AT&T (NYSE: T) is among the companies that offer massive cash returns to investors. It is considered as one of the best stocks for retirees and dividend investors. The company has raised dividends in the past 36 successive years. AT&T recently announced a 2% dividend increase for the following four quarters.

The company has also been awarding investors with big cash returns in the form of share buybacks. It has recently announced a $4 billion share buyback to support its earnings per share and dividend per share.

Moreover, investors should also expect initial capital appreciation, thanks to the steady share price growth potential. Its shares grew almost 27% year to date.

AT&T Cash Returns are Safe

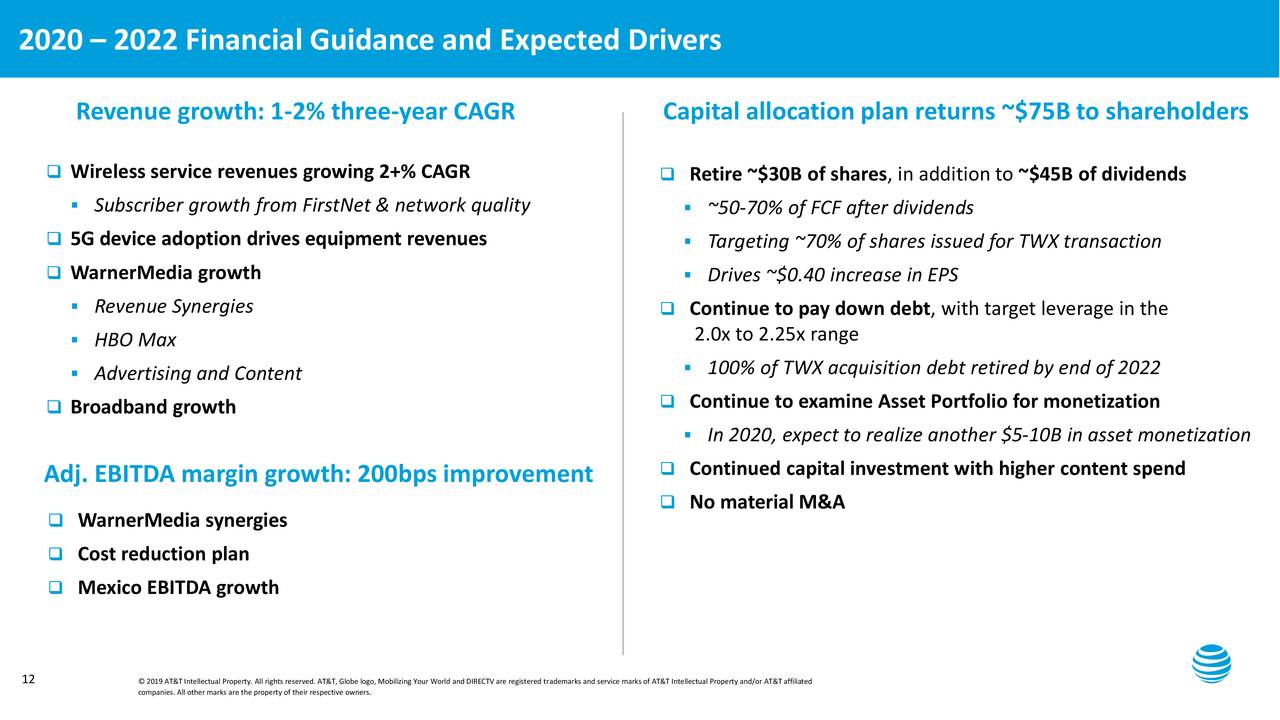

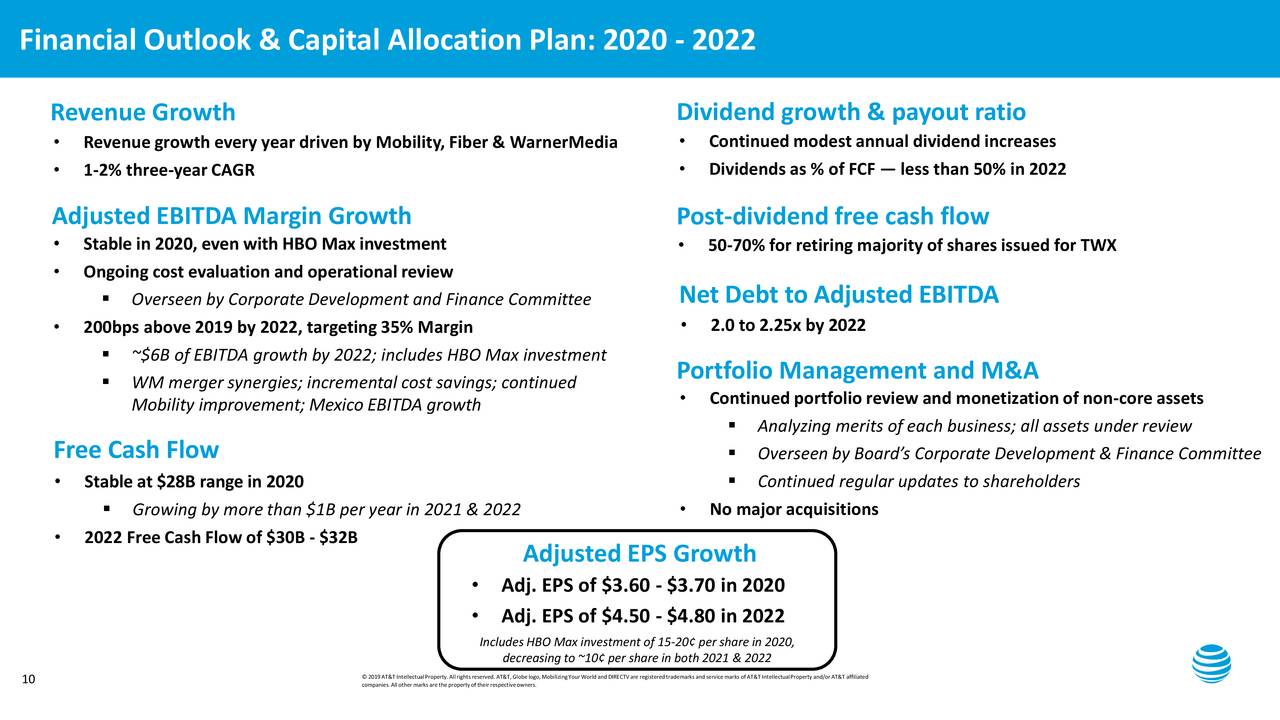

The company’s strategy of returning massive cash to investors appears safe. This is because of sustainable growth in financial numbers. The company expects to generate compound annual revenue growth in the range of low mid-single-digit over the next three years. The revenue growth is likely to be driven by strength in wireless, WarnerMedia and Mexico.

On the other hand, AT&T is seeking to expand its margins through cost cuttings and operational efficiencies. In addition, share buyback plans would also offer support to earnings per share. Consequently, the communication company anticipates EBITDA margins to grow by 200 basis points by 2022.

Cost Savings and Share Buybacks Will Support Earnings

The company says they have achieved annual cost savings of 6-8%, and they plan to extend the momentum in the following years.

CFO John Stephens says, “AT&T will continue to invest in the business while supporting continued modest annual dividend growth and retiring shares.” Specifically, it’s evaluating a 100M-share accelerated buyback for Q1 2020, and by the end of 2022 the company expects to retire 100% of the debt it incurred to acquire Time Warner.”

Moreover, the company’s cash generation offers a complete cover to cash returns. It expects 2019 free cash flow around $28B compared to dividend payments of $14 billion.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account