Amgen (NASDAQ: AMGN) stock price remains rangebound over the last two years. The stock price continues to trade around $200 level. Amgen shares have hit 52-weeks high $212 last month.

Amgen stock price tumbled amid increasing competition and soft financial performance. The company’s revenue and earnings remain unstable in the past couple of years. This is evident from its soft performance in the latest quarters.

Soft financials are Impacting Amgen Stock Price

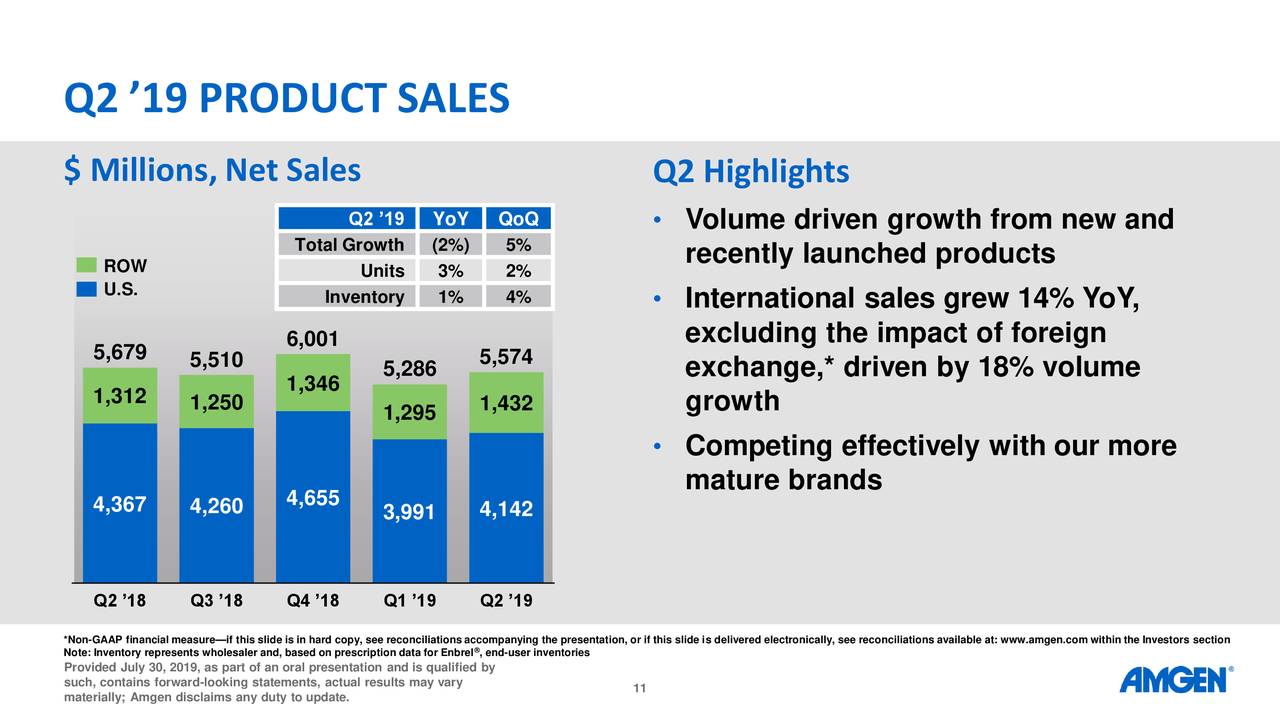

Amgen has generated negative revenue growth in the latest quarter. Its second-quarter revenue of $5.87 billion decreased 3% from the previous year period. The negative revenue growth is driven by a 2% decrease in product sales compared to last year’s quarter.

Its margins also remain under pressure. However, the company’s strategy of lowering the outstanding shares added to earnings potential.

Its net income declined 5% year over year in Q2 while earnings per share increased 4% to $3.57. The company claims they are launching new products to support the revenue base and earnings.

“With our newer products generating strong volume gains globally and many first-in-class medicines advancing through our pipeline, we are well-positioned to serve patients and deliver long-term growth for our shareholders,” said Robert A. Bradway, chairman, and chief executive officer.

Dividend Growth is Questionable

The company has a history of increasing its dividend at a double-digit rate. Its average dividend growth in the past five years stood around 22%. It currently offers a quarterly dividend of $1.45 per share, yielding around 2.97%.

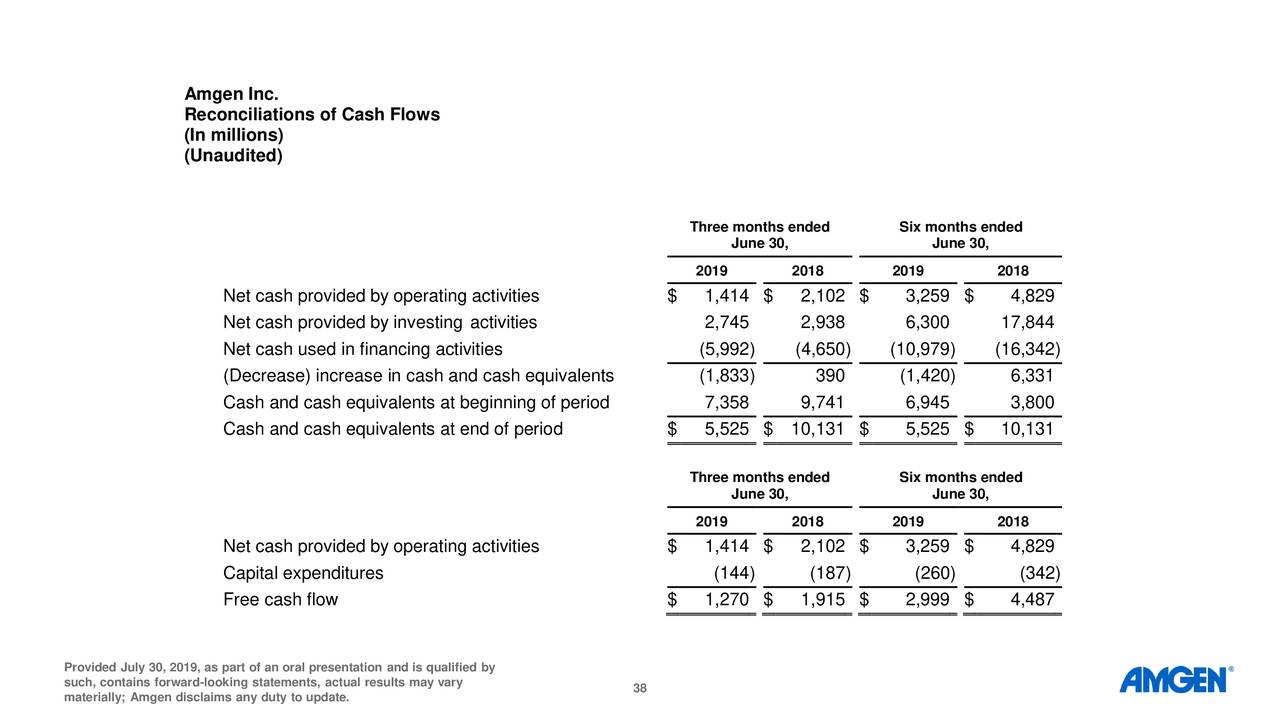

The sluggish financial numbers are also impacting Amgen’s cash-generating potential. The company has generated $1.3 billion in free cash flows in the latest quarter. This is slightly high from dividend payments of $0.9 billion.

It has also been working on share buybacks. Thus, the company has limited room for dividend growth. In addition, free cash flows are also not offering support for investments in growth opportunities. Overall, Amgen stock price is likely to remain under pressure in the short-term.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account