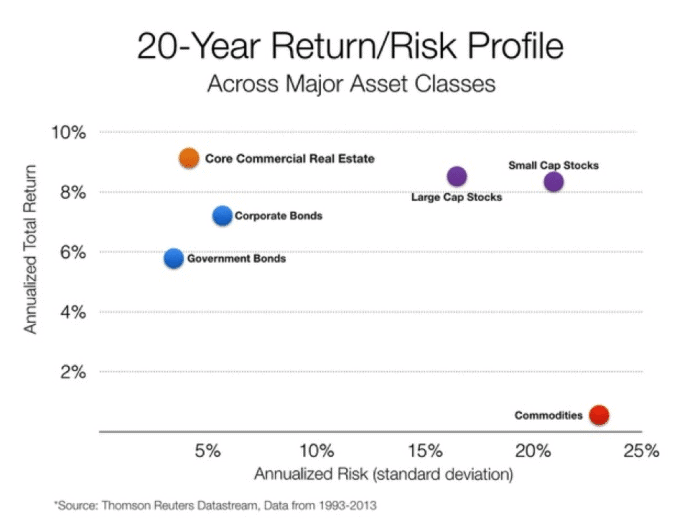

Financial advisors are often quick to point out that investors absolutely need an allocation to stocks in their portfolios. The following chart, however, may challenge conventional wisdom.

This chart, from RealCrowd’s recent eight-day educational email series, shows that from a risk/reward standpoint, during the 20-year period ending 2013, many investors would have found the combination of corporate bonds and core commercial real estate to be much more appropriate for their portfolios than having any exposure to stocks. This would have been especially true for investors nearing or in retirement, who need sufficient amounts of predictable income with lower levels of volatility.

Some will surely argue that going forward 8% returns from an allocation to corporate bonds and core commercial real estate will not be possible. I would respond with two thoughts:

- If you are an investor willing to purchase individual bonds (that mature at par) and take part in individual commercial real estate opportunities, which include not only core but also core-plus holdings, you should still be able to realize 8% returns over longer periods of time. For those less familiar with commercial real estate, “core” refers to the most conservative of the various types of investment opportunities, which include lower levels of leverage and more predictable cash flows. In other words, it didn’t require venturing into the most speculative commercial real estate deals to realize 8% returns during the 20 years ending 2013. “Core-plus” refers to moderate levels of risk and slightly higher returns than “core” holdings. Some examples of moderate levels of risk might include upcoming lease rollovers or a bit more leverage. Additionally, there are other types of holdings which include much more risk and are much more opportunistic in nature.

- Based on current broad-market equity valuations and exceptionally low broad-market dividend yields, investors who think the next 20 years will see stocks achieving the types of returns they did during the previous 20 years may end up quite disappointed a couple of decades from now.

During the 20 years ending 2013, a combination of core commercial real estate and corporate bonds has produced returns very close to those of stocks with far less annualized risk. Going forward, I don’t think it is far-fetched to assume the same can happen again. In the corporate bond space, there are plenty of investment grade notes with intermediate- to long-term maturities yielding in the 4% to 7% range. On the commercial real estate side, I’ve recently found two deals that I consider core and core-plus with cash-on-cash yields of greater than 9% and greater than 13%. Those returns don’t even include the potential for asset price appreciation over the terms of the investments (5 and 10 years respectively).

While I do think an allocation to stocks has certain benefits (I own plenty of stocks), I hope this article adequately illustrates that equity-like returns can be realized from other combinations of investments. Despite financial advisors and the financial press pushing stocks as the be-all end-all of investing, there are other allocations that might be just what the doctor ordered.

More from The Financial Lexicon:

The 5 Fundamentals of Building a Retirement Portfolio

Options Strategies Every Investor Should Kno

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account