Aurora Cannabis (NYSE: ACB) stock price plunged to the lowest level in two years after reporting lower than expected revenues. In addition, the company generated a wider than the anticipated loss for the first quarter.

The slowdown and bearish trend in the marijuana industry over the past six months have reversed all the gains that pot stocks had generated during 2018 and in early 2019.

The bleak outlook for the following quarter along with significant investment cuts are adding to the bearish trend. Aurora Cannabis stock price is currently trading around $3.29, down substantially from a 52-weeks high of $10 a share.

Q1 Added to Bearish Sentiments for Aurora Cannabis Stock Price

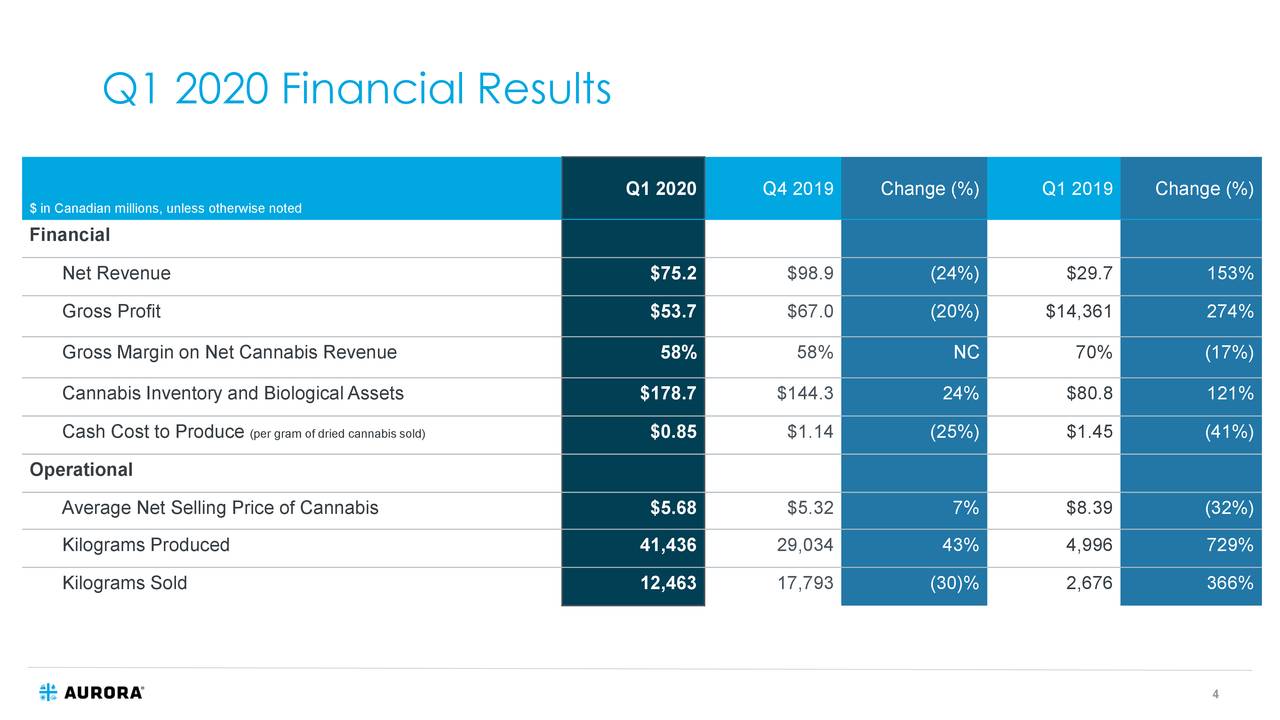

Aurora Cannabis first-quarter revenues declined 24% Q/Q to C$75.3M from C$98.9M. The company announced it would slow its expansion plans in Canada and abroad.

Its non-wholesale cannabis revenue dropped 19% sequentially while Canadian consumer cannabis revenue plunged 33% sequentially to $30.0 million. On the positive side, Its medical cannabis revenue grew 3% Q/Q to $30.5 million.

The slower than expected recreational cannabis revenue growth was due to the slow pace of getting pot shop licenses. Its Q1 adjusted EBITDA loss came in at $39.7M, higher than analysts’ consensus for $20.8M loss.

Cost Savings Could Offer Some Support

The company has also suspended its growth plans to cope with the slowing demand. It announced to immediately stop construction at its Aurora Nordic 2 weed-growing facility in Denmark. This could help in saving C$80M in the following quarters. Moreover, Aurora has also delayed the final construction and activation of its Sun facility in Canada.

The company has also been working on enhancing their operational efficiencies to improve margins. It’s cash cost to produce declined 25% year over year to $0.85 per gram in the first quarter.

“Despite short term distribution and regulatory headwinds in Canada that have temporarily impacted the industry, the long-term opportunity for Aurora in the global cannabis and cannabinoids market is immense,” said Terry Booth, CEO, Aurora Cannabis.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account