Autodesk (NASDAQ: ADSK) stock is likely to outperform again in 2021 amid robust growth in spending and digitalization. Analysts are suggesting investors play with the software stocks for big gains in the coming years. Autodesk is among the top picks. This is because of its strong financial and share price performance in 2019.

In addition, the robust outlook for 2021 is adding to investor’s sentiments. Autodesk stock price rose more than 30% in the last three months alone. Autodesk share price is currently trading around $190, slightly down from a 52-weeks high of $193. The software company does not offer dividends. Thus, it appears in a position to invest significantly in growth opportunities.

Analysts Raised Autodesk Stock Price Target

The market analysts are showing confidence in the future fundamentals of Autodesk and the software market. Wells Fargo is expecting the software industry to outperform in 2020. This is due to strong spending growth indicators. Its analyst Philip Winslow anticipates software spending to increase in the range of 10.2% CAGR in the following three years. The growth rate is 2.5x faster than the rest of the IT industry.

Its analyst raised the Autodesk share price target to $200. Stifel and Morgan Stanley also lifted the price target for ADSK shares. Stifel says faster-than-expected revenue and FCF growth is likely to support share price momentum.

Financial Numbers are Supporting Upside

The software company had generated 27.5% year over year revenue growth in the latest quarter. Its earnings exceeded analysts’ expectations by $0.06 per share.

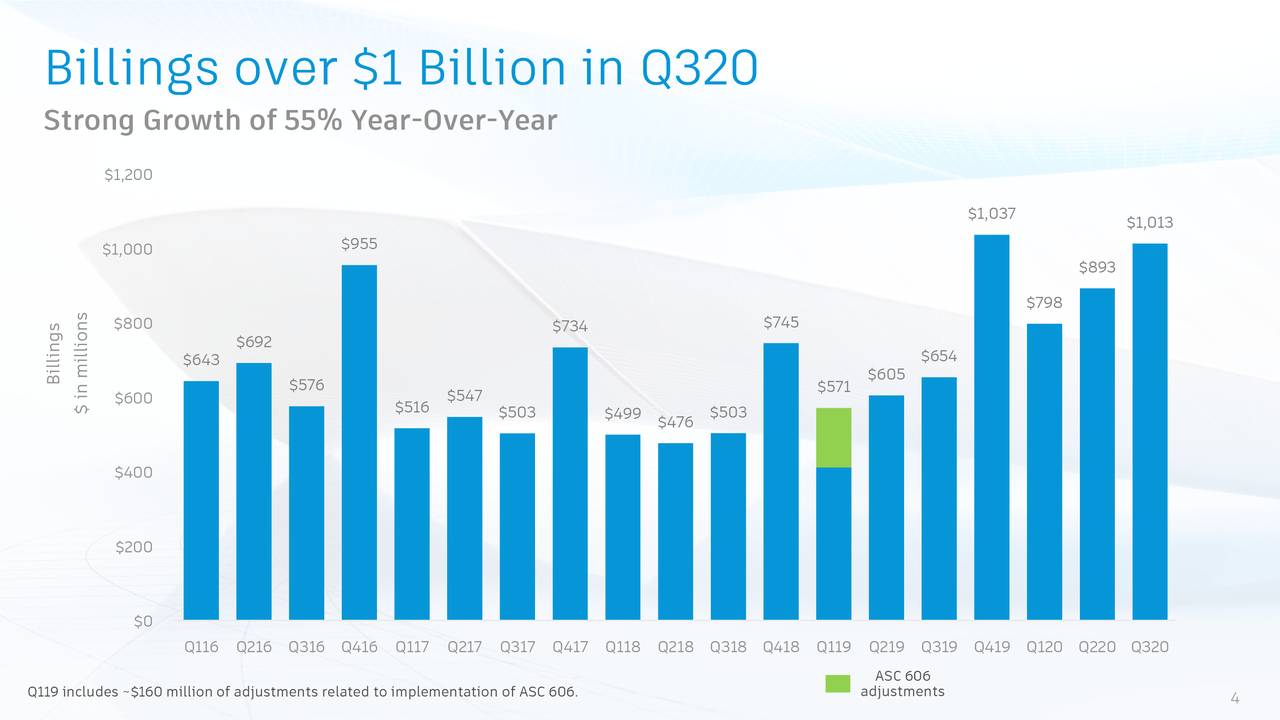

The total ARR grew 28% to $3.22 billion while billings jumped 55% to $1.01 billion. The company expects to accelerate the revenue growth trend in the following quarters. Therefore, holding this stock for more gains appears like a good investment strategy.

Andrew Anagnost, Autodesk president, and CEO said, “The breadth and depth of our product portfolio in Construction paved the way for another strong quarter. In Manufacturing, we continue to displace competitors and grow faster than the overall market.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account