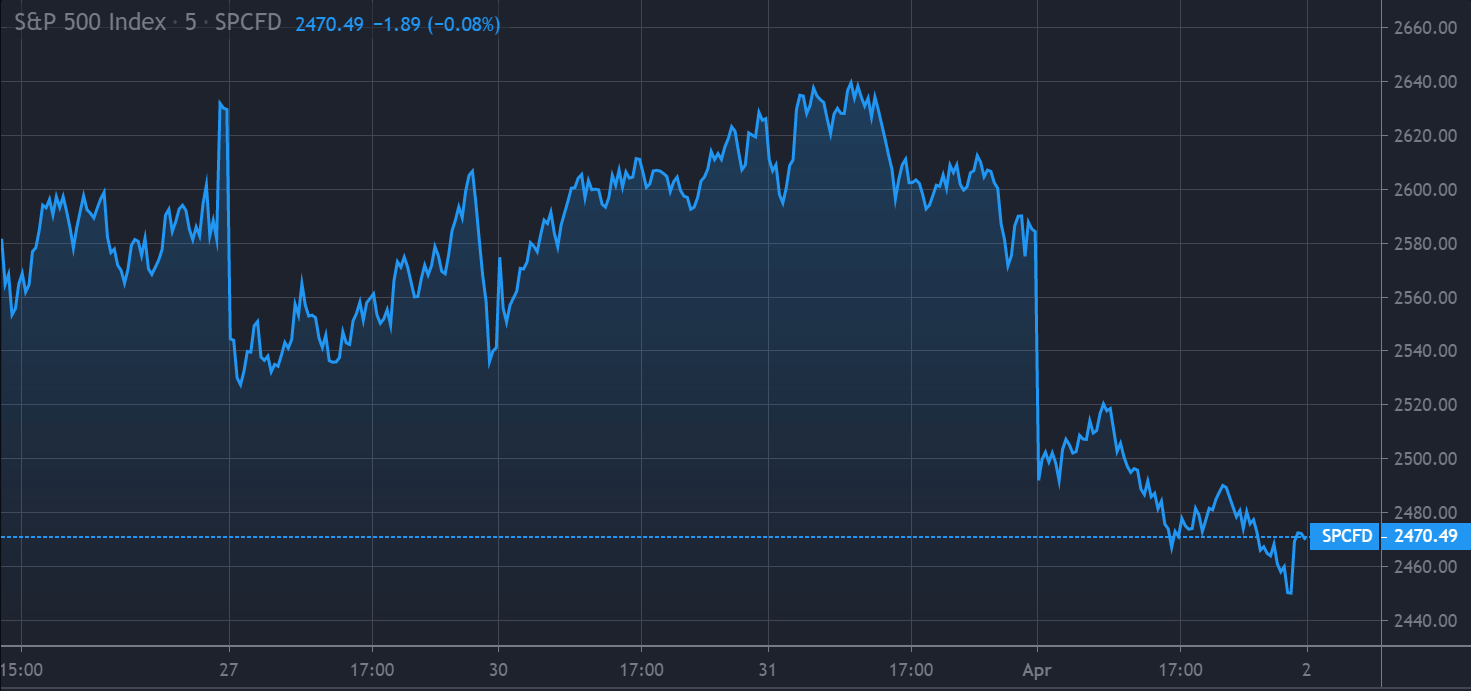

Both the Dow Jones Industrials and the S&P 500 just recorded their worst start to a calendar year in history. The DJIA fell by more than 4.32% during Q1, which had been the previous record. The first day of April was no kinder to US stocks, as the S&P 500 fell by 4.14% on Wednesday, to close at 2,470.50. One sector that is set to see further challenges in 2020 is the US auto industry.

US car companies may have to deal with double-digit declines in sales this year, according to analysts. J.D. Power expects auto sales to drop at least 32% in March compared with a year ago. Edmunds predicts that sales fall 35.5% this month, on top of an 11.8% decline in the first quarter.

The issues that the US auto industry face may create a vicious cycle in consumer spending. States like Michigan, Ohio, and Indiana, have forced most carmakers to halt operations, leaving workers to face uncertain times.

Automobile showrooms are also shuttered in many states, as the current presidential orders to create a social distance affects 35 US states comprising 231 million people or 70% of the US population.

Some automakers and dealers are to push online sales. General Motors has been one of the leaders in offering online vehicle sales tools to dealers as part of its purchasing process.

Online programs allow the sales to be done online, but customers will still need to physically sign some paperwork depending on state laws. However, once the deal has been done the vehicle will be delivered to the customer’s home.

Many automakers are offering special financing options and deferred payments to spur sales. These programs may help to boost sales, even as restrictions on mobility stay in place. General Motors (NYSE:GM) and Fiat Chrysler (NYSE: FCAU) offering qualifying new car buyers 0% financing for 84 months and deferred payments of 90 days.

Ford Motor (NYSE:F) is offering up to three months of deferred payment, and the company will pay for three additional months which allows six months of payment assistance. Ford stock traded down $0.43, or a fall of 8.9%, at Wednesday’s close. It has fallen by 56% so far in 2020.

Fiat Chrysler stock traded down by $0.37 yesterday to close at $6.82, a fall of 5.15%. It has fallen by around 55% so far in 2020. General Motors stock traded down by on Wednesday, $1.52, the fall of 7.31%. It has lost $19.26, or about 49% of its market cap in the first 3 months of 2020.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account