I hadn’t heard from Reuters Senior Market Strategist Daniel Berger in a while. He tends to reach out to me when something is not right in the municipal bond market. Recently, he shared with me a report which was going out to the thousands of traders, financial analysts, and mutual fund managers that pay good money to get his market analysis.

I hadn’t heard from Reuters Senior Market Strategist Daniel Berger in a while. He tends to reach out to me when something is not right in the municipal bond market. Recently, he shared with me a report which was going out to the thousands of traders, financial analysts, and mutual fund managers that pay good money to get his market analysis.

Here is the key paragraph from his report:

Indeed, muni bonds are “rich” and could be headed for a relative performance decline. . .we are worried that the best relative performance for the long-end may have already been achieved.

– Daniel Berger, Senior Market Strategist, Thomson Reuters 10/18/2012

By a Popular Measure of Value Munis Look Expensive

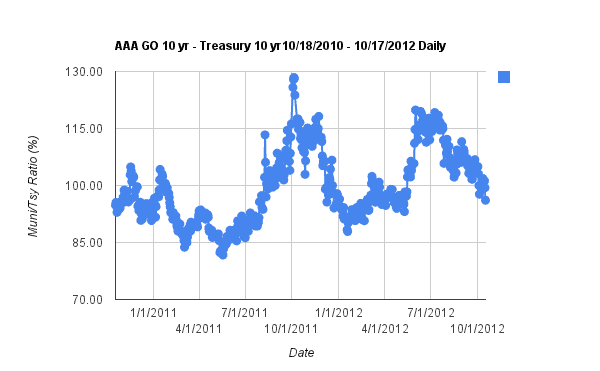

He also provided me with this very instructive chart. Municipal market participants tend to very closely follow the Municipal / Treasury Ratio (M/T Ratio). When the number is above 100, AAA rated municipal bonds yield more than treasuries. As the chart shows, municipal bond yields have been coming down relative to treasuries. Berger and others are suggesting the M/T ratio may be bottoming out.

Since July, the M/T ratio has been declining, meaning that municipal bonds have become about 20% more expensive relative to treasuries. The chart also indicates that the M/T ratio spent the majority of the first half of the year stuck between 90 and 100. If this proves to be the resistance area for higher muni prices, there is limited upside for buyers of municipal bonds.

At the Same Time, Bill Gross and PIMCO Are Buying Municipal Bonds

Bill Gross, the manager of the PIMCO Total Return Bond Fund, is a “go anywhere” bond investor. He can buy all the major segments of the bond market: Treasuries, MBS, Munis, Corporates, and International bonds. Unlike those that focus solely municipal bonds, he must constantly ask himself the question, “If I sell this bond, what can I buy to replace it.” Lately, Bill Gross has been selling treasuries and buying high-quality municipal bonds. Mr. Gross is buying munis for the traditional reasons that munis are popular. They have history of being very safe, they have been paying a yield close to or higher than treasuries, and they have a major tax benefit which treasuries don’t, making their effective yield much higher than treasuries. Around 10% of the PIMCO total return ETF is now invested in municipal bonds.

Looking for some quality municipal bond funds? The following bond funds are rated 4 or 5 Stars by LB Ratings (click on the funds name for the full report): Vanguard High-Yield Tax-Exempt Investor Shares (VWAHX), The Vanguard Intermediate-Term Tax-Exempt Fund (VWITX),

and S&P National AMT-Free Municipal Bond Fund (MUB).

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account