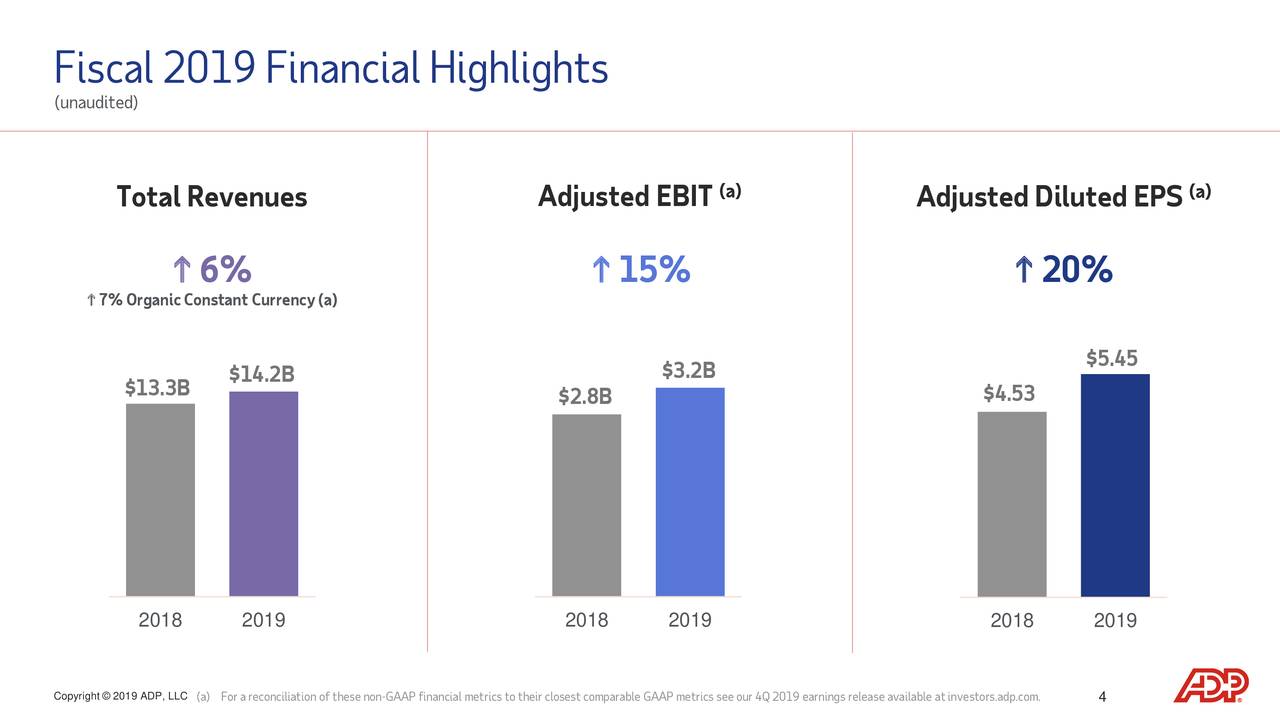

The company is targeting mid-single-digit revenue and high double-digit earnings growth. Its revenue grew 6% in fiscal 2019 compared to the past year. ADP has been actively turning revenue growth into big profits. Its adjusted earnings grew by 20% in 2019 from the past year.

Carlos Rodriguez, President, and Chief Executive Officer, ADP. “We are pleased that we have balanced our financial growth objectives with a number of operational priorities. We continued to successfully execute on our transformation initiatives, launched a new brand campaign, and made significant progress on our next-generation platforms as we stay focused on creating long-term shareholder value.”

The company expects to extend the momentum into 2020. It anticipates fiscal 2020 revenue in the range of $15 billion, representing an increase of 7% from 2019.

Cash Returns are Safe

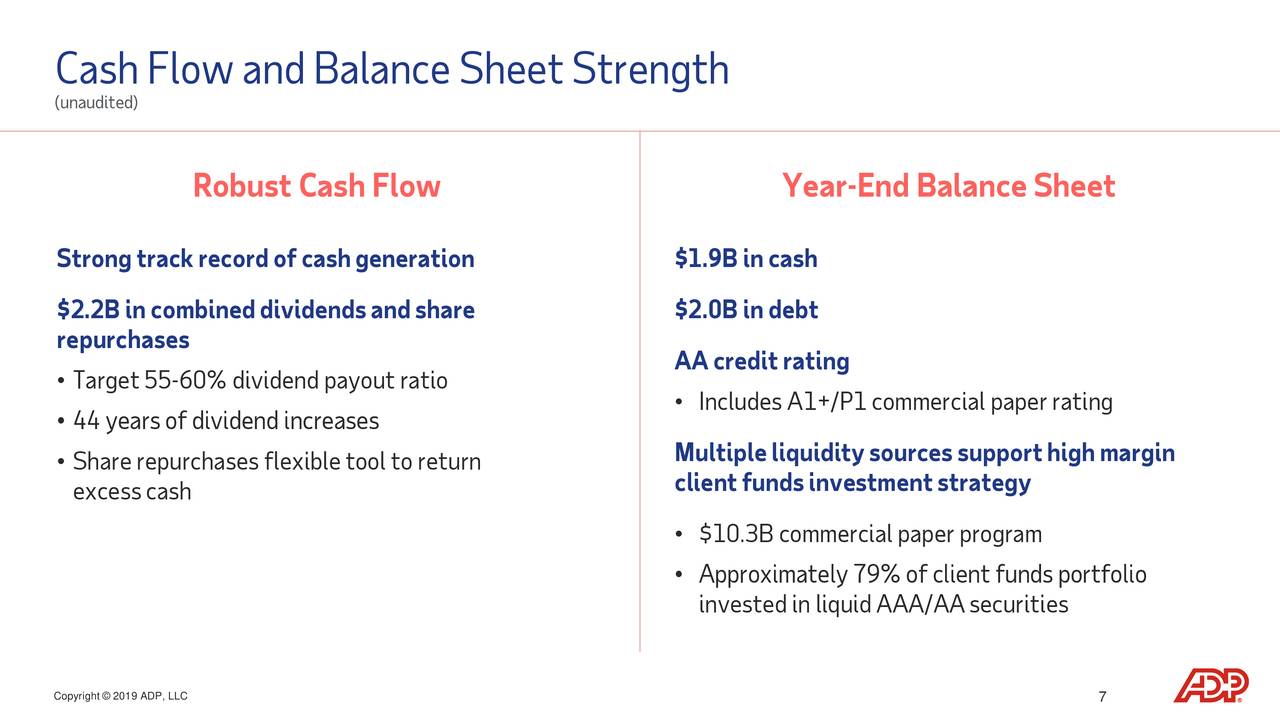

ADP has raised dividends in the past 44 consecutive years. In addition, the dividend growth rate stood in the double-digit range in the past three years. It currently offers a quarterly dividend of $0.91 per share, yielding above 2%. Its cash flows are completely covering the dividend payments. Moreover, the buyback plan of $5 billion indicates its confidence in cash generation potential.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account